Talking Points:

- AUD/USD Rebounds From Monthly Lows

- Daily Support Found at .7408

- Looking for additional trade ideas for the Forex market? Read our 2017 Market Forecast

The AUD/USD is rebounding sharply from monthly lows this Monday, as the US Dollar opens trading this week decisively lower. Technically the AUD/USD may now be considered trending higher in the short term, with the pair trading back above its 10 day EMA (exponential moving average) for the first time in 3 weeks. Traders should note that the 10 day EMA is found at .7408, and may be referenced as a point of support as prices trend higher. The next point of resistance on the daily chart may be found at the 200 day MVA (simple moving average) .7535.

In the event of a bearish reversal, traders should first look for prices to close back below the mentioned 10 day EMA later in the week. This change in momentum would then open up the pair to retest monthly lows which currently stand at .7335. In this bearish scenario, traders may next look for the AUD/USD to test the standing 2017 low found at .7165.

AUD/USD Daily Chart & Averages

Want to learn more about trading with market sentiment? Get our Free guide here.

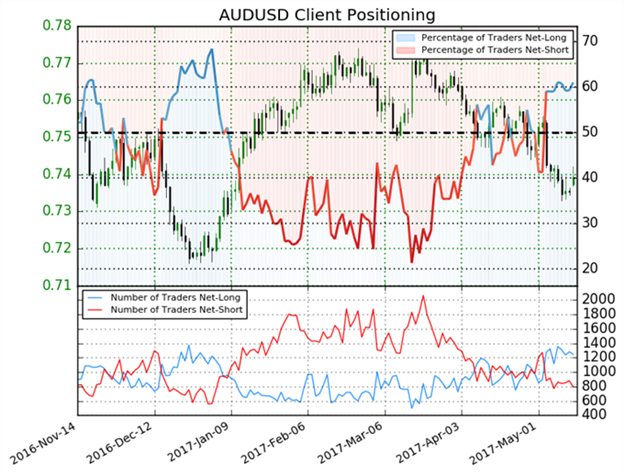

Sentiment figures for the AUD/USD remain net positive at +1.24, but have moderated slightly from last week’s reading of +1.3. As it stands IG Client Sentiment (IGCS) shows that 55% of traders are long the AUD/USD. As a contrarian indicator this value maintains a modest bearish bias. If prices continue to advance however, traders should look for sentiment reading to neutralize and potentially flip to a net negative reading. If prices do continue to trend lower however, traders should look for sentiment readings to push towards positive extremes of +2.00 or more.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.