EUR/USD Analysis and Talking Points

- Hawkish ECB Minutes, But Room For Disappointment Grows

- Bias Remains to Fade Euro Strength

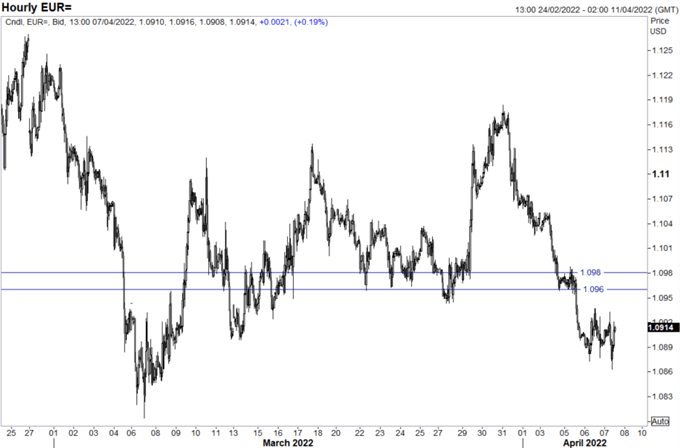

- Resistance at 1.0960-80.

Hawkish ECB Minutes, But Room For Disappointment Grows

The latest ECB meeting minutes were on the hawkish side, which was to be expected given the hawkish meeting. It is clear that while the governing council is divided on the inflation outlook, with different views on how persistent inflation will be. The ECB hawks are in the majority with a large number of members reiterating the view that the current high level of inflation and persistence, requires immediate further steps towards policy normalisation. As such, some members preferred to set a firm end date for APP net purchases during the summer, which could clear the way for a possible rate rise in Q3.

In reaction to the hawkish minutes, the Euro has firmed a touch to reclaim the 1.09 handle. Meanwhile, bund yields have ticked higher by 4bps. Back to the Euro and risks remain titled to the downside for the single currency, particularly against the USD. While the ECB continue to discuss steps towards policy normalisation, there remains room for disappointment given the spillover effects surrounding the Ukraine/Russia conflict. This is not the case for the Federal Reserve, who will look to overdeliver in order to bring down inflation, as pointed out by Brainard earlier this week. Therefore, fading rallies in the Euro towards 1.0960-80 remains the bias.

| Change in | Longs | Shorts | OI |

| Daily | -19% | -10% | -14% |

| Weekly | -24% | 26% | -3% |

EUR/USD Chart: Hourly Time Frame

Source: Refinitiv