GBP/USD, GBP/JPY Price Analysis & News

- Bond Market Throws a Tantrum

- GBP Corrects from the Extremes

Bond Market Throws a Tantrum

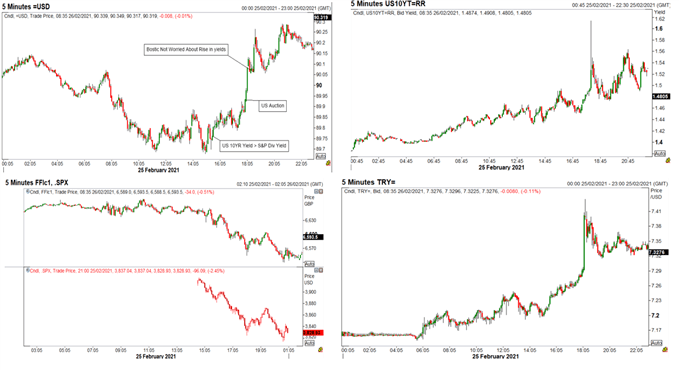

Equity markets finally listen to the noise that the bond market have been making, however, the Fed are still not listening. Quite the moves yesterday as the US 10yr hit the milestone of yielding 1.50%, moving above the S&P 500 dividend yield of 1.48%. Subsequently, this places a TINA (There Is No Alternative) headwind for the stock market, which has up until now, enjoyed the low rate environment. The tech sector endured most of the selling pressure with the Nasdaq falling over 3%, particularly after the worst 7yr auction in history, which kickstarted a bid in the greenback and sent EM FX heavily lower (Full analysis). As such, market focus on US bond auctions will undoubtfully garner much more attention.

That said, it has been noted for a while that equity markets have been trading at relatively lofty levels and given the seasonal pattern weakness from Feb 16/17th, this can be seen as a healthy correction, particularly as the US fiscal impulse will be soon upon us. In response to the move in the bond market, both the ECB and RBA have waved their white flag, with the latter defending its 3YR cap by stepping up purchases to A$ 3bln from A$ 1bln earlier in the week. Going forward, should we see another session like yesterday, I would not be surprised to see some Fed sources to do the rounds, in order to calm market volatility.

Yesterday’s Moves in USD, USD/TRY, FTSE 100, S&P 500, US 10yr

Source: Refinitiv

Sterling Experiences Rare Selling

As I’m sure many had noticed, the Pound’s valuation had become extremely stretched on the upside with the RSI on multiple GBP crosses trading in significantly overbought territory. That said, in response to the deleveraging in risk assets, the Pound had felt much of the brunt of this in G10s, but for context, GBP/USD is only back to levels that we were trading last week and let’s not forget, the Pound has been the best performer in 2021. The supportive narrative remains the same for the Pound, as such, with GBP normalising, dip buying is likely to re-emerge. However, keep an eye on risk sentiment indicators like US equity futures and the bond market, should the S&P 500 convincingly break the weekly lows, the Pound will likely see another wave of liquidation. On the technical front, GBP/USD remains in an uptrend with the pair holding above the 20 and 50DMAs.

GBP/USD Chart: Daily Time Frame

Source: Refinitiv

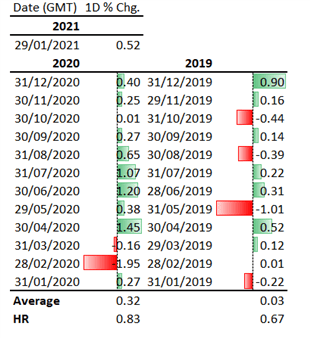

GBP/JPY and the Last Trading Day of the Month

Meanwhile, there will be other factors at play for GBP as month end investment models touts modest USD and JPY selling in favour of GBP buying. As such, the relationship between GBP/JPY and last trading day of the month gains will be put to the test with table below showing that GBP/JPY tends to perform well on the final day of the month. However, as I mentioned above, eyes will be fixated on the bond market.

Source: DailyFX

Find out more on trading GBP with our comprehensive guide