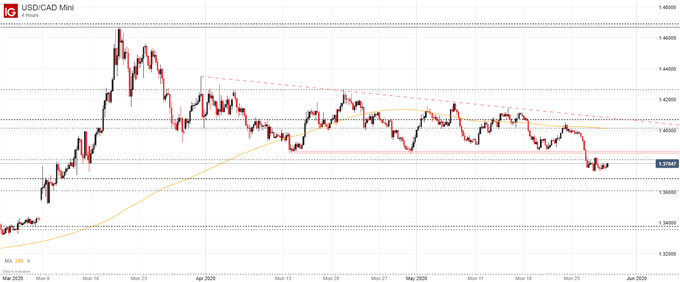

Canadian Dollar (USD/CAD) Price Outlook:

- USD/CAD suffered a bearish break beneath horizontal support earlier this week

- With a dominant downtrend and a break lower, further USD/CAD weakness may be on the horizon

- Learn the different trading styles to see what type of price action best suits you

Canadian Dollar Forecast: Support Breach May Lead to Further Losses

The US Dollar has fallen substantially this week as the Dollar Basket (DXY) skirts the edge of lower-lows as it forfeits the ground it captured in the March rally. Perhaps unsurprisingly, USD/CAD has fallen alongside DXY and suffered a bearish break beneath a horizontal trendline that had offered support to the currency cross a number of times in the last two months. With the larger downtrend intact and nearby support pierced, it appears USD/CAD may be in position to continue lower in the weeks ahead.

USD/CAD Price Chart: 4 – Hour Time Frame (March 2020 – May 2020)

Evidently, USD/CAD has established a rather gradual downtrend starting from the pair’s peak in mid-March. In the past, the descending trendline acted as a robust upper bound for USD/CAD while the horizontal level below served as an area of support. With the recent break below, will traders now view prior support as resistance and does the level command enough respect to stall an attempted rebound?

Either way, the bearish break is a notable development. If price should reclaim the level, the horizontal band may see reduced influence going forward and if it can reverse a rebound, it would allow for an attractive area of invalidation when considering bearish opportunities.

| Change in | Longs | Shorts | OI |

| Daily | 28% | -20% | -6% |

| Weekly | -9% | 1% | -3% |

As it stands, IG Client Sentiment Data suggests USD/CAD may head lower in the weeks ahead. With bullish-bets slightly overtaking bearish positioning even as price falls, it seems retail traders are attempting to call the bottom, but may catch a falling knife instead. Regardless, USD/CAD may remain vulnerable as long as the broader downtrend remains intact – in my opinion. As price action develops, follow @PeterHanksFX on Twitter for updates.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX