AUSTRALIAN DOLLAR, RBA - TALKING POINTS:

- Australian Dollar higher as RBA keeps key rate unchanged at 1 percent

- Policy statement hints Lowe & company not in a hurry to cut rate again

- Markets continue to expect at least one interest rate reduction this year

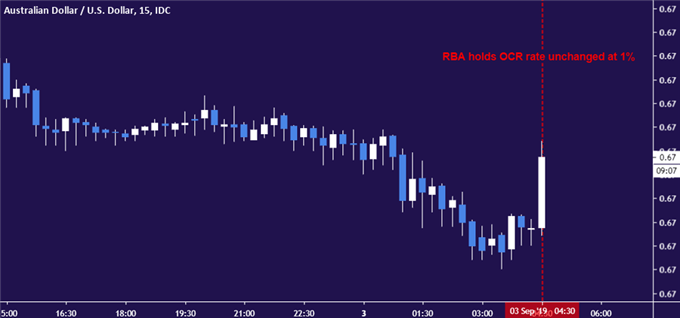

The Australian Dollar probed higher as the Reserve Bank of Australia (RBA) opted to keep its policy interest rate unchanged at 1 percent, as widely expected. Traders were pricing in the likelihood of stasis at over 80 percent. This might explain the currency’s relatively timid response: markets did not see much that was not already baked into the exchange rate.

The slight upward bias probably reflects the sense that the central bank does not seem to be in a hurry to ease further. The statement accompanying the announcement reiterated familiar concerns about downside risks to global growth, with a nod to the US-China trade war as a particularly notable source of uncertainty. In the same breath however, the RBA cited strong employment growth and easy global credit conditions.

RBA MAY DEFER RATE CUTS OTHER FED, CENTRAL BANKS EXPAND STIMULUS

The latter point may be critical. Officials noted that “a number of central banks [reduced] interest rates this year and further monetary easing is widely expected,” adding that “long-term government bond yields have declined and are at record lows in many countries, including Australia.” This seems to imply that Governor Lowe and company are happy for others – and mainly the Fed – to do the heavy lifting for now.

Nevertheless, financial markets continue to price in at least one more RBA rate cut before the calendar turns to 2020. Futures markets imply the probability of some kind of reduction is nearly 89 percent. The chance that a 25-basis-point cut appears at the central bank’s next conclave in early October is still assigned better-than-even-odds too. It now stands at 62 percent.

15-min AUD/USD chart created with TradingView

Join a free live webinar to get help interpreting market moves and building a trading strategy!

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter