Gold Price Analysis and Talking Points:

- Gold Consolidates Around $1500

- Jackson Hole Takes Precedence

See our quarterly gold forecast to learn what will drive prices throughout Q3!

Gold Consolidates Around $1500

Gold prices have continued to consolidate around the psychological $1500 level with little thus far this week providing much in the way of notable price action. Today’s focus will be on the FOMC minutes, however, in light of the current context, the meeting minutes could be perceived as hawkish, given that the decision had taken place a day before President Trump broke the US-China trade truce, while the US 2s10s curve has also inverted since then. Therefore, greater focus should perhaps be on the Jackson Hole Symposium speech from Fed Chair Powell on Friday.

In light of the developments since the July rate decision, the FOMC minutes may be seen as slightly more outdated as usual, thus the impact across asset classes could be somewhat modest at best.

Fed Commentary Since July Meeting

- Fed’s Rosengren: US economic conditions are still pretty good, adding that there are costs to easing policy too much. Also states that just because other countries are weak, this should not mean that the US should be easing.

- Fed’s Daly: Support for Fed rate cut in July did not reflect concern about impending economic downturn.

- Fed’s Mester: Would have preferred to hold interest rates steady in July, but it was a close call. Need to take time to assess economic conditions and then move policy as appropriate.

- Fed’s Bullard: Some recent market downdraft may be overdone given US data. Fundamentally the labour market is good, while growth is reasonable.

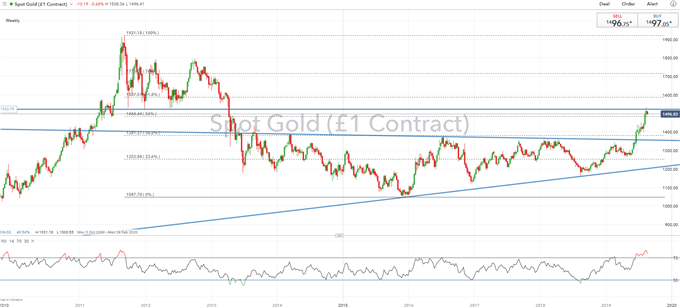

GOLD Technical Levels

Resistance 1: $1587 (61.8% Fibonacci Retracement)

Resistance 2: $1600 (Psychological)

Support 1: $1484 (50% Fibonacci Retracement)

Support 2: $1450 (Psychological)

GOLD PRICE CHART: Daily Time-Frame (Sep 2009 - Aug 2019)

What You Need to Know About the Gold Market

GOLD TRADING RESOURCES:

- See our quarterly gold forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX