GBP price, news and analysis:

- Sir Richard Branson has warned that a no-deal Brexit could cause the British Pound to plummet to parity with the US Dollar.

- When confidence in Sterling is so low, contrarians might argue that a GBP rally is now on the cards.

GBPUSD outlook: ripe for a recovery

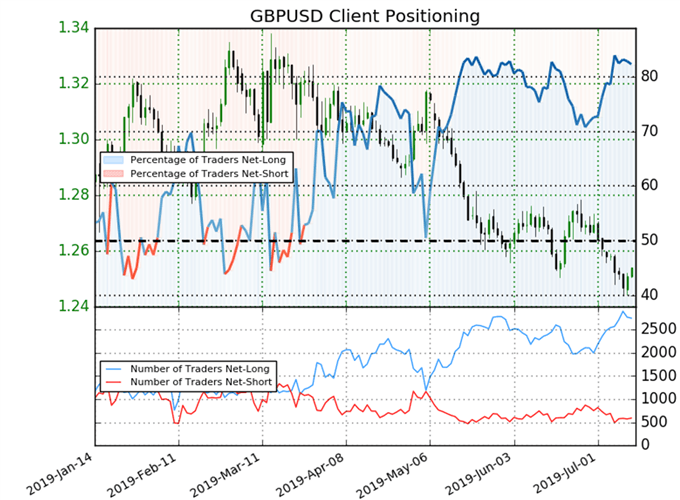

The British Pound has fallen so far against the US Dollar since GBPUSD hit a 2019 high of 1.3382 on March 13 that a rally cannot be ruled out. As the chart below shows, the pair is clearly trending lower. However, it now looks to be forming a base around the 1.25 level and, if that holds, a short-term recovery could be due.

GBPUSD Price Chart, Daily Timeframe (January 1 – July 11, 2019)

Chart by IG (You can click on it for a larger image)

The tumble in GBPUSD has been due principally to growing fears of a no-deal Brexit if, as seems likely, former UK Foreign Secretary Boris Johnson becomes the next leader of the ruling Conservative Party and therefore the next British Prime Minister. However, it is possible that such an outcome is now fully priced in to exchange rates.

Trading GBP When a New Tory Leader Takes on Labour

Moreover, Wednesday’s UK economic data were less bad than feared. GDP growth in May, on a three months/three months basis, beat expectations at 0.3% and the construction sector performed well that month – offsetting poor industrial production and manufacturing output numbers. That makes a further easing of UK monetary policy marginally less likely.

GBP to fall to parity with US Dollar?

In addition, Sir Richard Branson, the founder of the Virgin group, was reported Wednesday as saying that a no-deal Brexit would cause the Pound to plummet and be worth the same as the Dollar. Contrarians argue that when sentiment is so negative a recovery is overdue.

Sterling index steady

On the other side of the GBPUSD pair, the markets are now pricing in a 26.5% chance that the Federal Open Market Committee will cut US interest rates by half a percentage point on July 31 – up sharply since the first leg Wednesday of Fed Chair Jerome Powell’s semi-annual report to Congress. If that is delivered, the US Dollar could well weaken.

That said, a couple of cautionary notes need to be mentioned. First, negative sentiment towards GBP has been much less pronounced recently when looking at a chart of Sterling since the Brexit referendum against a basket of other currencies.

Sterling effective exchange rate index, January 2005 = 100, (January 4, 2016 – July 11, 2019)

Source: Bank of England

Second, positioning data on retail traders using the IG platform are currently neutral. They show that 82.2% of traders are currently net-long, with the ratio of traders long to short at 4.63 to 1. In fact, traders have remained net-long since May 6, when GBPUSD traded near 1.2911; the price has moved 2.9% lower since then. The number of traders net-long is 6.2% lower than yesterday and 10.4% higher from last week, while the number of traders net-short is 1.0% lower than yesterday and 10.8% lower from last week.

At DailyFX we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests the GBPUSD price may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us no clear GBPUSD trading bias.

Retail trader positioning (July 11, 2019)

Source: DailyFX/IG

Looking for longer-term forecasts for GBP and USD? Check out the DailyFX Trading Guides.

Resources to help you trade the forex markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex