Japanese Yen Talking Points

USD/JPY is back under pressure as fresh data prints coming out of the U.S. economy does little to boost bets for four Fed rate-hikes in 2018, and the pair may continue to consolidate ahead of the highly anticipated Non-Farm Payrolls (NFP) as it snaps the series of higher highs & lows carried over from the previous week.

USD/JPY Risks Larger Pullback Following Failed Run at March-High

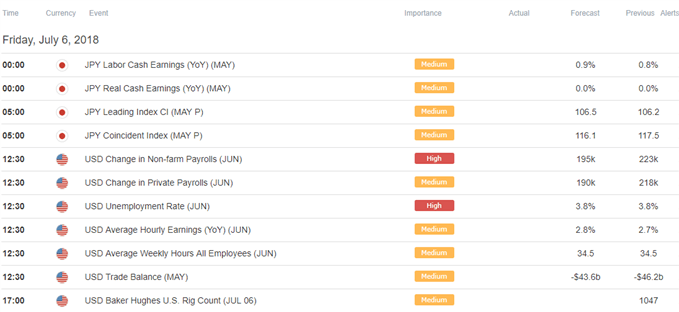

USD/JPY struggles to hold its ground as the U.S. ADP Employment report shows private payrolls increasing 177K in June versus forecasts for a 190K print, and the dollar-yen exchange rate may stage a larger pullback as it appears to have made another failed attempt to test the March-high (111.40).

With that said, the U.S. dollar may face additional headwinds over the next 24-hours of trade if the NFP report also falls short of market expectations, but signs of faster wage growth may heighten the appeal of the greenback as Average Hourly Earnings are projected to climb to an annualized 2.8% from 2.7% in May.

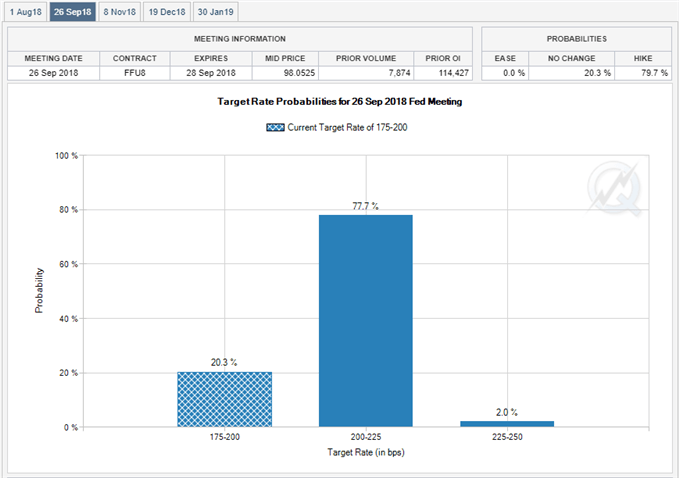

Indications of rising price pressures may keep the Federal Open Market Committee (FOMC) on course to deliver four rate-hikes in 2018 as ‘the median inflation projection is a little higher this year and next,’ and Chairman Jerome Powell & Co. may continue to strike a hawkish tone at the next meeting on August 1 as ‘gradually returning interest rates to a more normal level as the economy strengthens is the best way the Fed can help sustain an environment in which American households and businesses can thrive.’

Keep in mind, Fed Fund Futures continue to reflect expectations for another 25bp rate-hike in September following the updated projections from central bank officials, and the FOMC’s hiking-cycle may keep USD/JPY bid especially as both price and the Relative Strength Index (RSI) extend the bullish trends from earlier this year.

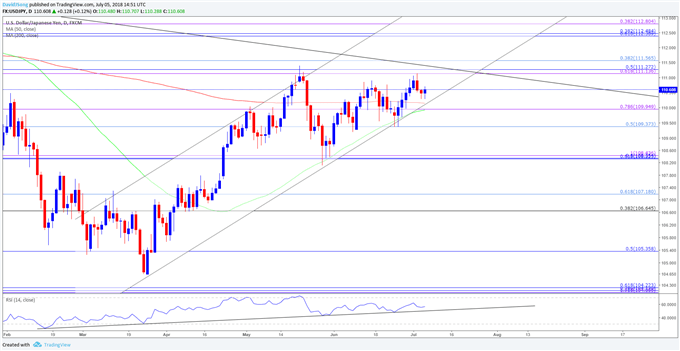

USD/JPY Daily Chart

- The near-term advance in USD/JPY appears to have stalled as it snap the bullish sequence from the previous week, with the string of failed attempts to break/close above the 111.10 (61.8% expansion) to 111.60 (38.2% retracement) region raising the risk for range-bound conditions.

- In turn, the 109.40 (50% retracement) to 110.00 (78.6% expansion) area sits on the radar, with a break/close below the stated zone raising the risk for a move back towards the Fibonacci overlap around 108.30 (61.8% retracement) to 108.40 (100% expansion), which sits just above the May-low (108.11).

For more in-depth analysis, check out the Q3 Forecast for the Japanese Yen

Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2018.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.