Talking Points:

- NZD/USD Remains at Risk for Larger Correction as H&S Formation Remains Intact.

- USD/JPY Rattles 2016 Bearish Trend; Retail Position Adjustments in Focus.

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| NZD/USD | 0.7254 | 0.7311 | 0.7249 | 21 | 62 |

NZD/USD Daily

Chart - Created Using Trading View

- Even as the Reserve Bank of New Zealand (RBNZ) keeps the door open to further embark on its easing cycle, the broader outlook for NZD/USD remains constructive as the upward trend from earlier this year remains intact; keeping a close eye on the RSI as it sits on trendline support, with a break of the bullish formation raising the risk for a head-and-shoulders top.

- The New Zealand dollar may face a larger correction ahead of the next RBNZ last 2016 meeting on November 10 amid growing speculation for a rate-cut, but the kiwi may continue to benefit from the low-yield environment especially if Governor Graeme Wheeler shifts gears and endorses a wait-and-see approach for monetary policy.

- Will continue to watch the near-term range in NZD/USD, with support coming in around 0.7200 (38.2% expansion) to 0.7210 (38.2% retracement), while resistance stands at 0.7350 (61.8% expansion).

| Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

|---|---|---|---|---|---|

| USD/JPY | 102.67 | 102.73 | 101.58 | 102 | 115 |

USD/JPY Daily

Chart - Created Using Trading View

- USD/JPY may stage a larger advance ahead of the key data prints on tap throughout the first full-week of October as it threatens the bearish trend carried over from the summer months, with the Relative Strength Index (RSI) highlighting a similar dynamic; may see the near-term advance threaten the downward trend from earlier this year as Federal Reserve officials appear to be following a similar path to 2015.

- It seems as though the Bank of Japan (BoJ) will retain its current policy at the next interest rate decision on November 1 as the central bank implements the ‘yield curve control’ to its existing list of non-standard measures; nevertheless, the Yen may continue to outperform its U.S. counterpart on a longer-term horizon as the region returns to its historical role as a net-lender to the rest of the world.

- Need a break/close above 102.70 (38.2% expansion) to open up the next topside target around 104.20 (61.8% retracement), which coincides with the September high (104.32).

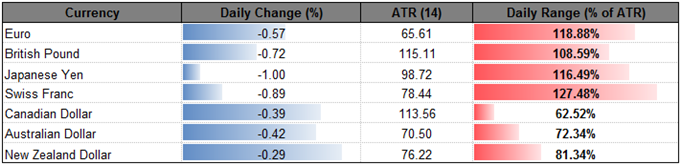

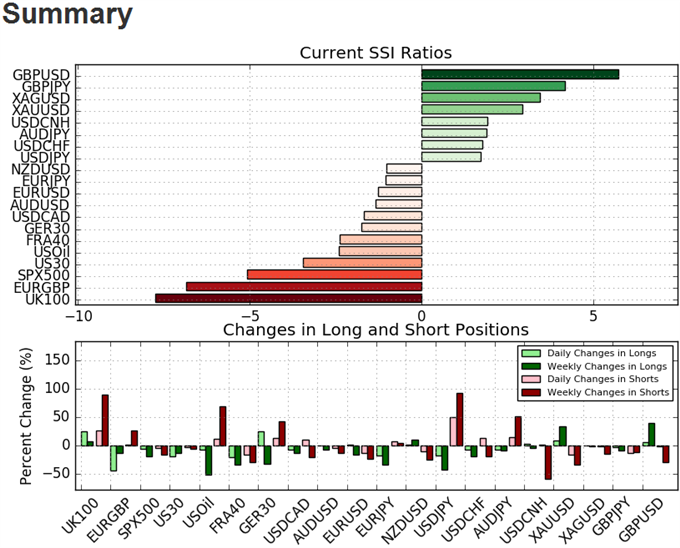

- The DailyFX Speculative Sentiment Index (SSI) shows the FX crowd has been net-long USD/JPY since July 21, with retail traders net-short NZD/USD since September 26.

- After hitting an extreme reading of +6.00 last month, USD/JPY SSI currently sits at +1.95 as 66% of traders remain long, while short positions have jumped 73.7% from the previous week even as open interest stands 2.7% below the monthly average.

- NZD/USD SSI currently sits -1.42 as 41% of traders are long, with long positions 7.7% lower from the previous week, while open interest stands 3.9% below the monthly average.

- May see the near-term breakout in USD/JPY accompanied by a further narrowing in the SSI going through the first full-week of October as there appears to be position adjustments ahead of the highly anticipated U.S. Non-Farm Payrolls (NFP) report.

Why and how do we use the SSI in trading? View our video and download the free indicator here

Click Here for the DailyFX Calendar

Get our top trading opportunities of 2016 HERE

Read More:

COT-4th Most Selling by CAD Speculators Since at Least 2002

FTSE 100: Bull Pattern Breakout to Start Q4

FX Technical Weekly: Don’t Get Caught Fading the Next EUR/USD Move

USD/JPY Technical Analysis: Fault Lines Are Showing Favoring JPY

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.