USD FUNDAMENTAL HIGHLIGHTS:

- USD Losing its Appeal Temporarily

- Eyes on August and March Peaks for Support

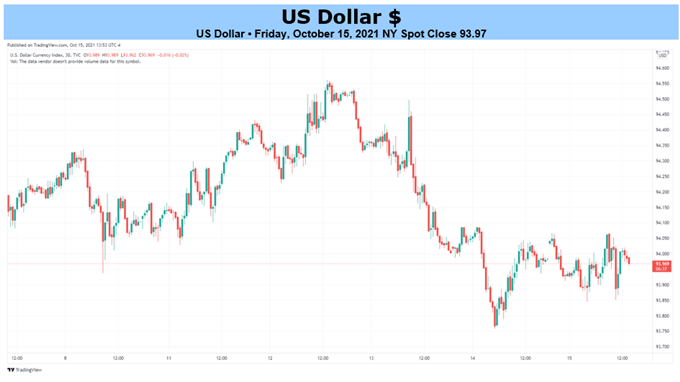

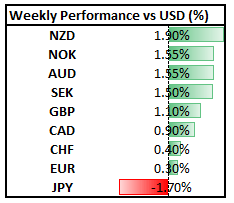

As risk appetite remains buoyant and while commodity prices continue to soar, the US Dollar has somewhat lost some of its appeal, with the greenback losing out to major counterparts across the board, excluding the Japanese Yen. That said, with the USD ending its streak of five consecutive weekly gains, markets appear to be long of dollars, which in turn raises the risk of greater unwind heading into next week, should risk appetite remain firm. On a technical note, as the USD index oscilates around the 94.00 handle, the weekly close is important, where a close below 94.00 may keep pressure on the downside.

Source: Refinitiv

Individual narratives have been popping up over the past week, which in turn has taken some of the attention away from the USD. This has ranged from BoE tightening bets for the Pound, JPY weakness stemming from higher commodities and bond yields, while the AUD has been helped along by China’s energy crunch induced coal buying, alongside the breakout in copper.

Looking into next week, with little on the economic calendar besides flash PMIs, risk appetite will likely dicate the state of play across the FX space. A reminder that, markets remain fickle in the current environment and thus choppy seas can be expected, besides cross-JPY.

A note on the Japanese Yen….

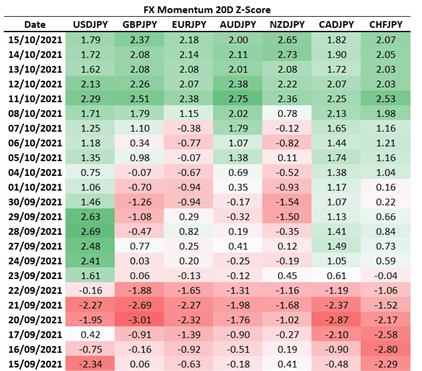

- As oil prices trade at 3yr highs, oil-importing currencies such as the Japan Yen will continue to remain weak. Therefore, looking to fade Yen weakness is the equivalent of standing in front of the proverbial freight train. Meanwhile, momentum indicators such as the RSI showing that Yen crosses are in overbought territory, although, this is by no means at extreme levels and thus doesn’t indicate that a reversal is imminent.However, I will be keeping a close eye for a pullback in oil and yields for a sign of a short-term top, alongside a dip in risk appetite.

Source: Refinitiv

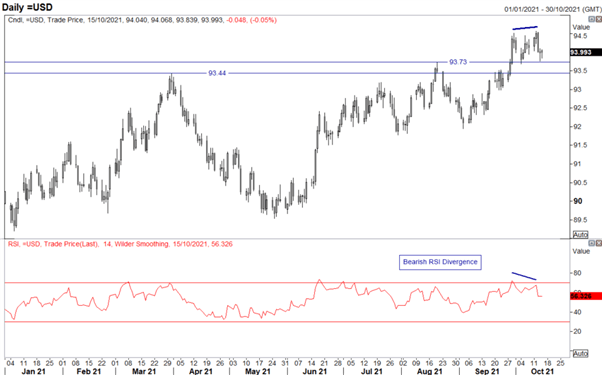

USD Technicals

Taking a look at the chart, the USD has posted a very slight bearish RSI divergence, typically a sign that upside momentum is stalling and thus leaves the greenback at risk of a larger setback. In terms of notable support, this lies at the August and March peaks at 93.73 and 93.44 respectively.

US Dollar Chart: Daily Time Frame

Source: Refinitiv