US Dollar Forecast - Fed Finally Hikes Rates. Now What for the US Dollar?

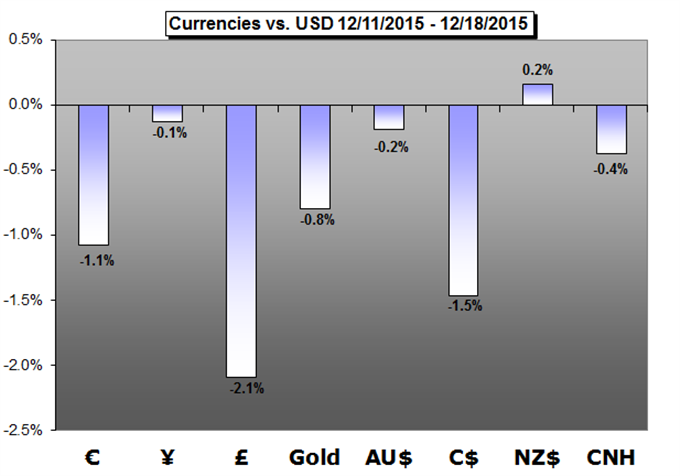

The Fed finally did it! Its interest rates are above zero for the first time in six years. But why did the Dollar not rally, and what might we watch for next?

Euro Forecast - Euro’s Economic Calendar Thins Out Through End of Year

With only a handful of events on the economic calendar over the next two weeks, it seems that the low liquidity environment typical around year end could pave way to some near-term stability.

British Pound Forecast – The Sterling Lining Presents a Glimmer of Hope after Dollar, Yen Drubbings

Data this week, on net, was pretty much a positive for the UK and the British Pound.

Japanese Yen Forecast – USD/JPY Risks Larger Pullback on Dismal US GDP, Sticky Japan CPI

Despite the 2015 Fed liftoff, USD/JPY stands at risk of facing range-bound prices in the week ahead as the final U.S. 3Q Gross Domestic Product (GDP) report is anticipated to show a downward revision in the growth rate, while the Bank of Japan (BoJ) largely endorses a wait-and-see approach for 2016.

Australian Dollar Forecast - Australian Dollar Volatility Risk Remains Amid Thin Liquidity

Australian Dollar volatility may break out despite the absence of clear-cut catalysts if unexpected headline risk strikes illiquid markets in pre-holiday trade.

Chinese Yuan (CNH) Forecast – Yuan Enters Retracement Phase, Eye on Domestic Policies

The onshore yuan exchange rate (USD/CNY) ended 10-days of declines before it closed at 6.4800 on Friday.

The Canadian Dollar is definitively the weakest currency within the G10 as pressures mount on the Bank of Canada to potentially ease again.

Gold Forecast – Gold Holds Range Fed Rate Hike- Shorts at Risk Above 1047

Gold prices are down for the second consecutive week with the precious metal off by 0.84% to trade at 1065 ahead of the New York close on Friday.

Sign up for a free trial of DailyFX-Plus to have access to Trading Q&A's, educational webinars, updated speculative positioning measures, trading signals and much more!

What are the Traits of Successful Traders? See what our studies have found to be the most common pitfalls of retail FX traders.