GBPUSD Analysis and Talking Points:

- Pound sees Steady Week to Find Base at 2018 Lows

- Near term GBPUSD direction and BoE policy to be dictated by deluge of UK data

Fundamental Forecast for GBP: Neutral (Next Week’s Range: 1.3370-1.3650)

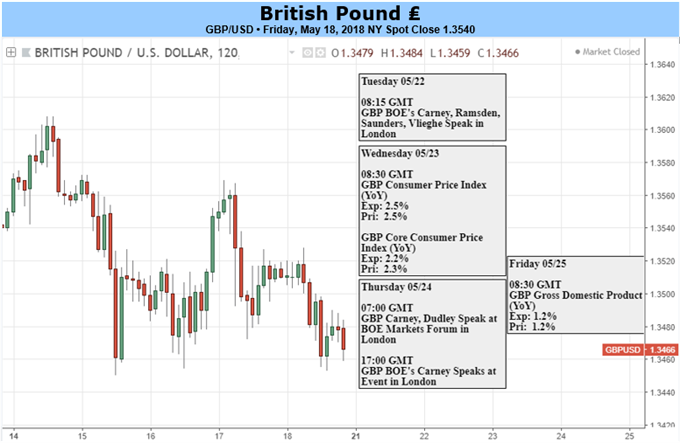

Relative to the past month, where GBP had fallen over 6%, the Pound saw a somewhat steady week which had largely been dictated by the continued rally in the USD. As such, GBPUSD gave up the 1.35 handle, forming a base at YTD lows around 1.3450. Elsewhere, the UK jobs reports indicated that the labour market continues to remain robust, while average wages ticked up to 2.9%, which saw real earnings rise to 0.4%.

Economic Data to Dictate GBP and BoE Policy

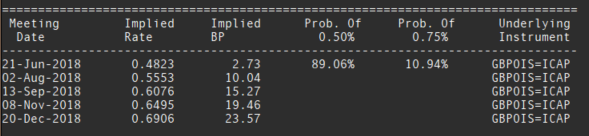

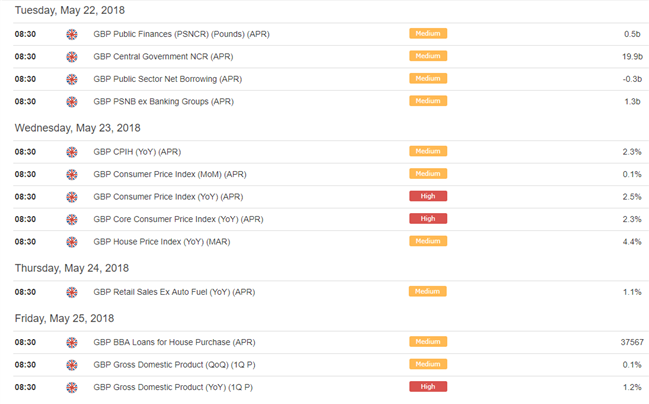

As we look ahead to next week’s calendar, a deluge of UK data points, most notably inflation and GDP figures may bring the relative calm to an end. As a reminder, it was last month’s inflation report that caused many investors to rethink a May hike after the headline CPI saw a sizeable drop to 2.5% from 2.7%, which represented a 1yr low. Expectations are for CPI to remain at 2.5%, however, a drop similar to that of last month would be a blow for GBP bulls looking for an August rate hike, which is currently perceived as a coin toss between a hike/hold.

Source: Thomson Reuters (Bank of England Rate Hike Expectations)

GBP traders will also be able to digest the latest retail sales data, which saw a sizeable decline last month due to temporary weather-related factors, as such, this latest reading could see a rebound. However, if survey indicators are anything to go, a recovery is somewhat doubtful. Finally, the week will close out on the second estimate to Q1 GDP, which is expected to be confirmed at 0.1% (weakest growth in 5yrs).

Overall Weekly Outlook is Neutral

For this week, we continue to remain neutral on GBPUSD, price action will of course be dictated by the incoming data with the largest focus on inflation. If CPI does miss expectations then this could potentially open 1.3275-1.33 support. However, a match on consensus should see GBPUSD continue to hold the 1.3450 base.

On a longer time frame we noted previously that the recent pounding may allow for long term GBP bulls to find tactical upside at these relatively cheap levels.

GBPUSD Technical Levels

Support

1.3450 (2018 low)

1.33025 (December 2017 low)

Resistance

1.3587 (post-NFP high)

1.3655 (2017 high)

1.3711 (March 1st low)

GBPUSD PRICE CHART 1: DAILY TIMEFRAME (November 2017-May 2018)

GBP TRADING RESOURCES:

- See our quarterly GBP forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX