TALKING POINTS – YEN, US DOLLAR, FED, SNB, BOE, AUSSIE DOLLAR

- US Dollar on the defensive after unexpectedly dovish FOMC policy call

- Yen may rise in risk-off trade as dovish SNB, BOE stoke slowdown fears

- Aussie, New Zealand Dollars may trim data-driven APAC session gains

The US Dollar underperformed in Asia Pacific trade, reeling in the wake for the Fed policy announcement. Scope for a dovish surprise was clearly greater than expected. Besides the anticipated downgrade of growth, inflation and rate hike expectations, officials cut QT asset sales from $50 to $35 billion per month (starting in May) while the policy statement hinted the FOMC’s next move may well be a cut.

The response from sentiment trends was perhaps more interesting than that of the Greenback however. Wall Street initially swung higher, buoyed by the promise of looser credit conditions, but the bellwether S&P 500 soon reversed to close with a loss as the Fed’s defensive stance stoked global slowdown fears. An analogous pattern appeared on Asia Pacific bourses.

DOVISH SNB, BOE MAY HELP COOL MARKET-WIDE RISK APPETITE

Such worries may be amplified if incoming policy pronouncements from the SNB and the Bank of England reinforce the sense that global monetary officialdom is collectively downbeat about the business cycle. To the extent that this stokes broad de-risking – an outcome already hinted by an APAC-hours drop in US stock index futures – the anti-risk Japanese Yen and even beleaguered USD may find support.

The Australian and New Zealand Dollars have managed standout performance before the opening bell in Europe, buoyed by supportive local economic data. Australia’s jobless rate fell to an eight-year low while New Zealand’s fourth-quarter GDP data showed growth picked up in the fourth quarter (albeit in line with consensus forecasts). Market-wide risk aversion may see these gains trimmed however.

What are we trading? See the DailyFX team’s top trade ideas for 2019 and find out!

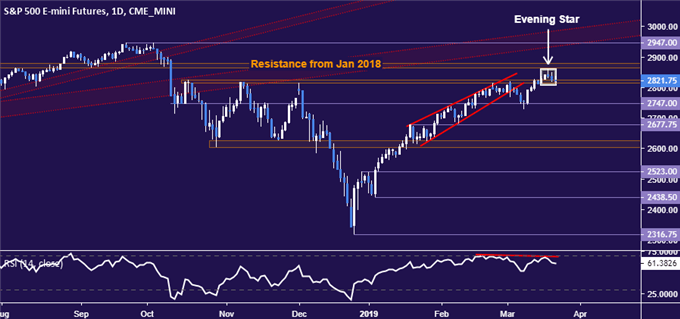

CHART OF THE DAY – S&P 500 SETUP WARNS OF RISK AVERSION AHEAD

Earlier in the week, the S&P 500 appeared to be showing signs of topping. Further evidence of an imminent downturn now seems to be on display, with prices showing a bearish Evening Star candlestick pattern coupled with negative RSI divergence. A daily close back below the 2814-25 area may offer preliminary confirmation and suggest that a sustained risk-off reversal is underway across global markets.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter