Talking Points:

- Euro may shrug off 2Q GDP revision with ECB QE taper in focus

- UK jobless claims data may pass with little notice from the Pound

- US Dollar may rise as FOMC minutes hint at third 2017 rate hike

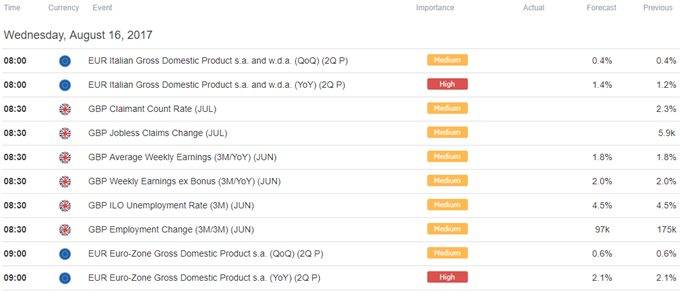

A revised set of second-quarter Eurozone GDP figures headlines the economic calendar in European trading hours. The flash estimate showing a 0.6 percent quarterly gain is expected to be confirmed, as is the trend growth reading putting on-year pace of expansion at 2.1 percent.

News-flow out of the currency bloc has deteriorated relative to forecasts since the initial projection was published at the beginning of this month. This points to downgrade risk. Such a result may hurt the Euro but lasting follow-through seems unlikely amid hopes for on-coming tapering of ECB QE.

The British Pound may be similarly unimpressed by July’s UK jobless claims report. Prospects for BOE policy tightening have dimmed after yesterday’s disappointing CPI numbers, making these numbers something of a moot pointregardless of the outcome.

Minutes from July’s FOMC policy meeting will be in focus thereafter. The US Dollar may rise if the document suggests that the rate-setting committee stands by June’s projection for three rate hikes in 2017 – two of which have already materialized – despite a run of sluggish inflation figures recently.

Join our webinar and follow the FOMC Minutes release and its market impact LIVE!

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak