Talking Points:

- Commodity currencies rise as energy, material shares boost ASX 200

- Yen higher as Japanese shares decline, driving anti-risk capital flows

- European, US stock index futures hint at further risk aversion ahead

The Australian, Canadian and New Zealand Dollars traded higher in Asian trade. The move tracked gains in Australia’s S&P/ASX 200 stock index. Materials and energy names led the way higher, which may explain strength in commodity-linked currencies. The Yen likewise advanced asJapan’s Nikkei 225 index suffered, sending capital flowing into local investors’ standby anti-risk play.

The European economic calendar is conspicuously thin on high-profile scheduled event risk. The US data docket is not much more exciting, offering a small helping of second-tier releases. This seems to open the door for sentiment trends to steer G10 FX price action. Futures tracking key US and European stock benchmarks are in the red, hinting at risk aversion that may help the Yen continue to build higher.

Want to run your trade ideas by a DailyFX analyst? Join a trading Q&A webinar and do it live!

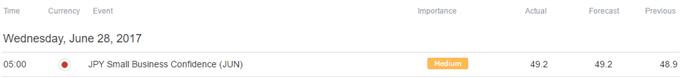

Asia Session

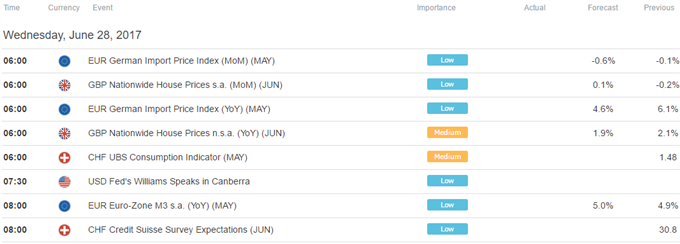

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak