Wall Street, Treasury Auction, China Trade, AUD/USD - Talking Points

- Wall Street moved higher as technology shares led the New York session

- Strong 30-year Treasury demand cooled yields, pressured safe-haven USD

- AUD/USD approaches trendline resistance but bullish path favored

Wednesday’s Asia-Pacific Outlook

Asia-Pacific markets may benefit from a broader sense of risk-taking in the market following an upbeat session on Wall Street. The New York trading session saw US inflation data for March cross the wires, with core inflation – which excludes volatile food and energy prices – coming in at 1.6% on an annual basis versus 1.5% expected. The tech-heavy Nasdaq 100 led US equities higher, closing with a 1.21% gain.

The safe-haven US Dollar failed to move higher despite the beat on inflation. That may be because markets view the uptick as a transitory event following dovish comments from Federal Reserve members saying the same. That said, a sustained increase will be necessary for markets to capitulate to any real rise in prices, even with inflation expectations continuing higher. Not long ago, many viewed the run in Treasury yields as a test of the Federal Reserve’s conviction on inflation policy – the Fed's resolve dissuaded those notions, however.

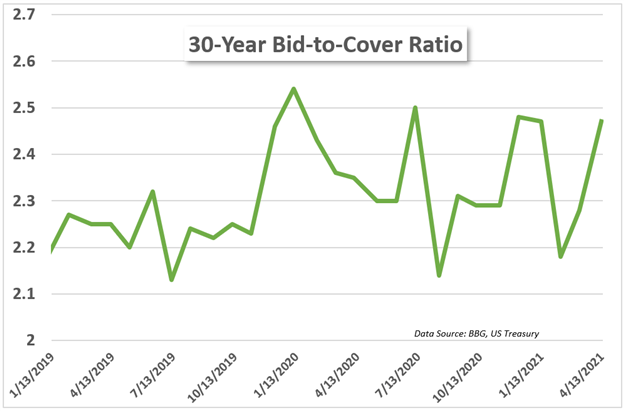

A strong 30-year Treasury auction also posed headwinds to the Greenback. The Treasury Department reported a 2.320% high yield with a better-than-average bid-to-cover ratio of 2.47. An auction’s bid-to-cover ratio provides a gauge of demand by measuring bids received versus those being auctioned. A higher ratio shows greater demand.

Today will bring two potentially hard-hitting economic events: Australian consumer confidence and an interest rate decision from the Reserve Bank of New Zealand (RBNZ). Australia’s Westpac consumer confidence index for April is scheduled to hit the wires at 00:30 GMT. New Zealand’s interest rate decision will follow at 02:00 GMT.

The RBNZ is likely to maintain its dovish policy outlook. That said, both the Aussie-Dollar and Kiwi may be set for some event-driven movement today. One notable development to factor into the RBNZ’s decision making process is the decline in real estate investors in New Zealand’s domestic economy, which is likely to bode well for ongoing dovishness in central bank policy.

30-Year US Treasury Bid-to-Cover Ratio

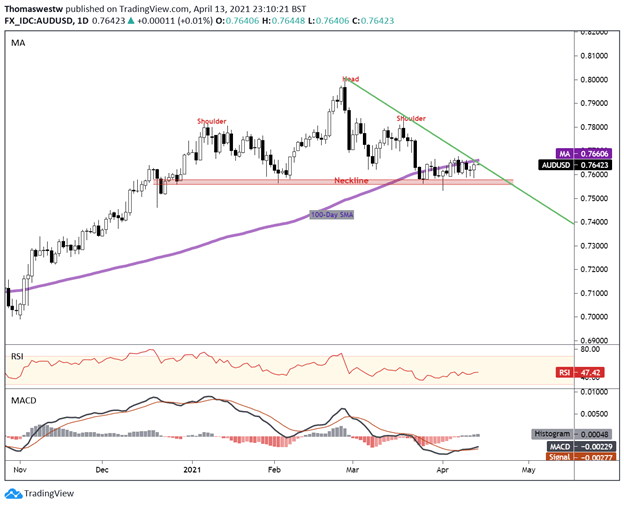

AUD/USD Technical Outlook

The Australian Dollar has been in a phase of consolidation over the past few weeks with a slight drift higher from the neckline of a Head and Shoulders pattern. While prices have fallen below the 100-day Simple Moving Average, a trendline from the February swing high may give way to a directional break within the next couple of days. MACD is trending higher toward its center line.

AUD/USD Daily Chart

Chart created with TradingView

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter