Australian Dollar, AUD/USD, Japanese Yen, US Dollar – Asia Pacific Market Open

- Australian Dollar may fall as week gets going, but AUD/USD uptrend holds

- Weekend futures hint a “risk-off” tilt that may benefit the Yen and US Dollar

- Markets may have priced in stimulus bill, US virus deaths may surpass 200k

Australian Dollar May Fall as Japanese Yen and US Dollar Gain Ahead

The “growth-linked” Australian Dollar may wilt as the “anti-risk” Japanese Yen and similarly-behaving US Dollar gain as the new week gets underway. Weekend Wall Street futures – courtesy of IG – showed the Dow Jones Industrial Average down almost one percent heading into Monday’s Asia Pacific trading session. This also follows a rather pessimistic North American trading session when last week wrapped up.

On Friday, the Dow Jones and S&P 500 closed -4.06% and -3.37% to the downside. This is despite the US passing a US$2 trillion fiscal stimulus package to support an economy that is being battered by the coronavirus outbreak. This might have been due to markets having already priced in the bill’s passage, leaving no room for surprise when President Donald Trump signed it into law.

Equities declined into Friday’s close as the Federal Reserve announced it would lower the daily pace of Treasury purchases to $60b from $75b on April 2-3. This would represent a slight reduction in future liquidity provisions. Still, keep in mind that the central bank is currently conducting an open-ended quantitative easing program.

Over the weekend Anthony Fauci – Director of the National Institute of Allergy and Infectious Diseases – said that deaths from COVID-19 could reach 200,000 in the US. Spain also reported a record 838 coronavirus deaths over the course of 24 hours. Meanwhile fatalities from the virus in Italy surpassed 10,000 though deaths slowed for two consecutive days.

Australian Dollar Technical Analysis

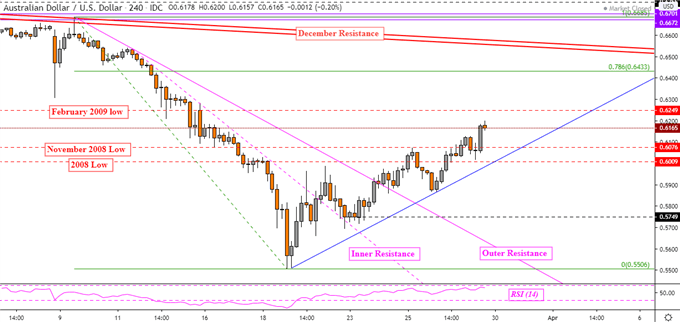

AUD/USD continues to trade with an upside technical bias. This followed the Australian Dollar breaking above “outer” resistance on the 4-hour chart below. Shifting to a bearish outlook entails taking out near term rising support which was established when prices bottomed on March 19. Otherwise AUD/USD could be looking to retest lows from February 2009 at 0.6249.

| Change in | Longs | Shorts | OI |

| Daily | -21% | 32% | -1% |

| Weekly | -21% | 28% | -2% |

AUD/USD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter