Asia Pacific Market Open – Brexit News, British Pound, NASDAQ Composite, Apple, Australian Dollar

- UK Prime Minister Theresa May backed down the Brexit draft vote, British Pound tumbled

- Tech lead Wall Street higher despite Qualcomm ruling banning some iPhone sales in China

- Asia Pacific equities may pause fall, Australian Dollar at risk to weak business confidence

Find out what retail traders’ British Pound buy and sell decisions say about the coming price trend!

Battered by the latest Brexit news, the British Pound depreciated across the board. GBP/USD closed at its lowest since April 2017 as it had it worst day in almost one month. After it became increasingly unlikely that UK Prime Minister Theresa May could not pass her Brexit draft through Parliament, she ultimately backed down and delayed the vote.

She also said the government will be stepping up no-deal Brexit preparations as she heads back to Brussels to discuss the Irish backstop. Despite technical warning signs that EUR/GBP might have been on the verge of turning lower, critical fundamentals brought with it its highest close since August as it wiped out multiple resistance barriers. Local government bond yields sunk as a BoE hike next year now looks more unlikely.

Despite the presence of risk aversion in Asia and European benchmark stock indexes, Wall Street ended the day cautiously higher. The rally was upheld by information technology as Facebook, Amazon and Apple shares edged higher. In fact, the S&P 500 was up only about 0.18% while the more tech-based NASDAQ Composite rallied 0.74%.

The rally in Apple shares is also impressive given that Qualcomm, an American multinational semiconductor company, won a ruling that would ban the sale of certain iPhone devices in China. Gains in information technology occurred following weekend news that Uber Technologies filed confidentially for an IPO. Monday allowed regional bourse to react to the news. A clear catalyst for the reversal in risk trends during the second half of Monday seemed rather unclear however.

With that in mind, anti-risk currencies outperformed. In particularly, the Swiss Franc rose as a regional haven to Brexit uncertainties. To the benefit of weakness in Sterling, the US Dollar edged cautiously higher alongside front-end government bond yields as stocks rose. Meanwhile the pro-risk Australian and New Zealand Dollars saw gains as well.

Tuesday’s Asia Pacific trading session is lacking prominent economic event risk which places market mood as the dominant driver for stocks and FX. The rally in tech shares could bring with it a pause in weaknesses seen in recent days. Speaking of sentiment, the Australian Dollar carefully eyes local business confidence data which is currently sitting at 2016 lows. Local data has been tending to underperform relative to economists’ expectations, opening the door to further disappointment and AUD declines.

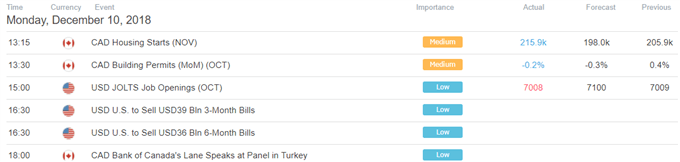

US Trading Session

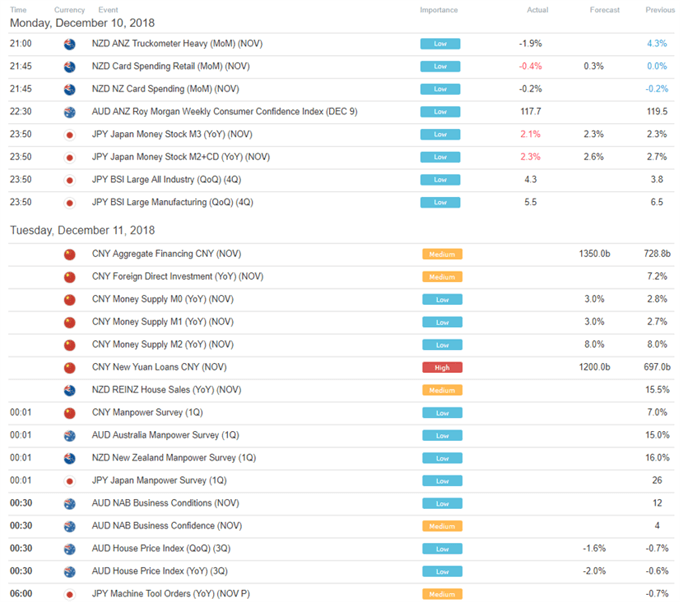

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter