Fundamental Forecast for the Crude Oil: Neutral

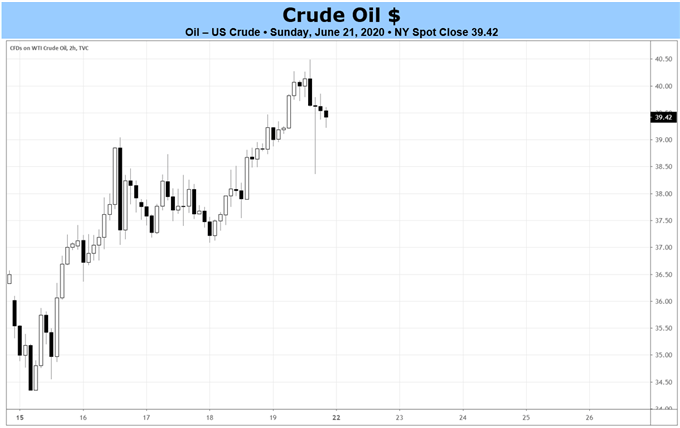

- Both Brent oil and crude oil prices closed at their highest levels since early-March, marking the seventh time in eight weeks that both benchmarks rallied.

- The supply-demand imbalance favors dwindling supplies over the coming months, a tailwind for crude oil prices.

- The IG Client Sentiment Index suggests that crude oil prices are on neither bullish nor bearish grounds.

Crude Oil Prices Week in Review

Energy markets rebounded last week, shrugging off only their first weekly loss since the second to last week of April, returning to their coronavirus pandemic highs. Crude oil prices added a hefty +8%, their highest weekly close since the first week of March. Brent oil prices traded in a similar fashion, gaining +7.6%. As concerns around The Great Lockdown’s impact on the global economy – and what shape the ensuing recovery will look like – energy markets have been able to rally thanks in part to efforts made by the world’s major producers to set supplies on a downward trajectory for a significant period of time.

Supply-Demand Imbalance: Production Cuts Allow for Storages to Drain

Even as global growth concerns emerge once again, crude oil prices have a tailwind at their back: the shifting relationship between supply and demand forces. The IEA foresees the global supply-demand balance quickly shifting from a surplus to a deficit from Q2’20 to Q3’20, with global inventories dropping by around 4.5 mb/d through Q3’20 and Q4’20. OPEC+ has put out more aggressive estimates, however, suggesting that its members will allow demand to outpace supply by at least 7 mp/d through the end of 2020. Draining inventories thanks to steep production cuts will almost assuredly guarantee that demand outstrips supply, a precondition for a rising market.

Economic Calendar Week Ahead Impact on Crude Oil Prices

The forex economic calendar is in a state of flux as June and the second quarter come to a close, insofar as the coronavirus pandemic has upended the attention that would typically be given to various data releases. In effect, the closer in proximity the data are to present day, the better; weekly releases like initial jobless claims and crude oil inventories have proven to leave a greater imprint on price action than monthly or quarterly releases.

To this end, any of the PMI readings due over the course of the week are likely to have a greater impact on price action than, say, the final Q1’20 US GDP reading, which will barely take into account the influence of the coronavirus pandemic.

Of course, given the changing nature of energy production and demand as the global economy emerges from The Great Lockdown, we’ll want to keep on the EIA inventory data due to be released at 14:30 GMT on Wednesday, June 24. The data will reinforce the notion that we’re in the beginning innings of a long ballgame where there will be persistent supply-demand deficits – for the next several quarters, if not years.

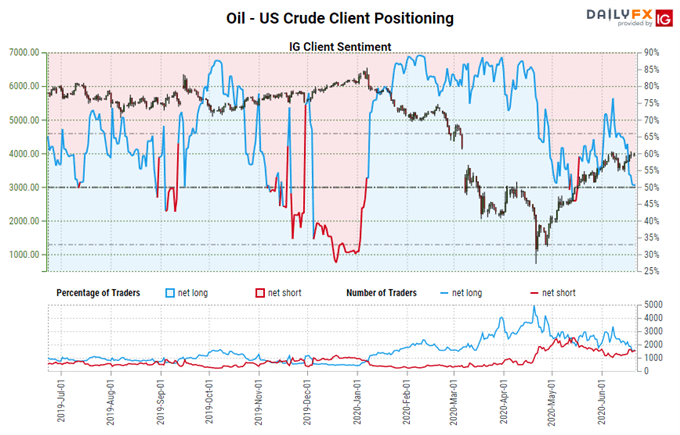

IG Client Sentiment Index: Crude Oil (June 22, 2020) (Chart 1)

Oil - US Crude: Retail trader data shows 52.45% of traders are net-long with the ratio of traders long to short at 1.10 to 1. The number of traders net-long is 12.65% higher than yesterday and 24.98% lower from last week, while the number of traders net-short is 4.71% higher than yesterday and 29.22% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Oil - US Crude trading bias.

Latest COT Data Shows Oil Longs Ease

Finally, looking at positioning, according to the CFTC’s COT for the week ending June 16, speculators sharply decreased their net-long Crude Oil positions to 546.3K contracts, down from the 567.6K net-long contracts held in the week prior. Crude oil net-long positioning remains far below the highs seen over the past two and a half years, when 739.1K net-longs were held during the week ending February 6, 2018.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist