Australian Dollar (AUD/USD) Prices, Charts, and Analysis

- RBA hikes rates as expected by 25 basis points to 4.35%.

- Australian dollar on the back foot against the US dollar.

Download our Free Q4 Australian Dollar Forecast:

The Reserve Bank of Australia hiked rates by 25 basis points earlier today, as the central bank continues to struggle with above-target inflation. The move, widely expected, saw the Official Cash Rate raised to 4.35%. The RBA has kept rates unchanged at the last four policy meetings. In the accompanying statement, RBA Governor Michele Bullock noted that while inflation has passed its peak, it is still ‘too high and proving more persistent than expected a few months ago.’ Ms. Bullock added,

‘While the central forecast is for CPI inflation to continue to decline, progress looks to be slower than earlier expected. CPI inflation is now expected to be around 3½percent by the end of 2024 and at the top of the target range of 2 to 3 percent by the end of 2025. The Board judged an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe.‘

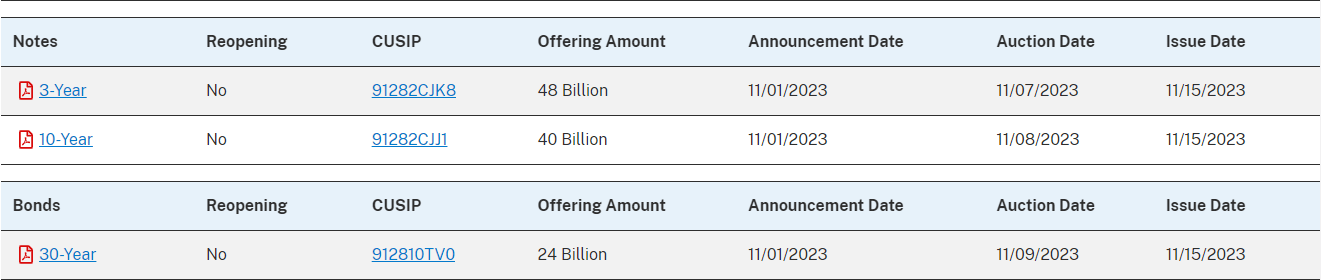

The Australian dollar fell against its US counterpart after the release, paring some of its recent gains. US Treasury yields picked up again overnight after last week’s sell-off, as traders look to this week’s USD112 billion of bond sales. Today USD48 billion of 3-year notes are up for sale, tomorrow USD40 billion of 10-year notes are on the block, while on Thursday USD24 billion of 30-year bonds will be up for grabs. It looks likely that traders are trying to force yields higher this week ahead of these sales.

Learn How to Trade AUD/USD

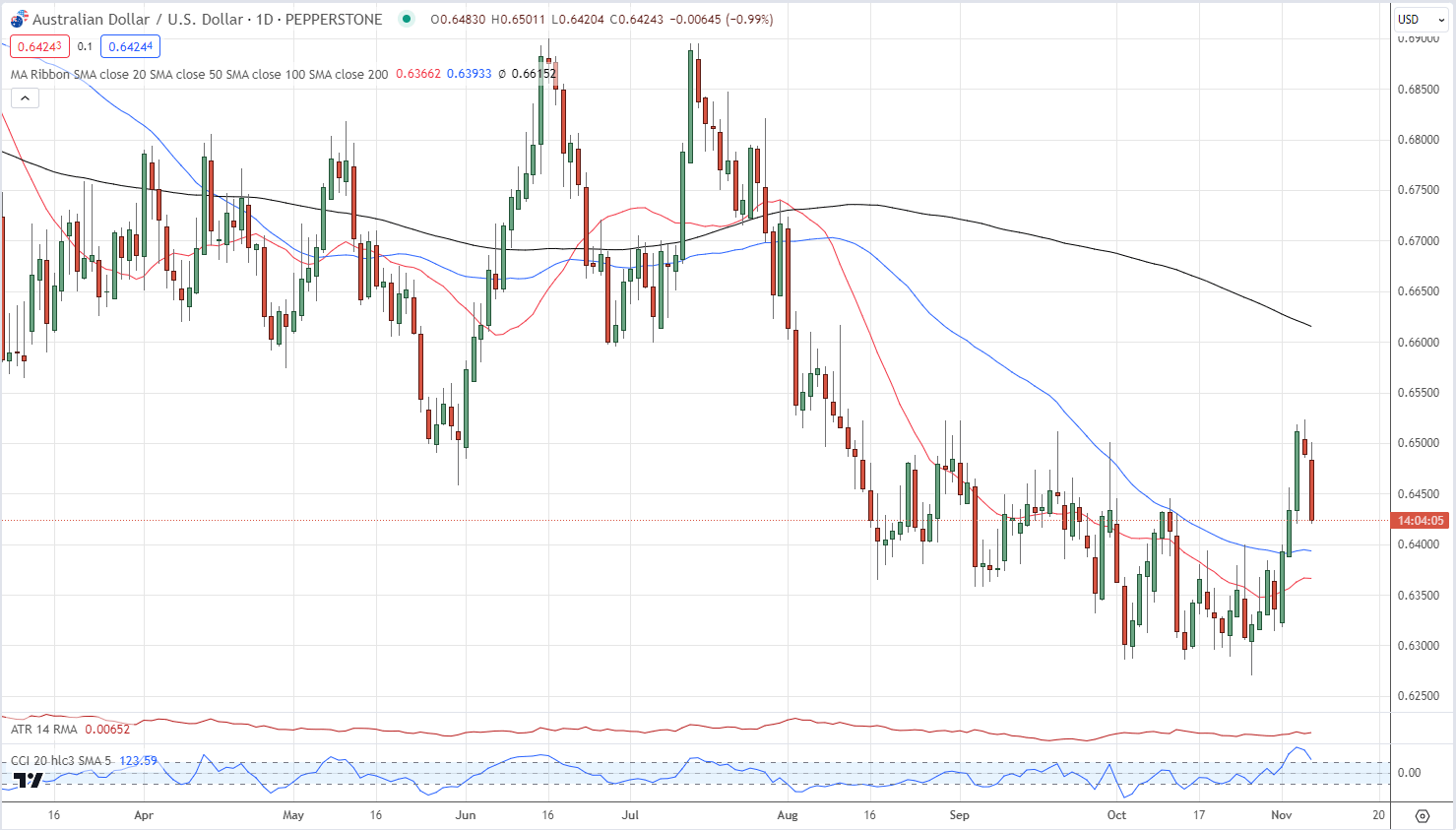

The recent move higher in AUD/USD, on the back of a weaker US dollar and thoughts that the RBA would raise interest rates, pushed the pair away from a rough zone of prior trade between 0.6300 and 0.6500. The pair currently trade at 0.6425 and need to hold above the 50-day sma at 0.6393 and the 20-day sma at 0.6366 to continue last week’s bullish move.

AUD/USD Daily Price Chart – November 7, 2023

| Change in | Longs | Shorts | OI |

| Daily | -17% | 35% | 1% |

| Weekly | -17% | 20% | -3% |

What is your view on the Australian Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.