Japanese Yen (USD/JPY) Prices, Charts, and Analysis

- USD/JPY remain close to 150.00 despite BoJ warnings.

- US Jobs Report may help or hinder the Japanese central bank.

Download our Brand New Q4 Japanese Yen Forecast for Free

The US Jobs Report (NFP) is a closely watched monthly event that normally causes a dash of volatility going into the weekend. The latest look at the US labor market gives the Fed, and the market, further information about the strength of the US economy and plays a major part when the US central bank looks at appropriate monetary policy settings.

US Jobs Report Preview: What’s in Store for Nasdaq 100, USD, Yields, and Gold?

It won’t just be the Federal Reserve watching closely today as the Bank of Japan will also have a keen interest in any US dollar moves post-release. Earlier this week there were unconfirmed reports that the BoJ intervened in the fx markets when USD/JPY touched 150.00, a level many see as a line in the sand for the Japanese central bank to step in and defend the Yen. USD/JPY moved lower quickly on these reports but quickly rebounded back to the 149 level as US dollar buyers stepped back in. The pair currently trade just under 149 ahead of today’s US release.

Bank of Japan - Foreign Exchange Market Intervention

Current market NFP forecasts are for 170k new jobs to be added in September, down from 187k in August. The unemployment rate is expected to tick 0.1% lower to 3.7% while average hourly earnings m/m are seen rising by 0.1% to 0.3%.

If these numbers come in lower-than-expected, or if there are any substantial downward revisions to August’s data, the US dollar is likely to fall, in turn taking USD/JPY lower. Any unexpected strength in the numbers will rekindle thoughts that the Fed will have to increase rates again this year, pushing the dollar, and USD/JPY higher. If this happens and USD/JPY breaks above 150, then the BoJ may need to step in and take action. This afternoon’s number may well set the stage for USD/JPY for the weeks ahead.

Learn How to Trade USD/JPY

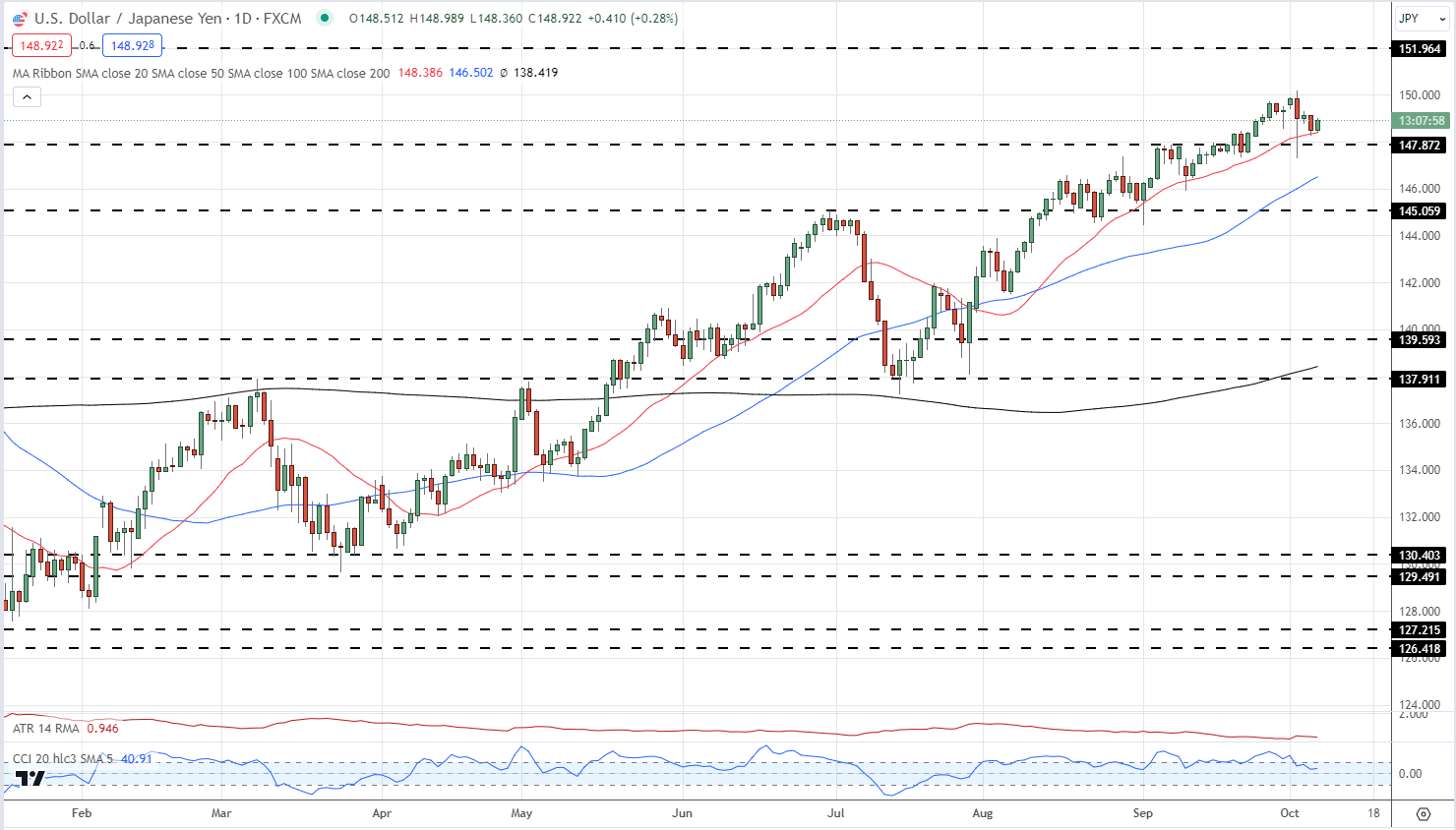

USD/JPY Daily Price Chart – October 6, 2023

Download the Latest IG Sentiment Report to See How Daily/Weekly Changes Affect the USD/JPY Price Outlook

| Change in | Longs | Shorts | OI |

| Daily | 34% | -10% | 0% |

| Weekly | 45% | -35% | -23% |

What is your view on the Japanese Yen – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.