Written by Axel Rudolph, Senior Market Analyst at IG

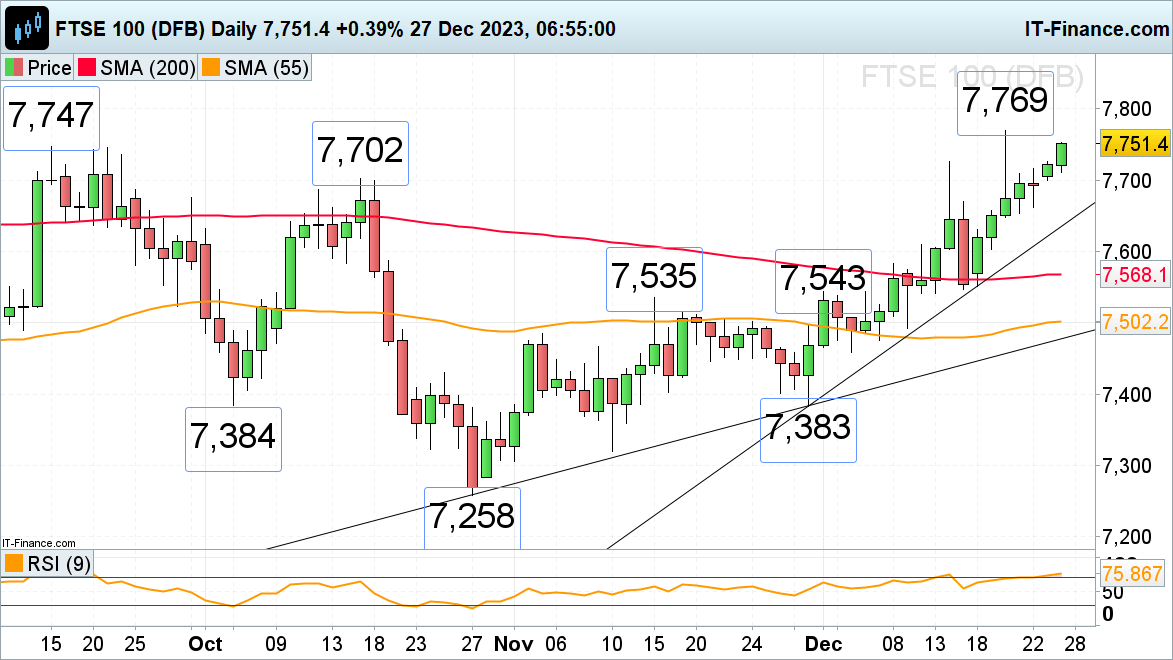

FTSE 100 flirts with September peak

The FTSE 100 is seen kicking off the final week of 2023 on a positive note as investors return from a holiday-extended weekend.

Following a rise in US and Asian stocks, the FTSE 100 once more flirts with its September peak and tries to reach its current December high at 7,769. Above it lurks the 7,800 zone.

Slips should find support around Friday’s 7,716 high and the 7,702 October peak.

DAILY FTSE CHART

Chart Prepared by Axel Rudolph

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

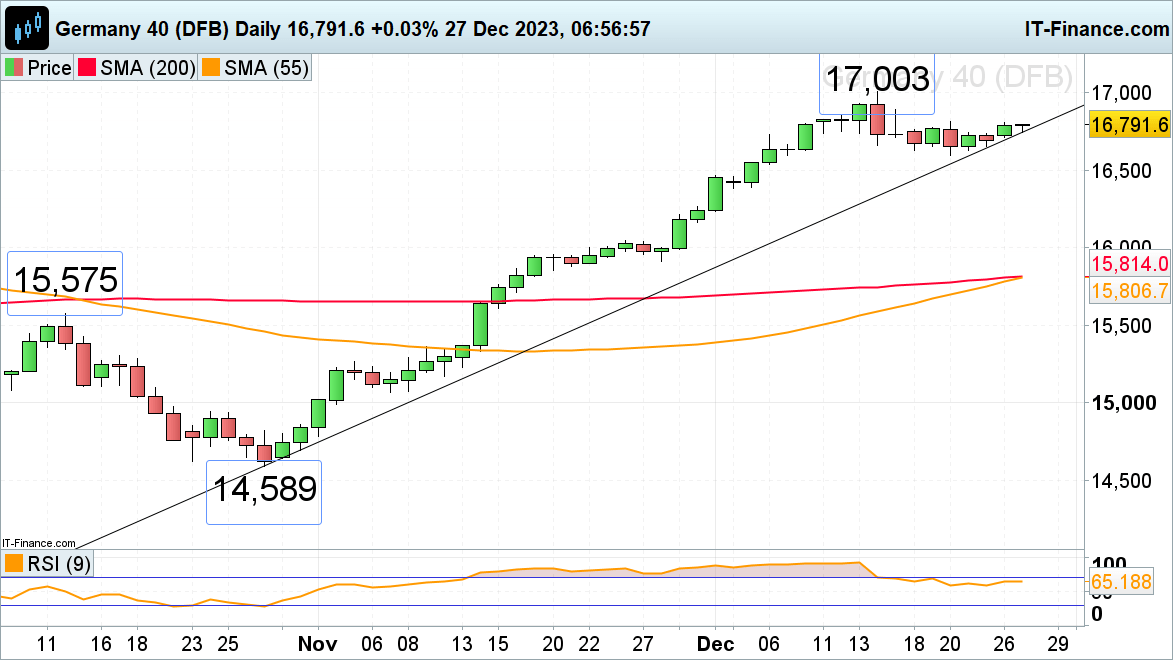

DAX 40 resumes its advance

Having traded in a relatively tight sideways range since mid-December, the DAX 40 is probing the upper end of its recent trading band, helped by positive US and Asian sessions on Tuesday and Wednesday.

A rise above the 20 December high at 16,811 would put the 11 December high at 16,827 and the 15 December high at 16,889 on the map, ahead of the 17,000 region.

Support below the October-to-December uptrend line at 16,746 sits at Friday’s 16,653 low and, more importantly, at last week’s 16,595 trough. Only if the 16,595 low were to give way, would the July peak at 16,532 be back on the cards but should then offer support.

DAILY DAX CHART

Chart Prepared by Axel Rudolph