Unlock exclusive insights and customized strategies for EUR/USD by requesting the comprehensive trading guide for the euro!

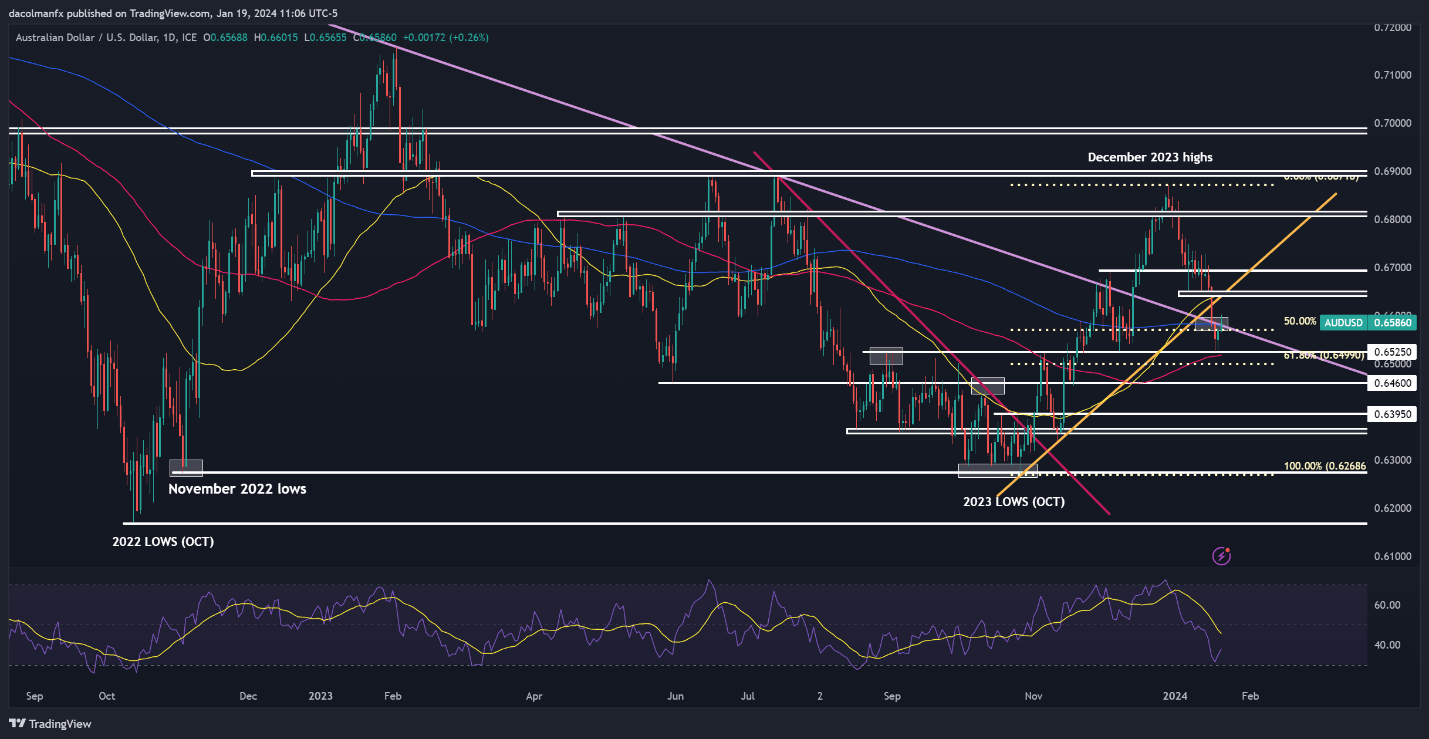

EUR/USD TECHNICAL ANALYSIS

EUR/USD lacked directional conviction on Friday, holding above its 200-day simple moving average at 1.0840. To boost sentiment towards the euro, this floor must remain intact, as a breach may lead to a decline towards 1.0770. If weakness persists, all eyes will be on 1.0700 handle.

Conversely, if bulls orchestrate a turnaround and push prices higher, initial resistance stretches from 1.0910 to 1.0930. Sellers are likely to vigorously defend this zone on another retest; however, a successful breakout could pave the way for a rally toward 1.1020.

EUR/USD TECHNICAL CHART

EUR/USD Chart Prepared Using TradingView

Curious about the correlation between retail positioning and USD/CAD’s short-term path? Discover all the insights in our sentiment guide. Request a free copy now!

| Change in | Longs | Shorts | OI |

| Daily | -2% | 10% | 3% |

| Weekly | 34% | -13% | 7% |

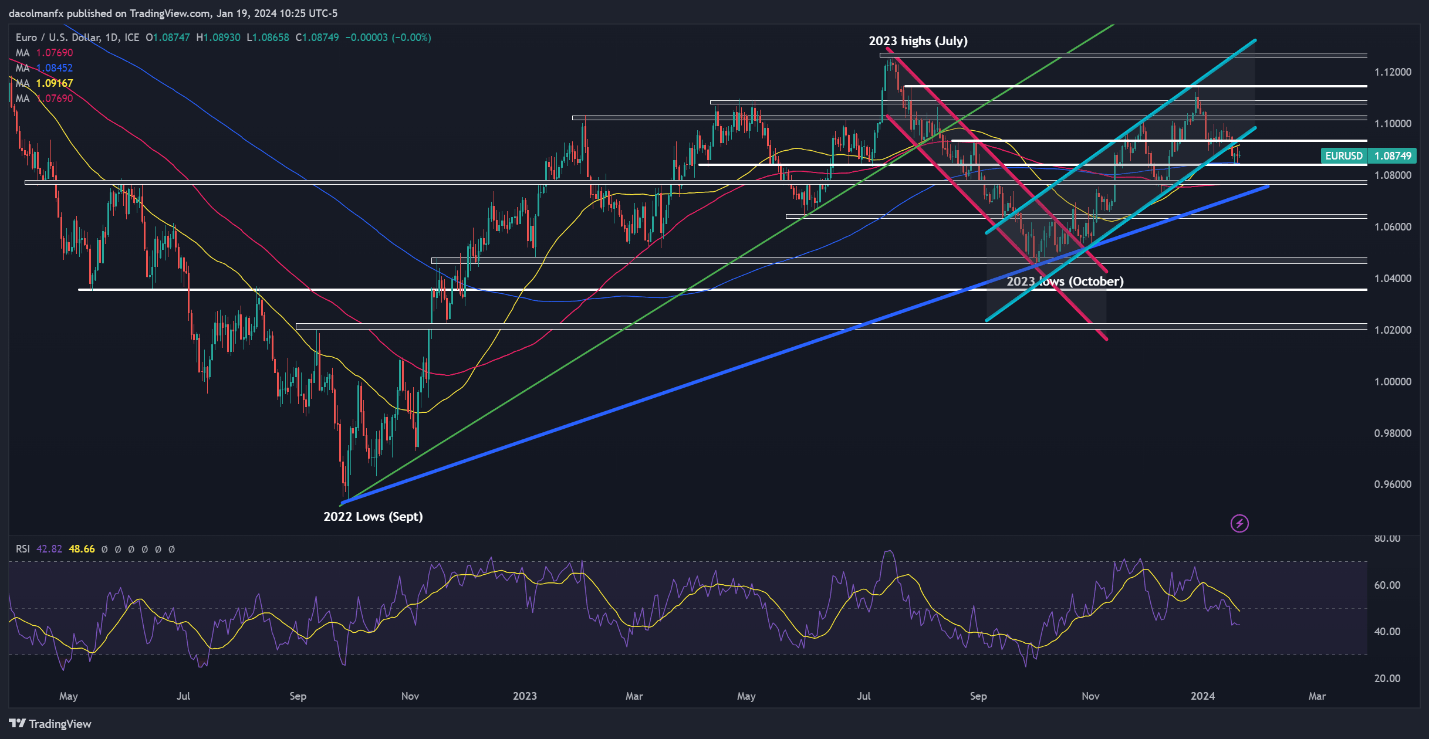

USD/CAD TECHNICAL ANALYSIS

USD/CAD has rallied sharply since late 2023, but its upward momentum has started to fade following an unsuccessful attempt at clearing trendline resistance and a key Fibonacci level near 1.3540, a rejection that led to a modest pullback towards the 200-day simple moving average at 1.3475.

Although the short-term outlook remains constructive, prices need to stay above the 200-day SMA to preserve this bias; failure to do so could attract new sellers into the market, creating the right conditions for a pullback towards 1.3385.

In case of a bullish continuation, resistance lies at 1.3540, as stated before. While buyers might have a hard time pushing the exchange rate above this area, a clean break could send the pair towards 1.3570. On further strength, there's potential for an advance towards 1.3625.

USD/CAD TECHNICAL CHART

USD/CAD Chart Created Using TradingView

Unsure about the Australian dollar’s prospects? Gain clarity with our complimentary Q1 trading forecast!

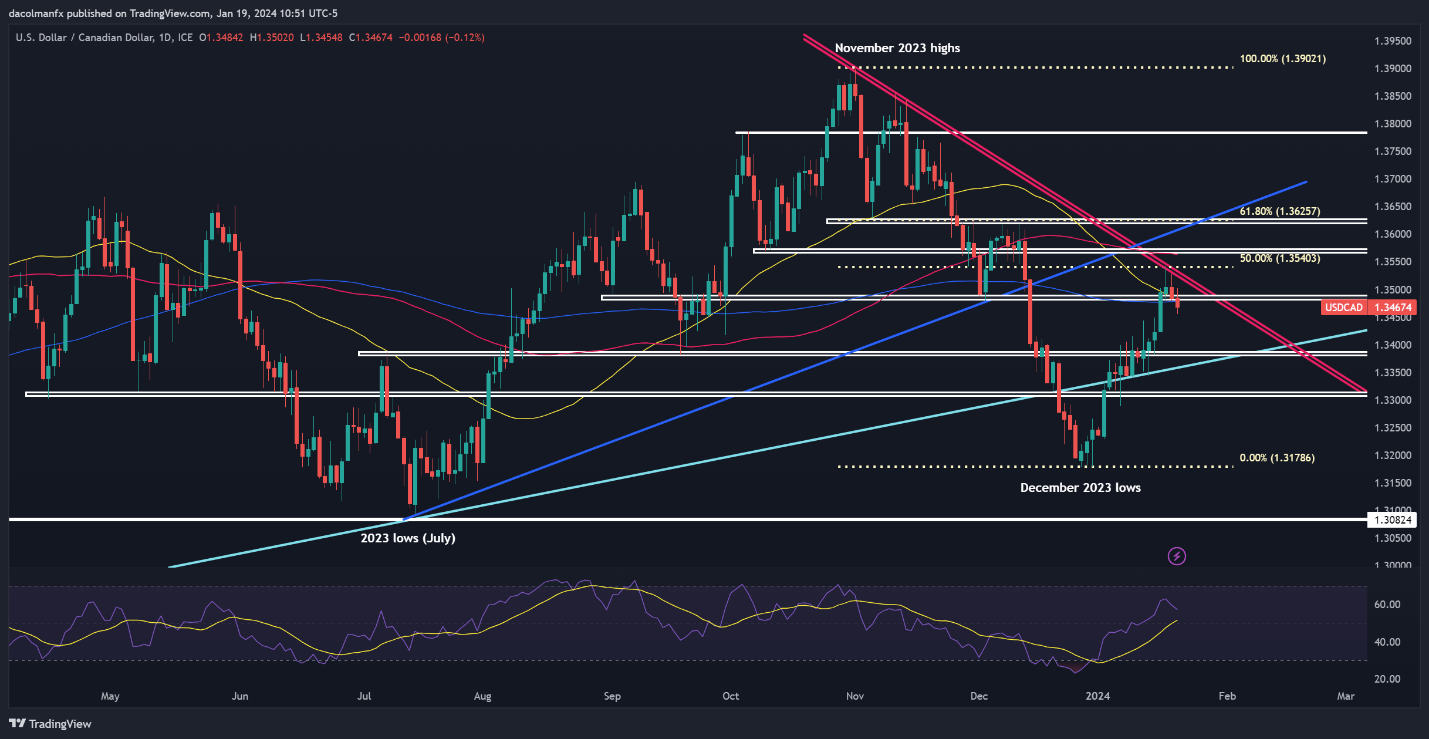

AUD/USD TECHNICAL ANALYSIS

AUD/USD sank from late December through early this week, but has bounced off technical support at 0.6525. The focal point now is on whether the pair can close above the range of 0.6570-0.6580 on a weekly basis. If it does, a potential rally toward 0.6650 and subsequently 0.6700 may be on the horizon.

On the flip side, should sellers reemerge and drive prices below the 100-day SMA near 0.6525, the next important area of support appears at 0.6500, which corresponds to the 61.8% Fib retracement of the October/December leg higher. Below this threshold, all attention will be on 0.6460.

AUD/USD TECHNICAL CHART