EUR/USD ANALYSIS

- All eyes now shift to eurozone CPI to round off the week.

- ECB President & Fed speakers under the spotlight later today.

- EUR/USD finds resistance at overbought zone.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

EURO FUNDAMENTAL BACKDROP

The euro has been capitating off the weaker than expected US CPI earlier this week despite weakening slightly both yesterday and today. Markets are seemingly expecting the Federal Reserve to have reached its hiking cycle peak and have since ‘dovishly’ repriced expectations through to December 2024. This may be an overreaction as inflation remains sticky and after Fed Chair Jerome Powell’s recent comments to maintain elevated interest rates, the roughly 91bps of cumulative rate cuts by the end of 2024 could be amplified. US PPI did encourage further disinflation being a leading indicator but Fed officials stay cautious.

From a euro area perspective, the EU commission stated that the region will avoid a technical recession but recent economic data has shown extremely poor statistics including yesterday’s industrial production.

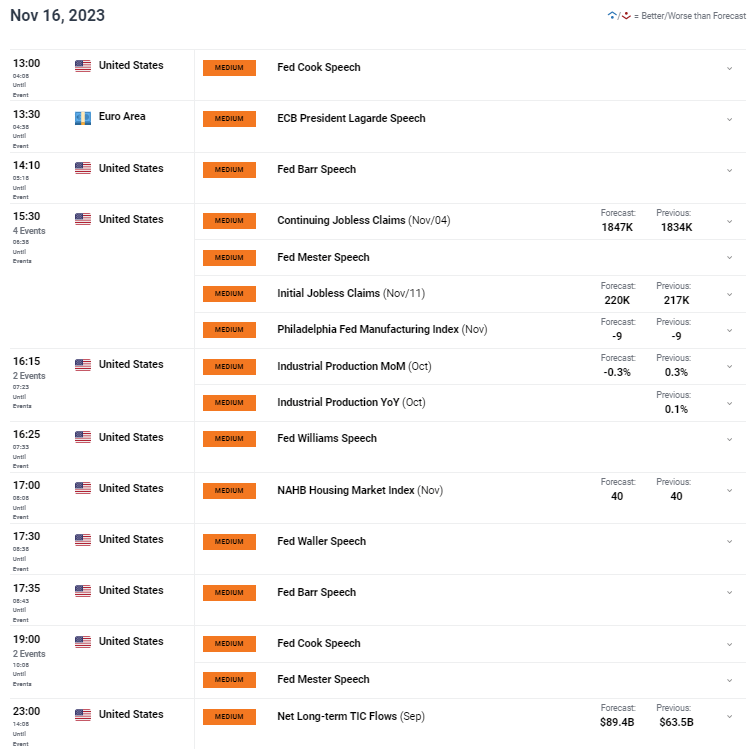

The day ahead will be dominated by central bank speakers with the European Central Bank’s (ECB) President Christine Lagarde included (see economic calendar below). It will be interesting to see how Fed speakers respond to the recent inflation and retail sales reports. Considering the US and UK have released their inflation statistics, the euro report scheduled for tomorrow could bring the euro down from recent highs if actual data fall in line with estimates.

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

TECHNICAL ANALYSIS

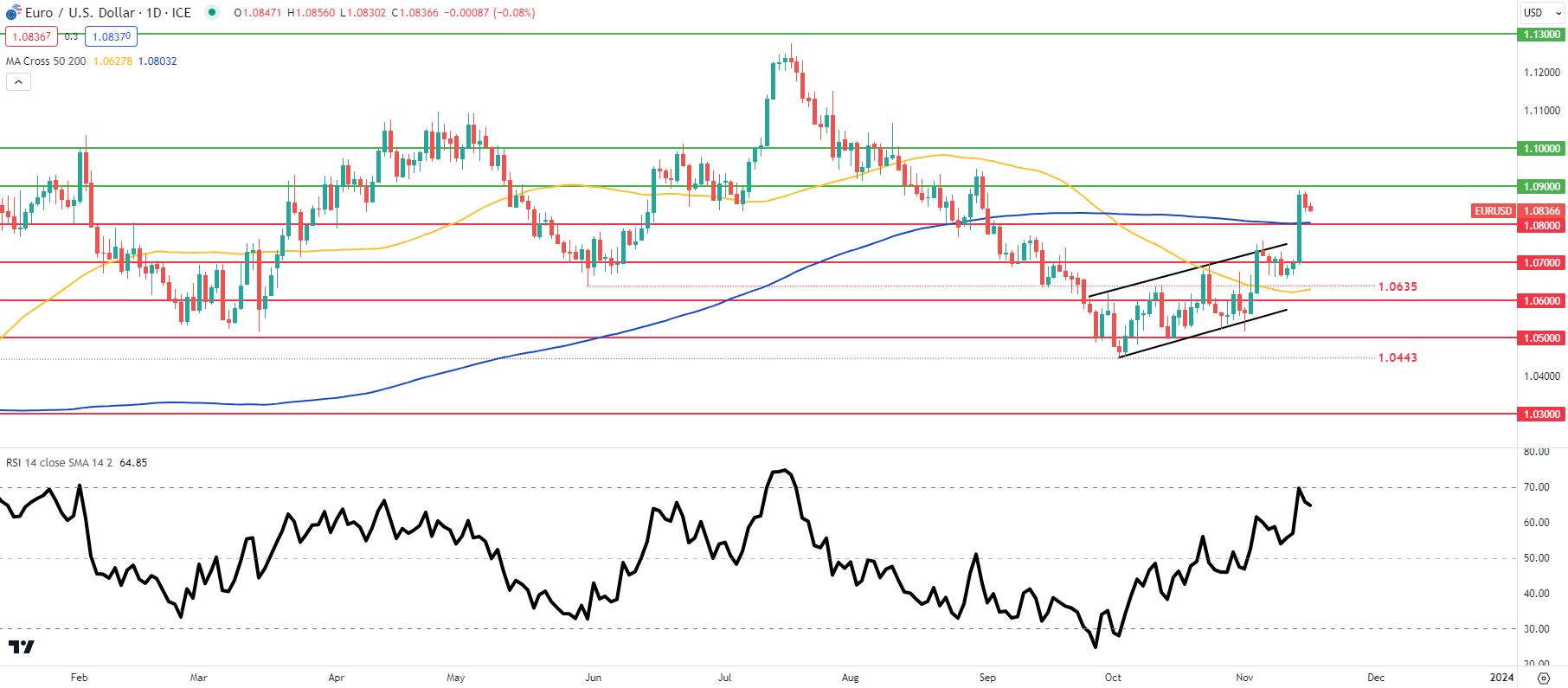

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD daily chart above has been rejected around the overbought mark on the Relative Strength Index (RSI) coinciding with the 1.0900 psychological handle. A sharp decline in euro area inflation could see the pair back below the 200-day moving average (blue)/1.0800 once more.

Resistance levels:

- 1.1000

- 1.0900

Support levels:

- 1.0800/200-day MA

- 1.0700

- 1.0635

- 50-day MA

- 1.0600

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently neither NET SHORT on EUR/USD, with 59% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas