The Federal Reserve's rate decision is dead ahead, and the market has been waiting for this event. There is clear conviction that the outcome will be a rate hike, and yet that won't likely set us up for a Dollar rally.

Talking Points:

- The Federal Reserve will announce its final policy decision of the year Wednesday and the market is certian of a third 2017 hike

- Given the heavy speculation and the fact that this is a 'quarterly' meeting, the focus will turn to forecasts for the 2018 pace

- It will be easier to disappoint the Dollar and 'risk trends' (like the S&P 500) given assumptions and pricing

Do you have Dollar or US market exposure and plan on watching the Fed decision to assess its impact? Do you plan to place trades based on the central bank's decision? Join me as I cover the rate decision live. Sign up on the DailyFX Webinar Calendar.

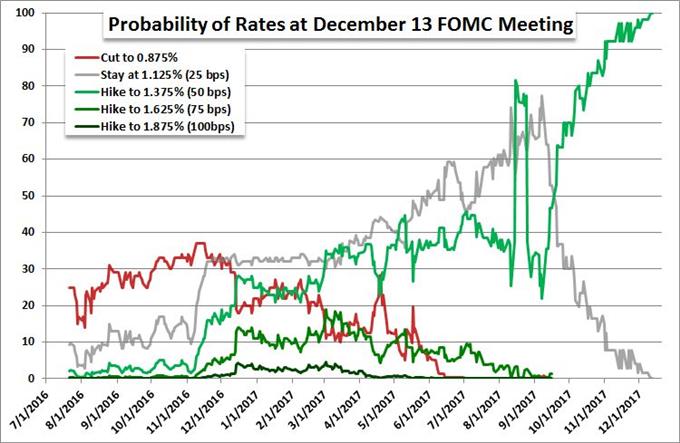

We are facing arguably the most underwhelming but meaningful fundamental shift of the year in the upcoming session. Ahead, the Federal Reserve's final rate decision of the year is on tap. What's more, it is one of the 'quarterly' meetings in which there is not only a rate decision and policy statement; but also the forecasts and Fed Chair press conference that are standard in 'quarterly' events. It is good that there are these additional elements, otherwise we would be looking at the least market-moving rate hike in modern record. According to both Fed Fund futures and swaps, the market is fully pricing in another 25 basis point hike from the Fed. That would be the third lift in 2017 which brings the benchmark range to a median of 1.375 percent. Normally, a rate hike in these extremely dovish conditions in which most central banks are still zero-bound and QE-heavy would warrant a contrasting bid. Yet, that hasn't been the theme for the Greenback for some time.

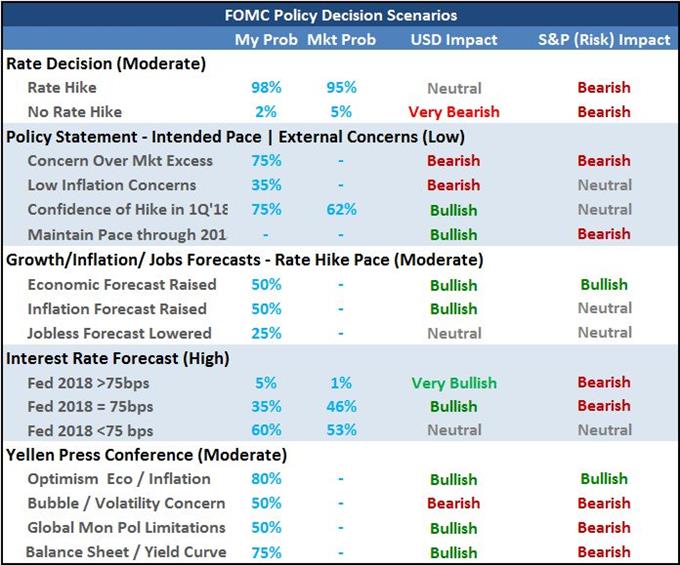

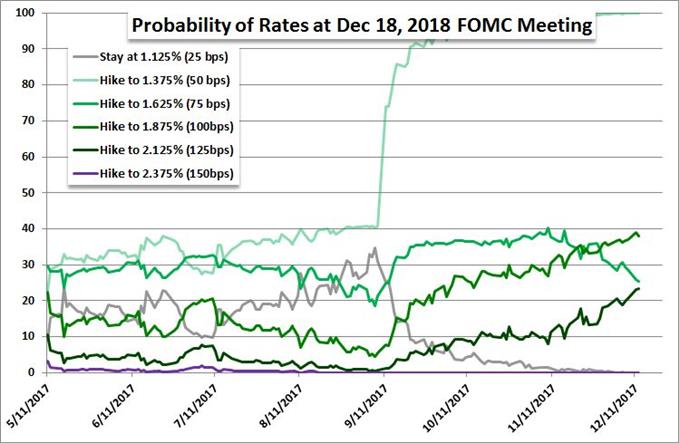

If realized, the Fed's hike Wednesday would meet the group's forecast for three quarter percent hikes through the year which they have maintained since early in the year. Yet, as the central bank has moved to make these forecasts a reality, the Dollar has spent its time in full retreat. It isn't that other currencies are closing the yield gap, it is just that the Dollar priced in these hikes and likely more in its initial run through 2014 and 2015. This 'gradual' pace has afforded its advantage, and now the currency is standing at its fair value with these greater rates of return accounted for. Yet, there is still room for speculation. That is not in what the Fed does at this meeting - only a hold on rates would generate a serious response in a Dollar and S&P 500 tumble - but rather in the forecasts for the pacing through 2018. At the September event, the Summary of Economic Projections (SEP) projected another three-hike-year ahead. The market has meanwhile maintained a discount to this view. If the Fed commits despite recent language softening on inflation certainty, it could offer a modest bid to the Dollar. However, if the central bank succumbs to the market's assumptions, it would seem easy to cut down a 7-day advance for the DXY Dollar Index.

In general, it is easier to disappoint the Dollar and US capital markets (I use the S&P 500 as my standard bearer for that latter category). It is very unlikely that the Fed accelerates its pace given its warranted concerns. It is easier to disappoint given the fully price expectations and favorable standings. For the Dollar based pairs, there are the options that are short-term opportunities like USD/CAD with a well established and modest range. Then there are high hopes for full blown trends which run EUR/USD reversal and NZD/USD inverse head-and-shoulders. But don't forget risk trends. Why would a dovish shift from the Fed render concern among speculative assets when previously it had fueled the markets with an appetite to chase gains with extremely cheap lending environment? Because we are not talking about materially lowering rates from already cheap levels. Instead, it would be a concern over the economy if the Fed has to slow its already restrained efforts to ease off crisis-era policies. Watch this event closely, but remember that short-term volatiltiy is not the only product of its outcome. We focus on this event in today's Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE