EUR/USD Technical Outlook

- EUR/USD holding proven support level

- Pullback may be over, but hurdles yet to cross

EUR Technical Outlook: EUR/USD Trying to Stabilize, Levels & Lines to Watch

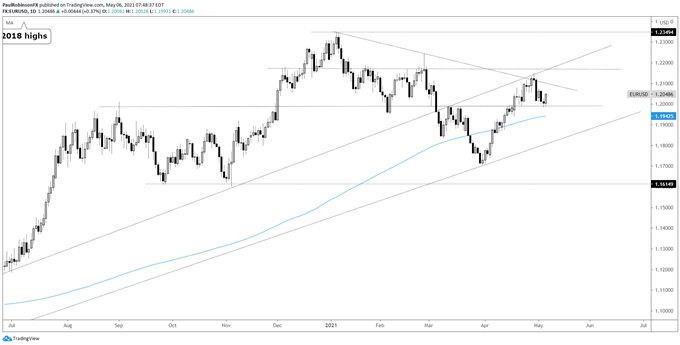

The Euro dipped a bit in recent trade, but as of yesterday it found support at a proven level just a tad beneath the 12000 level. This level has been in play as both support and resistance on several occasions for the past two months.

Given we are seeing EUR/USD hold and turn higher we will use 11985 as the floor; stay above on a daily closing basis and the short-term bias is neutral at worst to bullish. A daily close below support will be a warning that further weakness is on its way.

The 200-day, not in confluence with any highly noteworthy price levels will be next up as a possible level of support. But it would be the March 2020 trend-line (<11900) where focus would turn in the event of a breach of above noted support.

First up as resistance is the trend-line off the January high, and really given how close it is to significant resistance a break above the trend-line will only help the bullish case in a moderate manner. Just a bit shy of 12200 lies significant resistance in the form of several short-term swing highs dating to early December. In confluence with this is a slope from February 2020.

There was one attempt in late February to break above horizontal resistance, but EUR/USD violently rejected lower. This proceeded the sharp March decline. A daily close above 12190 should do the trick in getting the Euro to roll higher towards the January high at 12349 or better.

EUR/USD Daily chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX