THE MACRO SETUP OVERVIEW:

- US equities sell-off finally arrives amid a perfect storm for risk aversion

- Will China’s Evergrande contagion be contained for the foreseeable future?

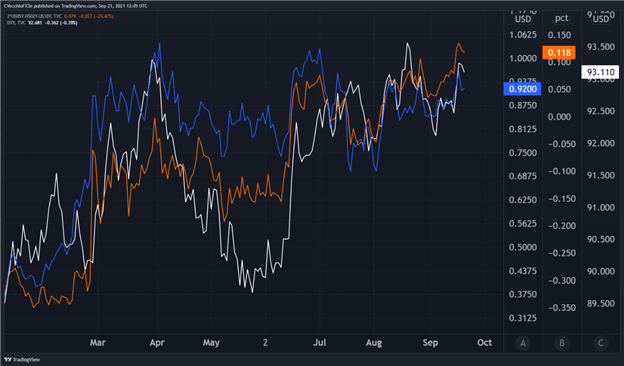

- The US Dollar continues to follow Fed hike odds, US Treasury yield curve shifts

Will the Fed React to Evergrande?

In this week’s edition of The Macro Setup, featuring Dan Nathan and Guy Adami, we talked about why the news out of China regarding property developer Evergrande is weighing down US financial markets, as well as what the September Fed meeting could mean for the US Dollar, US stocks, gold, oil, and bitcoin.

While concerns have been lingering about China’s property market for several years, the situation appears to have come to a head for China’s second largest property developer in recent weeks as Evergrande appears poised to miss upcoming debt repayments, setting it on course for default.

With delta variant concerns still raging – even though US economic data appears to be weathering the storm, so to speak – the upcoming Federal Reserve meeting may be arriving at an inopportune time for risk appetite. After all, expectations are running high that the FOMC will suggest that enough progress has been made to warrant a winddown of pandemic-era stimulus measures, with a formal taper announcement and commencement of the policy shift before the end of the year.

The risk-off attitude proving pervasive in global financial markets, coupled with the Fed’s intention to withdraw stimulus efforts, has proven beneficial for the US Dollar (via the DXY Index). But strength in the greenback has enhanced weakness in commodity prices, particularly those that are sensitive to growth conditions like copper, crude oil, and iron ore.

*For commentary from Dan Nathan, Guy Adami, and myself on the US Dollar (via the DXY Index), the US S&P 500, gold prices, among others, please watch the video embedded at the top of this article.

CHARTS OF THE WEEK

Eurodollar Futures Contract Spread (September 2021-DECEMBER 2023) [BLUE], US 2s5s10s Butterfly [ORANGE], DXY Index [WHITE]: Daily Rate Chart (January 2021 to September 2021) (Chart 1)

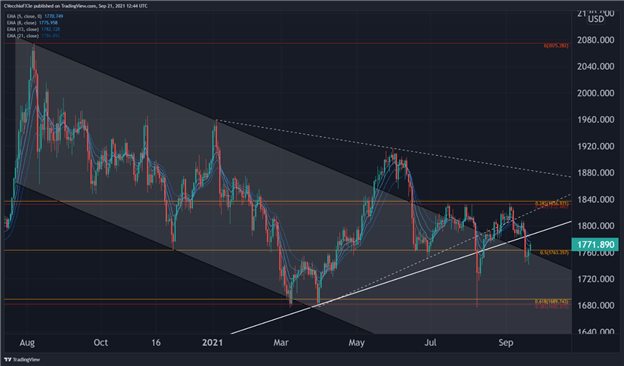

GOLD PRICE TECHNICAL ANALYSIS: DAILY CHART (JULY 2020 TO SEPTEMBER 2021) (CHART 2)

GBP/USD PRICE TECHNICAL ANALYSIS: DAILY CHART (MARCH 2020 TO SEPTEMBER 2021) (CHART 3)

--- Written by Christopher Vecchio, CFA, Senior Strategist