Equity Analysis and News

- DAX Outperforms Peers in April

- Focus on Threat of Auto Tariffs – EU/US Trade War

- DAX 1-Month Implied move +/- 2.6%

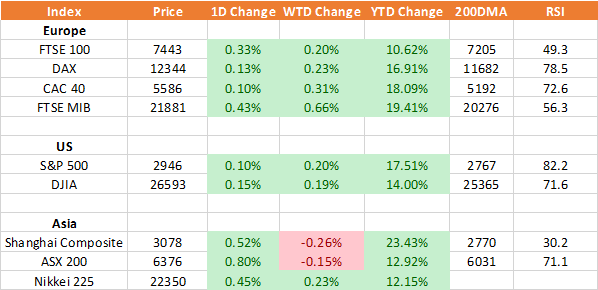

Source: Thomson Reuters, DailyFX

DAX Outperforms Peers in April

The DAX has been the notable outperformer throughout April with the index gaining over 7%, outpacing its European peers by quite some margin, which is despite the soft data from Germany. Much of the outperformance had stemmed from the sizeable exposure that the DAX has in the auto and tech sector. Most notably stemming from SAP (largest weighted stock in the DAX at 10%) who saw its shares surge by the most in over a decade after activist investor disclosed a $1.3bln stake in the company.

Euro Drops to a Near 2yr Low

Another supportive factor behind the gains observed in the DAX had been the downside breakout in Euro, which saw the currency drop to a near 2yr low. Consequently, this provided an added boost to German exporters (auto sector), while the increased optimism that China the US could seen agree a trade deal had also helped risk appetite.

Focus on Threat of Auto Tariffs – EU/US Trade War

On February 17th, the Department of Commerce had submitted its report in regard to the potential security threat of auto imports, in which President Trump has until May 18th to announce what, if any action he will take. This means that Trump has until May 18th to decide whether he agrees that auto imports pose a national security threat, with an added 15 days to implement any action. Although, if the President chooses to begin negotiations, he will have another 180 days before he can decide whether to take other actions. As such, a step up in rhetoric will be particularly important for Volkswagen, BMW, and Daimler.

- Risk of auto tariff to begin with rate of 10% (potentially rising to 25%)

1-Month implied move: The expected move in the DAX for May is a +/- 2.6% swing.

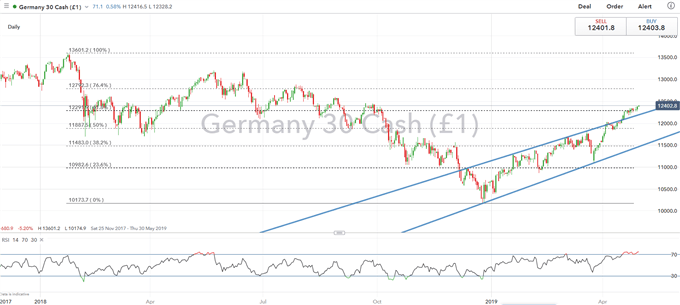

DAX Price Chart: Daily Time Frame (Nov 2017 – May 2019)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX