Euro Talking Points

EUR/USD slips to fresh 2018 lows even as the Euro-Zone Gross Domestic Product (GDP) report instills an improved outlook for the monetary union, with the exchange rate at risk for a further decline as the bearish momentum appears to be gathering pace.

EUR/USD Outlook Mired by Oversold Signal

The Euro is back under pressure despite an upward revision in 2Q GDP, with the growth rate expanding 2.2% per annum versus an initial forecast for a 2.1% rise, and the single-currency may continue to exhibit a bearish behavior as the euro-area’s exposure to Turkey undermines the stability of the region’s banking system.

In response, the European Central Bank (ECB) may keep the door open to further embark on its easing-cycle as ‘uncertainties related to global factors, notably the threat of protectionism, remain prominent,’ and President Mario Draghi and Co. may continue to strike a dovish tone at the next meeting on September 13 as the Governing Council struggles to achieve its one and only mandate for price stability.

In turn, geopolitical risks surrounding the euro-area may continue to impact EUR/USD, with recent price action raising the risk for a further decline in the exchange rate as it snaps the summer range and starts to carve a series of lower highs & lows. At the same time, developments in the Relative Strength Index (RSI) suggest the bearish momentum is gathering pace as the oscillator breaks below 30 and pushes into oversold territory.Interested in having a broader discussion on current market themes? Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups!

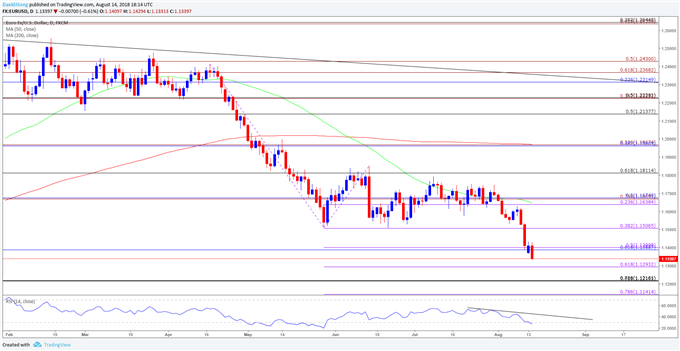

EUR/USD Daily Chart

- Downside targets are back on the radar for EUR/USD as it snaps the summer range, with the pair at risk of extending the decline from the previous week as the RSI holds below 30.

- Close below the 1.1390 (61.8% retracement) to 1.1400 (50% expansion) region raises the risk for a move back towards 1.1290 (61.8% expansion), with the next region of interest comes in around 1.1220 (78.6% retracement) followed by the 1.1140 (78.6% expansion) area.

For more in-depth analysis, check out the Q3 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 201 8.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.