Crude Oil Prices, Singapore Election, Coronavirus, Wall Street Stocks – TALKING POINTS

- Wall Street stocks closed lower after Florida medical metrics showed an alarming trend

- Risk-off tilt amplified by commentary from Democratic Presidential candidate Joe Biden

- Crude oil prices suffered largest one-day decline in almost a month – what happens now?

Wall Street stocks were hammered, first by alarming medical metrics coming out of Florida and then by an uncharacteristically populist tilt in comments by Democratic presidential candidate Joe Biden. The Dow Jones and S&P 500 indices closed 1.38 and 0.57 lower, respectively, while the tech-leaning Nasdaq index closed just a hair above 0.53 percent.

The latter’s strength underscores the resilience of technology-leaning equities amid the Covid-19 pandemic. Their impressive rise appears to have been in large part due to work-from-home policies that in turn have generated more demand for internet-based services. The biggest loser in the industrial-oriented Dow Jones index was the energy subcomponent, and specifically the Oil, Gas & Consumable Fuels sector.

The significant drop in the S&P 500 index came after Florida reported that Covid-related deaths were up to a record of 120. The prior report had them at 48. New hospitalizations also showed a record 409 reading, far above the prior 333 report. Those alarming medical metrics exacerbated the growing fear that another surge in coronavirus cases could compel officials to re-implement or extend growth-hampering lockdown measures.

As a cycle-sensitive commodity, crude oil was hit hard by those concerns, and may have contributed to dragging down the Norwegian Krone. Perhaps not entirely by coincidence, the petroleum-linked NOK was the session’s hardest-hit G10 currency. On the other hand, the sour mood spurred haven demand and pushed Treasuries and the US Dollar higher. The anti-risk Japanese Yen and Swiss Franc also rose.

This dynamic was further amplified by comments from Mr. Biden in a speech he gave on economic policy in Pennsylvania. He said that it is time to end “the era of shareholder capitalism”, adding that “Wall Street bankers and CEOs didn’t build America”. Such populist-leaning commentary may become more frequent as the November election approaches.

Friday’s Asia-Pacific Trading Session

With a relatively sparse data docket, traders will likely put an emphasis on macro-fundamental themes like Covid-19 medical metrics. An extension of the risk-off dynamic on Wall Street trade may hurt crude oil prices in the upcoming session along with commodity-linked currencies like AUD and NZD. The haven-linked US Dollar and anti-risk JPY and CHF may extend their gains along with Treasuries.

Crude Oil Analysis

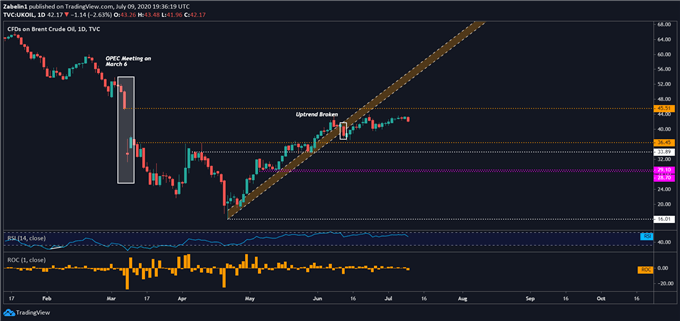

Crude oil prices closed over 2.40 percent lower on Thursday, the worst one-day decline since June 24. Since breaking the March uptrend – gold parallel channel – Brent has traded sideways. A clear lack of a directional bias speaks to an underlying uncertainty not only in a technical sense but also fundamentally. Given the current circumstances, crude oil prices may continue to pull back in the upcoming session.

Crude Oil – Daily Chart

Crude oil chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter