US Dollar Weekly Forecast: Bullish

- The US Dollar weakened as jobless claim surge cooled hawkish Fed bets

- Focus in the week ahead turns to US CPI report and the Federal Reserve

- Bullish Golden Cross remains in play for the DXY Dollar Index, where to?

Fundamental Analysis

The US Dollar (DXY) fell -0.47% last week, which was the worst 5-day performance since the middle of April. Demand for the haven-linked currency weakened as stock market sentiment continued improving. On Wall Street, the S&P 500 entered a technical bull market, rallying 20 percent from the most recent bottom. The Dow Jones and Nasdaq 100 also pushed higher.

Most of DXY’s underperformance occurred on Thursday, when an unexpected surge in US jobless claims poured some cold water on expectations of a rate hike from the Federal Reserve in July. Still, the data was not enough to spook financial markets in terms of an impending recession, although that could still change.

There are 2 key economic event risks in the week ahead for the US Dollar. The first will be May’s US inflation report on Tuesday. Headline CPI is expected to tick much lower to 4.1% y/y from 4.9% prior, in part due to the drop in commodity prices. However, core inflation (which strips out volatile food end energy prices) is seen ticking lower to 5.3% y/y from 5.5% prior.

The latter could be annoying for the Fed, but altogether, the data may continue to point in the direction of cooling inflation. Speaking of the central bank, the very next day will be June’s FOMC monetary policy announcement. The Fed is widely expected to keep benchmark lending rates unchanged. Although, it should be noted that recently there have been hawkish surprises from the RBA and BoC.

Where things will probably get more interesting is the central bank’s language about interest rates. That is because financial markets are pricing in about a 2/3 probability that the Fed could continue tightening next month. As such, do not discount the likelihood of a turn higher in the US Dollar in the week ahead. Also, keep in mind that if economic conditions unexpectedly deteriorate, haven demand may boost USD.

Technical Analysis

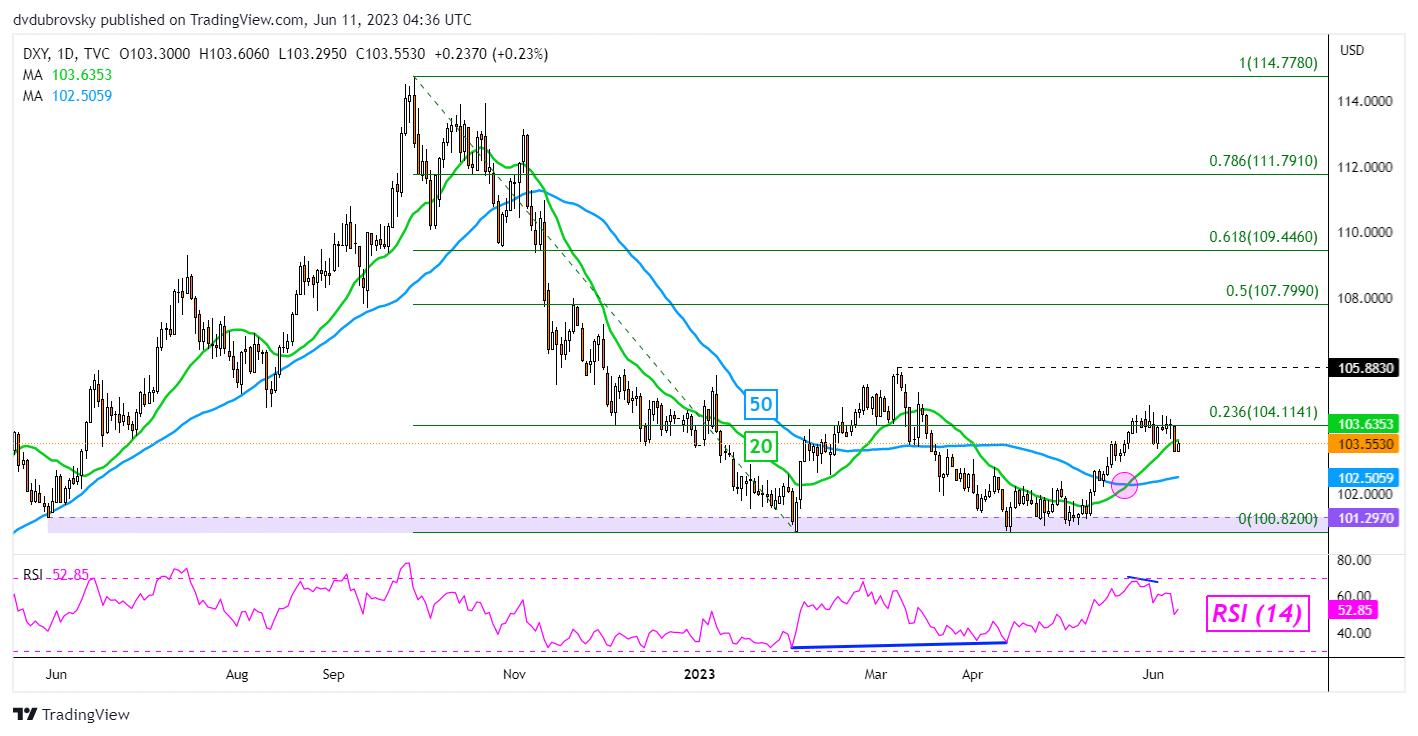

From a technical standpoint, DXY has closed under the 20-day Simple Moving Average. Follow-through is lacking. Meanwhile, a bullish Golden Cross is still in play between this line and the 50-day equivalent. Key resistance is the 23.6% Fibonacci retracement level at 104.11. Clearing this point exposes the march peak at 105.88. Otherwise, a turn lower places the focus on the 100.82 – 101.29 support zone.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

DXY Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com