COT Analysis and Talking Points

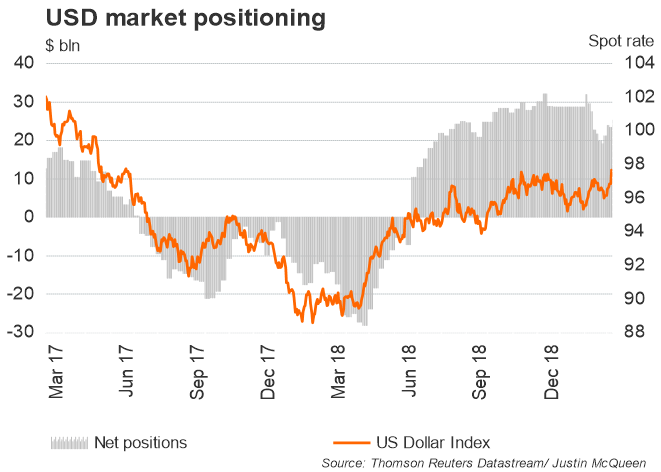

- USD Long Positioning on the Rise Yet Again

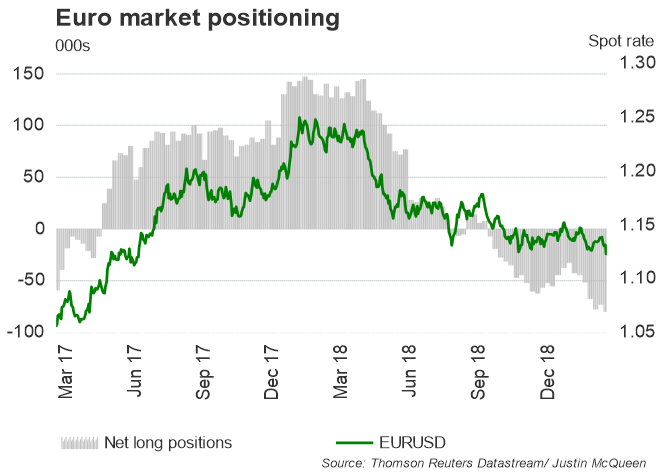

- Largest EURUSD Shorts Since December 2016

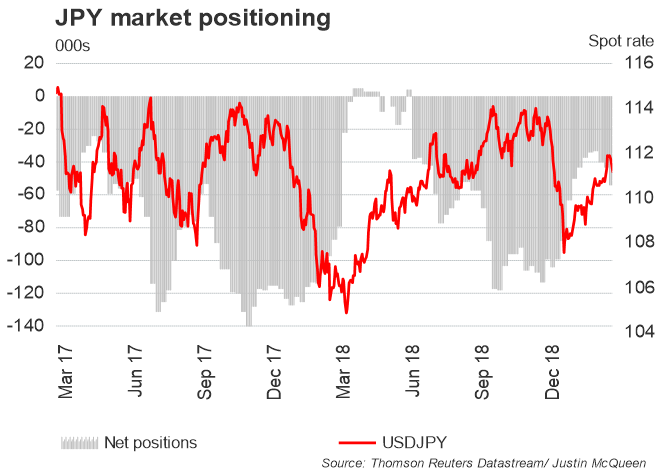

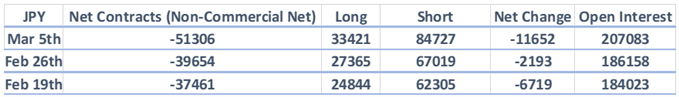

- JPY Sees Biggest Increase in Net Short Positioning

The Predictive Power of the CoT Report

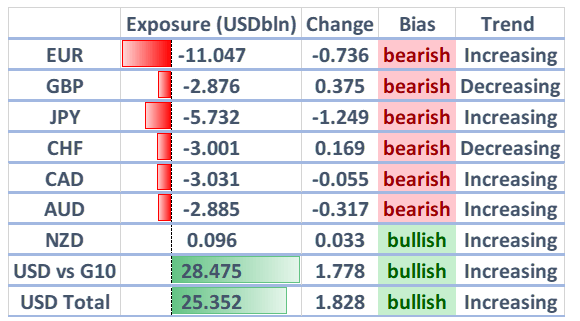

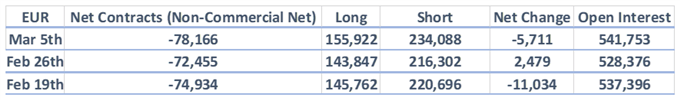

Source: CFTC, DailyFX (Covers up to March 5th, released March 8th)

Largest Euro Net Short Positioning Since Dec’16, USD Bullish Bet Rise Again

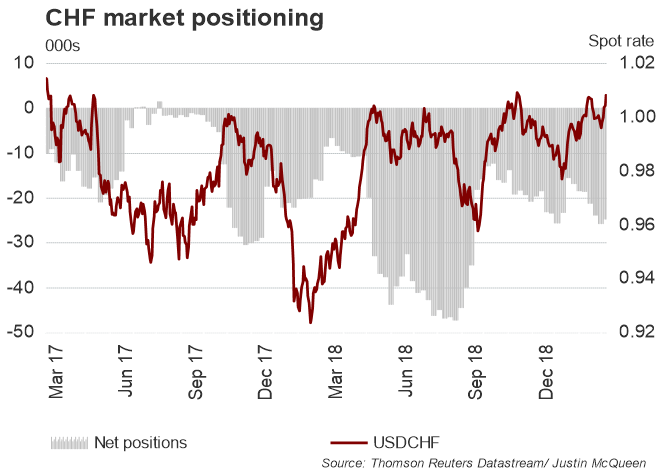

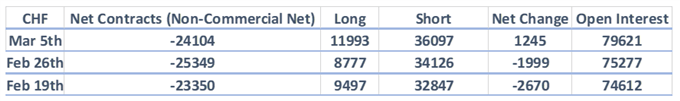

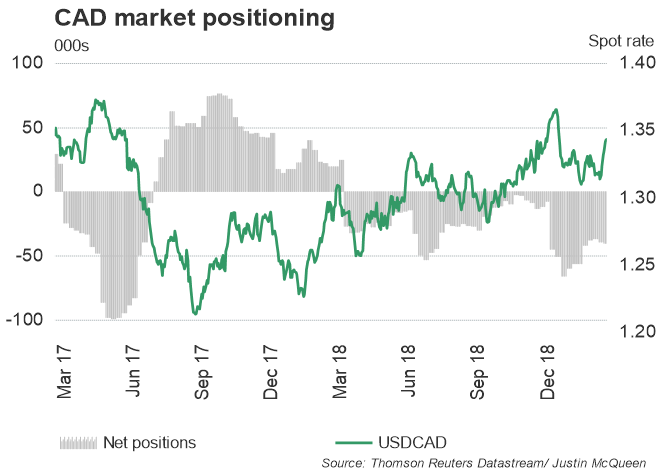

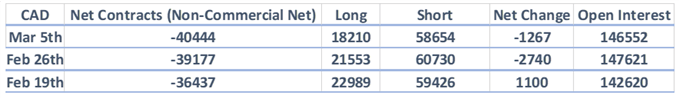

USD longs saw yet another increase ($1.778bln vs G10 FX), with the gains predominantly made up of Euro and Yen shorts. Speculators remain most bearish on the Euro in the G10 complex with shorts increasing by $736mln to $11bln, whereby Euro shorts are now the largest since December 2016. As such, given that this data had been prior (March 5th) to the ECB decision, these shorts would have been rewarded given the price action after the ECB announcement.

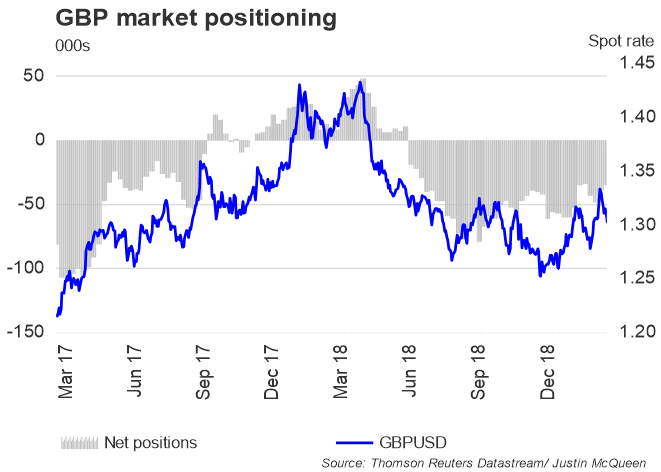

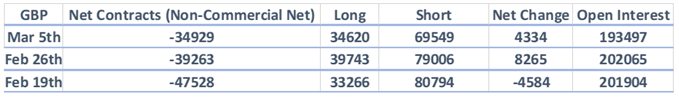

Elsewhere, net positioning in GBP had been less bearish following a wave of short covering with 9.5k gross short contracts being reduced. JPY positioning saw a sizeable $1.2bln increase net shorts, which in turn sees the JPY continuing to remain the second largest shorted currency in the G10 space.

US Dollar

EURUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q1 forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX