Market sentiment analysis:

- Traders are cutting their exposure to risk modestly as the December 15 deadline for new US tariffs on Chinese imports draws closer.

- However, at the start of a week dominated by major central bank interest rate decisions and the UK General Election, there are few signs yet of a major move into safe havens.

Trader confidence holds up

Traders remain broadly confident ahead of a week dominated by central bank interest rate decisions in the US and the Eurozone amid hopes that Sunday’s deadline for new US tariffs on Chinese imports will pass without the US taking any action.

Traditional safe havens such as the Japanese Yen, the Swiss Franc and gold are all modestly firmer but investors are by and large holding their nerves, while GBP/USD continues to benefit from opinion polls suggesting an overall majority for the ruling Conservatives in Thursday’s UK General Election.

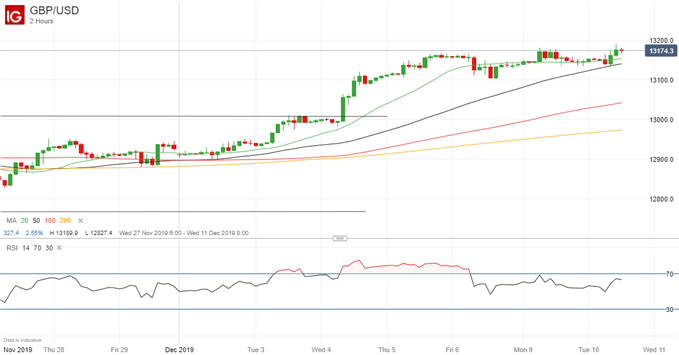

GBP/USD Price Chart, Two-Hour Timeframe (November 27-December 10, 2019)

Chart by IG (You can click on it for a larger image)

The likelihood of Democrats in the US House of Representatives unveiling formal charges against President Donald Trump as they move towards impeaching him has had little adverse impact on overall market sentiment either.

In this webinar, I looked at the trends in the major currency, commodity and stock markets, at the forward-looking data on the economic calendar this week, at the IG Client Sentiment page on the DailyFX website, and at the IG Client Sentiment reports that accompany it. You might also like to check out the DailyFX Trading Global Markets Decoded podcasts.

Resources to help you trade the markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex