Asia Pacific Market Open Talking Points

- Australian Dollar at risk as sentiment sours on rising US recession worries

- Aussie gains on jobs report could dwindle as global growth prospects fade

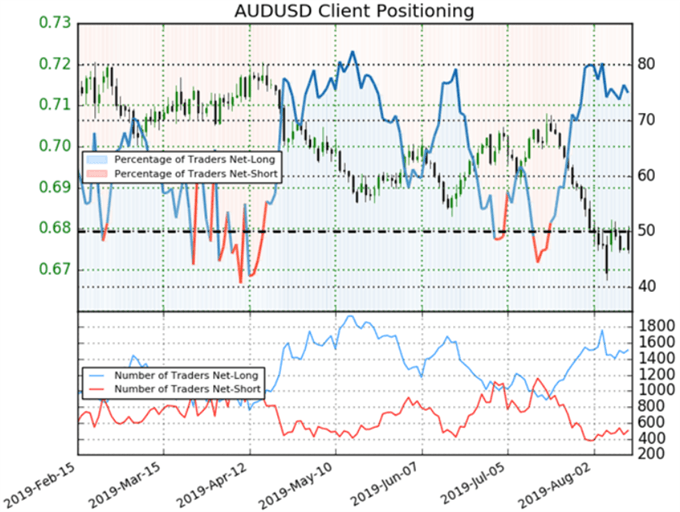

- AUD/USD downside momentum fading but positioning offers bearish bias

Find out what the #1 mistake that traders make is and how you can fix it!

Australian Dollar at Risk as US Yield Curve Inversion Sinks Sentiment

The sentiment-linked Australian and New Zealand Dollars underperformed over the past 24 hours as rising fears of a US recession roiled financial markets. The Dow Jones Industrial dropped over 3 percent in its worst day on Wall Street this year as the S&P 500 fell by almost as much. Meanwhile, the anti-risk Japanese Yen and similarly-behaving Swiss Franc soared.

The source of panic likely stemmed from the inversion of the spread between US 10-year and 2-year government bond yields. The higher premium for near-term Treasuries compared to those maturing at a later date is historically seen as an acute signal of a looming recession. The more closely watched 10-year and 3-month spread has already been inverted since the end of May.

This is despite the US delaying a portion of additional $300b in Chinese import tariffs until December, perhaps reflecting fading confidence of a trade resolution between the countries down the road. Meanwhile, the global economy is becoming increasingly vulnerable after growth in Chinese industrial production slowed to its weakest in 17 years and German GDP contracted 0.1% q/q in the second quarter.

Thursday’s Asia Pacific Trading Session

Ahead, this leaves the sentiment-linked Australian Dollar at risk as it awaits an upcoming local employment report. Australia is anticipated to add 14.0k jobs in July and it may very well beat estimates. Relative to economists’ expectations, data has been tending to surprise to the upside in Australia as of late. While this may bode well for AUD/USD in the near-term, down the road it may fall flat on its face if global risk aversion escalates.

Join me as I cover AUD/USD and the Australian jobs report beginning at 1:15 GMT as I discuss the Aussie outlook

Taking a look at S&P 500 futures, they are pointing notably lower heading into Thursday’s Asia Pacific trading session. This may lead local benchmark stock indexes, such as the Nikkei 225 and ASX 200, to the downside. As such, this poses a threat to the Aussie while potentially benefiting the anti-risk Japanese Yen if the turmoil in markets continues.

AUD/USD Technical Analysis

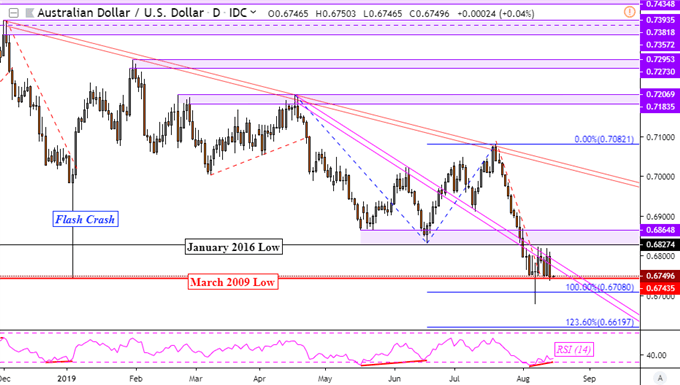

Positive RSI divergence in AUD/USD does warn of ebbing momentum to the downside, offering bears a sign of caution. This may precede a turn higher or translate into further consolidation. The latter has been more of the case as of late as prices hover above March 2009 lows. Near-term resistance appears to be well-solidified as a range between 0.6827 and 0.6865. These are the former 2019 lows.

AUD/USD Daily Chart

AUD/USD IG Client Sentiment

Meanwhile, IG Client Positioning is offering a stronger AUD/USD bearish contrarian trading bias. The number of net-short Aussie trading is unwinding quicker than net-long positioning. If this continues, we may see the downtrend in the Australian Dollar pick up pace. If you would like to learn more about using this tool in your trading strategy, join me every week on Wednesday’s at 00:00 GMT to see how !

FX Trading Resources

- See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving Crude Oil prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter