Talking Points

EUR/USD30 Minute Chart

(Created using Marketscope 2.0 Charts)

Losing Money Trading? This Might Be Why.

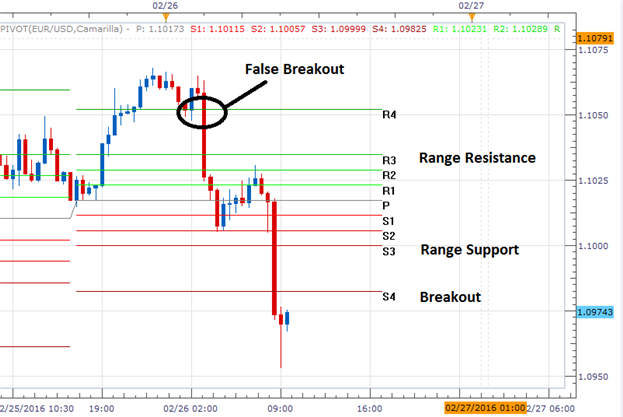

The EUR/USD is breaking out this morning below support, after the US Dollar rallied on better than expected GDP data. Forecasts for the event were set at 0.8% and the actual total was released at 0.9% beating expectations. With prices now trading below the S4 Pivot at 1.0981, traders may look for the pair to trade towards new weekly lows before today’s close. Potential bearish targets for the day begin at 1.0947, which is found by extrapolating 1X todays 34 pip range.

It should be noted that before today’s GDP event, the EUR/USD did attempt to breakout higher above today’s R4 pivot point. Even though this initial bullish breakout was invalidated, traders looking for a bullish reversal should continue to monitor price for a late day rebound. A move in price back above today’s R3 pivot point, which is found at a price of 1.0999, would represent at least a temporary change in market conditions. In this scenario, traders may look for the EUR/USD to again challenge values of resistance which include today’s R3 pivot point at 1.1033.

SSI (Speculative Sentiment Index) for the EUR/USD continues to read flat at -1.05. A neutral reading here suggests that the pair is not decisively trending in one direction. Going into next week, traders should continue to monitor SSI to see if a new extreme is created.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Do you know the biggest mistake traders make? More importantly, do you know how to overcome the biggest mistake? Read page 8 of the Traits of Successful Traders Guide to find out [free registration required].

Contact and Follow Walker on Twitter @WEnglandFX.