Trade management can be a potent weapon in the trader’s arsenal.

It’s often too-late that traders learn the value of risk management. Many risk management behaviors run directly counter to human nature, which is probably one of the reasons why trading might seem so difficult to new traders. These mannerisms or behaviors take some time to learn. That amount of time can be different for everyone; some pick it up quickly, others take longer.

Nowhere is that lesson as challenging as with the break-even stop.

What is The Break-Even Stop?

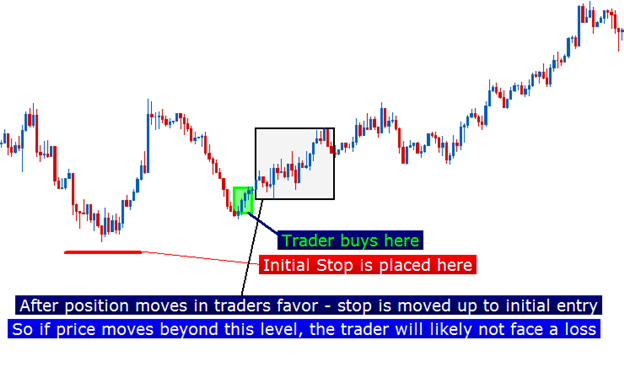

The break-even stop is enacted when a trader adjusts their stop to their trade’s entry price to remove the initial risk amount from the trade.

Created by James Stanley

Many new traders reject this action because they fear price may move down to this marker, taking them out of the trade before they have a chance to gain a profit. And this is true.

But more to the point is the fact that price may not reverse and move back into profitability, leaving you exposed to your initial risk levels.

An important point to always keep in mind is that even if you have a trade get stopped out at break-even, you may have incurred a loss if no action was taken and the trade moved to your initial stop level.

Trading opportunities are infinite - trading capital is not.

Some traders have a far greater affinity for the break-even stop; but for many - this is a favorite tool for managing risk, and managing trades in the FX market.

When to move stop to break-even?

If a trader moves a stop to break-even too quickly, they may see far more trades stopped out for no gain or loss than they might want. Additionally, they expose themselves to additional risk factors such as slippage with the more trades that are placed and stopped out.

However, if a trader waits too long, or doesn’t move their stop to break-even, they run a larger chance of seeing a gain turn into a loss, running into their stop.

The ‘right’ time to move a stop to break-even is often going to be governed by the trader’s goals, strategy, and style.

The table below will suggest some potential intervals for moving stops to break-even based on whether a trader wants to take a conservative, moderate, or aggressive stance on their trade management.

| Risk Style | Conservative | Moderate | Aggressive |

|---|---|---|---|

| Later to Move Stop | Faster to Move Stop | ||

| Stop Multiple For Break-Even Move | 1X Risk Amount | .75 X Risk Amount | .5 X Risk Amount |

| If Stop is | 50 pips | 50 pips | 50 pips |

| Stop adjust to breakeven at: | 50 pips | 43 pips | 25 pips |

All amounts are based on the traders risk amount, which is the distance between the entry price of the position, and the stop loss. So if a trader went into a long EURUSD position at 1.2400 and placed a stop at 1.2350, the risk amount would be 50 pips.

If that trader wanted to take a conservative approach -

Explanation of con, moderate, aggressive with table created in excel

Trading Defensively

Traders that avoid moving stops to break-even often do so because they desire to win on that trade.

But traders must keep in mind that any one trade is just a single opportunity, and for traders to find true long-term success, they will need to keep tight reigns on their risk management so that even when they hit a string of losing trades, or a run of bad luck - they can come back tomorrow or next week or next month with a substantial portion of their trading capital.

The break-even stop can help traders conserve their capital by helping to eliminate the dreadful situation of watching a winning trade become a loser.

--- Written by James B. Stanley

You can follow James on Twitter @JStanleyFX.

To join James Stanley’s distribution list, please click here.