Canadian Dollar Talking Points

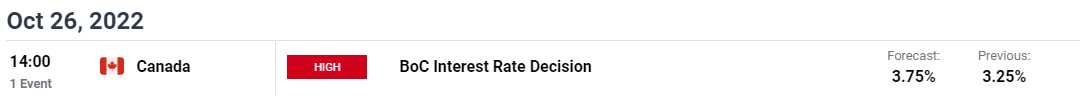

USD/CAD consolidates after clearing the opening range for October, but the exchange rate may attempt to retrace the decline from the yearly high (1.3978) as the Bank of Canada (BoC) is expected to deliver a smaller rate hike.

Fundamental Forecast for Canadian Dollar: Bearish

USD/CAD holds above the monthly low (1.3503) as the Federal Reserve’s hawkish forward guidance props up the Greenback, and expectations for a restrictive policy in the US may keep the exchange rate afloat as the BoC appears to be on track to winddown its hiking-cycle.

The BoC is anticipated to increase the benchmark interest rate by 50bp after implementing a 75bp rate hike at its previous meeting, and it remains to be seen if the central bank will further adjust its approach in combating inflation as Canada’s Consumer Price Index (CPI) slows for the third consecutive month.

As a result, the updated Monetary Policy Report (MPR) may show little indications for a restrictive policy in Canada as “the Bank continues to expect the economy to moderate in the second half of this year,” and Governor Tiff Macklem and Co. may continue to shift gears over the remainder of the year as the central bank “will be assessing how much higher interest rates need to go to return inflation to target.”

With that said, USDCAD may attempt to retrace the decline from the yearly high (1.3978) should the BoC deliver a smaller rate hike, and a shift in the forward guidance for monetary policy may keep the exchange rate afloat if the central bank unveils plans to winddown its hiking-cycle.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong