US DOLLAR FORECAST:

- U.S. dollar begins the week on the back foot, undermined by concerns over the U.S. debt limit impasse and disappointing economic data

- The U.S. retail sales and industrial production reports from April should be watched on Tuesday

- In terms of technical analysis, the DXY reverses lower off Fibonacci resistance, failing to follow-through on the topside after a bullish breakout late last week

Most Read: Crude Oil Market Outlook Darkened by Debt Ceiling Debacle and Recession Risks

After a strong rally late last week, the U.S. dollar, as measured by the DXY index, declined on Monday despite rising U.S. Treasury yields across most tenors. In early afternoon trading in New York, the dollar gauge was down 0.23% to 102.46, retreating from its highest level in more than five weeks reached during the overnight session – a sign bullish momentum seen over the previous two days may be waning.

In terms of drivers, the U.S. dollar’s underperformance can be likely attributed to concerns over the U.S. debt limit impasse and disappointing economic data released earlier.

On the debt ceiling, Congress remains deadlocked, with House Speaker Kevin McCarthy stating that negotiations with Democrats are still far apart. On the macroeconomic front, the New York Empire State Manufacturing Index for May sustained the largest drop since April 2020, dropping to -31.8 from 10.8 previously versus the -3.75 expected, signaling that the economy may be downshifting more rapidly than predicted.

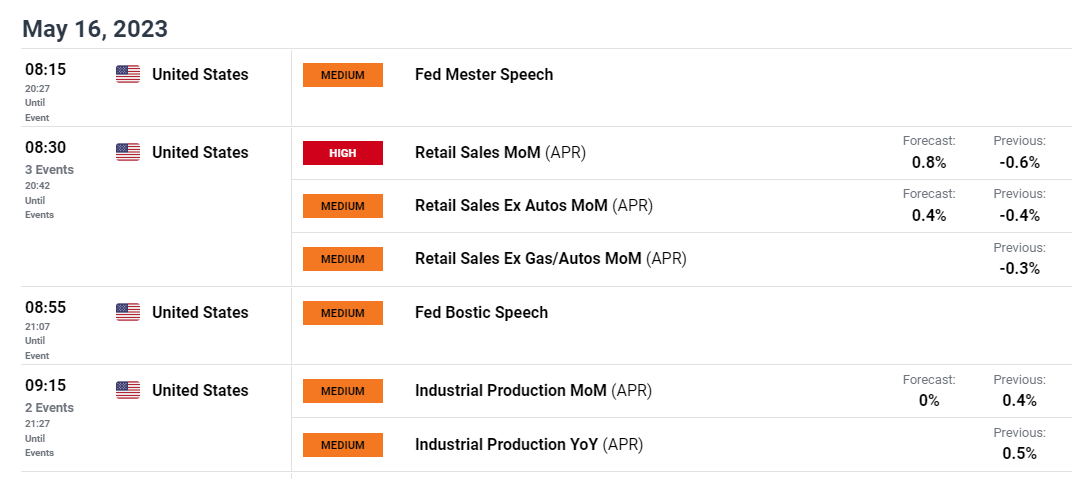

Looking at the U.S. economic calendar, there are several high-impact events worth watching later this week, including retail sales and industrial production data on Tuesday. Traders should closely scrutinize these reports for clues on the overall outlook, bearing in mind that weakness in both indicators could strengthen the case for a pause in the Fed’s hiking cycle in June.

INCOMING US ECONOMIC DATA

Source: DailyFX Economic Calendar

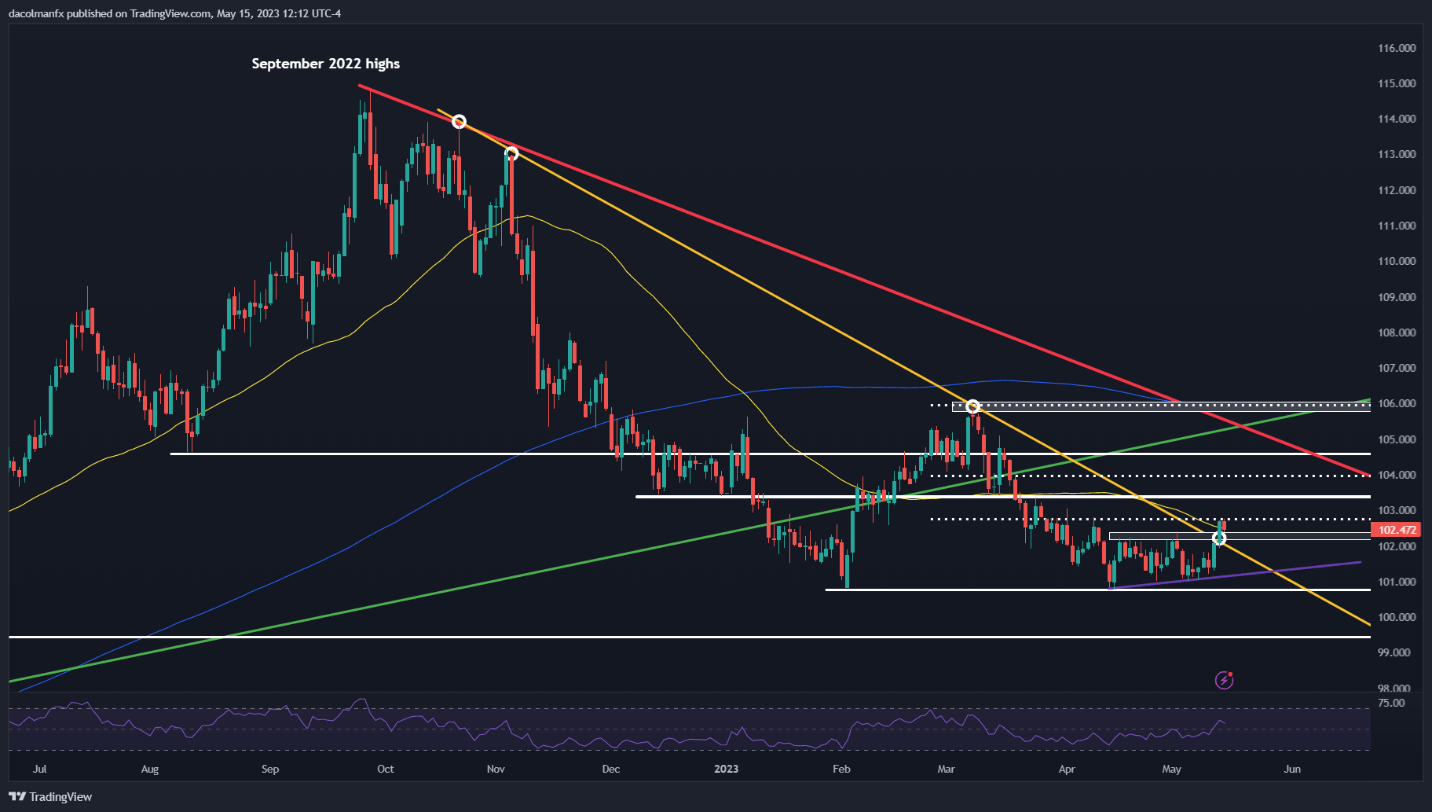

US DOLLAR DXY TECHNICAL ANALYSIS

From a technical analysis standpoint, the DXY index staged a bullish breakout last Friday, breaching confluence resistance at 102.24/102.40, but has failed to follow through on the topside, with prices reversing lower off a key Fibonacci area on Monday.

For bulls to have a shot at some upside in the coming days, the index must remain above 102.24/102.40. Failure to defend this floor could sour the mood, triggering a pullback toward 101.15, followed by the 2023 lows.

Conversely, if the U.S. dollar rebounds from current levels, initial resistance appears at 102.75, the 38.2% Fib retracement of the March/April sell-off. If this barrier is taken out decisively, bulls may be able to launch an attack on 103.40.

US DOLLAR (DXY) TECHNICAL CHART