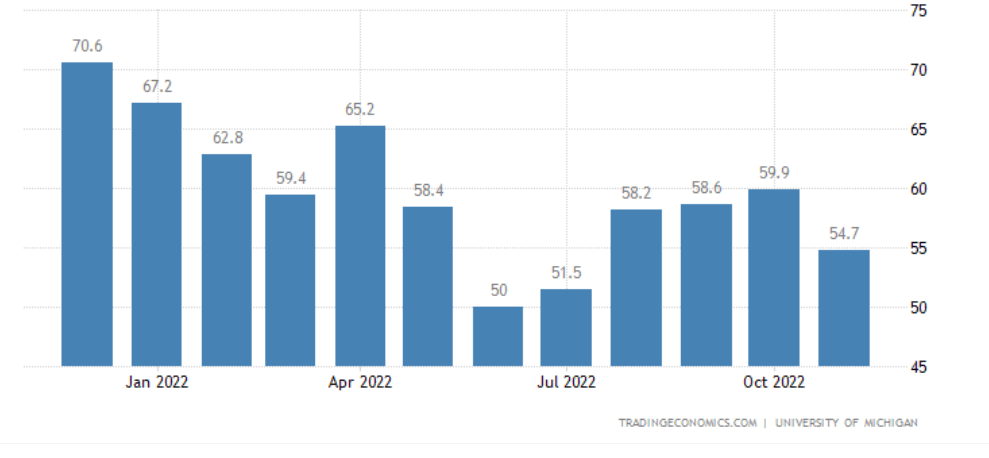

CONSUMER SENTIMENT KEY POINTS:

- November consumer sentiment falls to 54.7 from 59.9 in October, well below market expectations

- The pullback in confidence suggests Americans are becoming more pessimistic about the economic outlook

- U.S. dollar extends losses after the survey release, but the move may be largely likely related to yesterday's October CPI data

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: Consumer Sentiment Index - Basic Principles and Uses in Trading

A popular gauge of U.S. consumer attitudes fell in November, ending a three-month streak of recovery and retreating to its lowest level since July, a sign that Americans are starting to become increasingly more pessimistic about the economic outlook again.

According to preliminary results from the University of Michigan, its consumer sentiment index plunged to 54.7 from 59.9 in October against a backdrop of elevated inflation, rising rates, mounting recession risks and political uncertainty. The median forecast of economists in a Bloomberg News poll called for a more modest pullback to 59.5.

For much of the year, the spike in consumer prices has been the main source of consternation for most households, as the rapidly growing cost of living has had a detrimental effect on real incomes. The trend appears to be improving thanks to the Fed's tightening measures, but the aggressive hiking cycle has increased the likelihood of a downturn, a situation that may dampen spending in the coming months.

CONSUMER SENTIMENT CHART

Source: TradingEconomics

Delving into today’s data, the current economic conditions index plummeted to 57.8 from 65.6, while the expectations indicator fell to 52.7 from 56.2. For its part, one-year inflation expectations remained unchanged at 5.1%, but the five-year measure drifted upwards to 3.0% from 2.9%.

The US dollar, as measured by the DXY index, extended losses after the sentiment survey crossed the wires, but the move may be largely related to yesterday's CPI report. For context, October inflation data surprised to the downside by a wide margin, increasing the likelihood of a downshift in the pace of interest rate hikes by the Fed. This should be the main narrative in the near term, so the greenback could maintain a negative bias in the coming days.

US DOLLAR INDEX (DXY) CHART

Source: TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

---Written by Diego Colman, Market Strategist for DailyFX