US PCE REPORT KEY POINTS:

- September U.S. consumer spending advances 0.6% on a monthly basis, versus 0.4% expected

- Core PCE, the Fed’s favorite inflation gauge, climbs 0.5% month-over-month, pushing the annual rate to 5.1% from 5.0%, one-tenth of a percent below market estimates

- The U.S. dollar retains session's gains, but its reaction to the data is negligible

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: Nasdaq and Dow Ratio Highlight FAANG Collapse, Fed and Recession Top Themes Next Week

The U.S. Bureau of Economic Analysis released its latest report on personal consumption expenditures this morning.

According to the agency, September personal spending advanced 0.6% month-over-month, ahead of expectations for a 0.4% gain, a sign that the American consumer remains resilient, thanks in part to the strong labor market. Healthy consumer spending may help prevent a severe downturn and allay recession fears for now considering that household consumption is the main driver of U.S. economic activity.

Elsewhere, the PCE Price Index, which measures the costs that people living in the U.S. pay for a variety of different items, climbed 0.3% month-over-month and 6.2% year-over-year, one-tenth of a percent below the estimate.

Meanwhile, the core PCE indicator, the Federal Reserve’s preferred inflation gauge that excludes food and energy and is used to make monetary policy decisions, advanced 0.5% on a seasonally adjusted basis, pushing the annual reading to 5.1% from 5.0%, versus 5.2% expected, indicating that price pressures remain elevated, but are growing at a slower pace than earlier in the year, a positive development for the U.S. central bank.

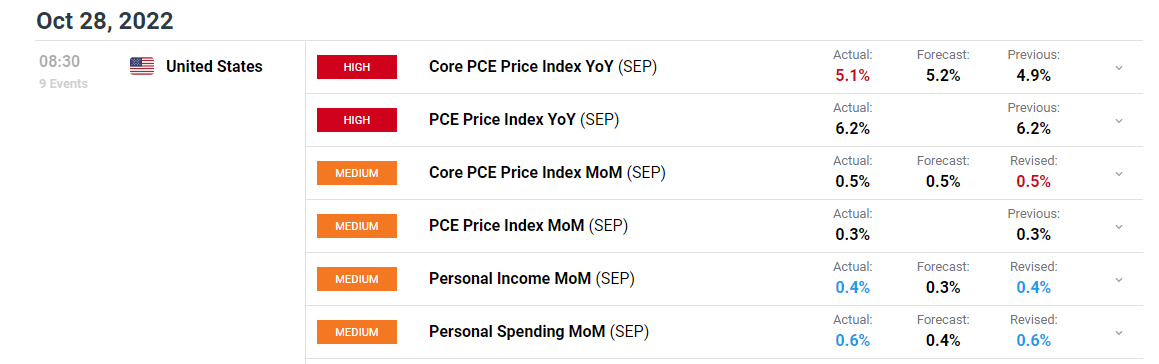

The following table highlights the main results.

PCE REPORT DETAILS

Source: DailyFX Economic Calendar

Today's PCE numbers did not provoke a major reaction in the markets, as the Q3 GDP report, released yesterday, already covered the September period and provided a more complete picture of the economy, including consumption levels and quarterly price gains. In this context, the U.S. dollar, as measured by the DXY index, managed to hold on to most of the session's gains after the data crossed the wires.

Looking ahead, all eyes will be on next week's FOMC decision. While the Fed is widely expected to deliver another front-loaded 75 basis-point hike, policymakers may signal that future rate hikes will be smaller in size on concerns that the aggressive tightening cycle could lead to a painful hard landing. Should the central bank embrace a less hawkish approach, we could see a rally in equities and a pullback in the U.S. dollar.

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

---Written by Diego Colman, Market Strategist for DailyFX