Central Banks, Inflation, Consumer Price Rises, Ukraine

- Global prices are rising at a pace not seen for decades

- Central bankers’ once unquestioned mastery of inflation is in tatters

- The price docility markets have been used to seems unlikely to return

Global inflation has resumed hostilities after an unprecedented, decades-long truce, and central bank credibility is not having a good war. Whether the globe’s monetary guardians counterattack successfully or not, the world has changed with profound implications for financial assets everywhere.

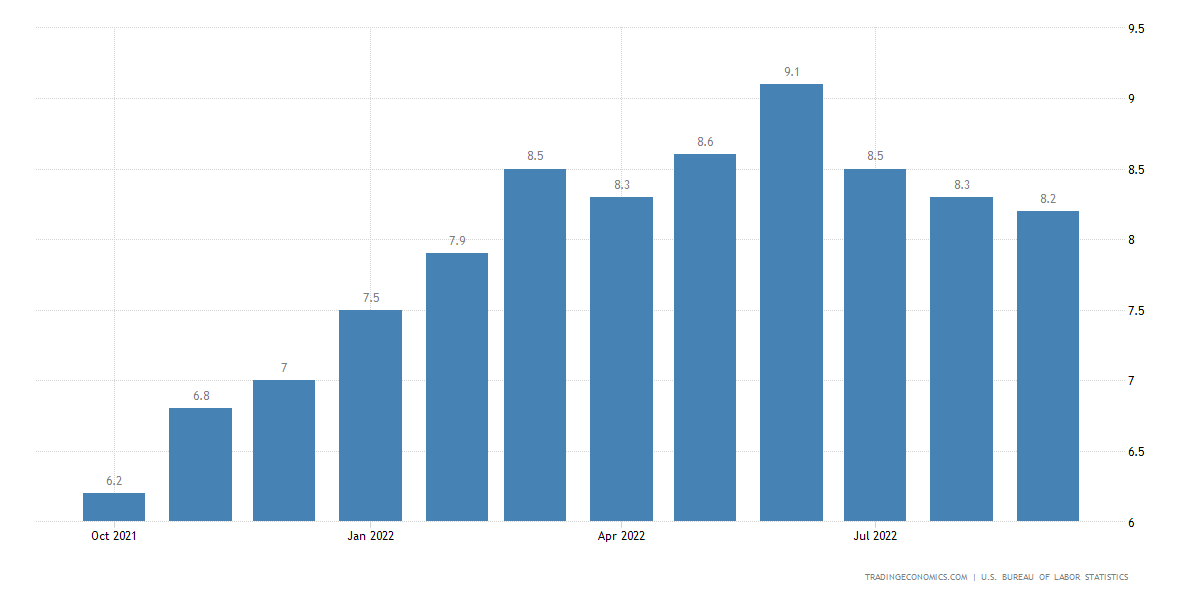

At the time of writing, US consumer price inflation stands at 8.2%. It’s 9.9% in the Eurozone and a blistering 10.1% in the United Kingdom. Even in Japan, where deflation had been an entrenched norm, consumer prices are rising by 3.0%.

Sobering then to realize that from 1994 to 2021 prices, excluding fuel and food, never once managed a gain of more than 3% in either the US or Europe.

Overall US Consumer Price Rises, Year on Year.

Source: TradingEconomics, US Bureau of Labor Statistics

Gone Are the Days When a Word to The Markets Was Enough

For much of that long period, central bankers were ascribed almost supernatural abilities, lauded for their magician-like way with the world’s markets. They showed every sign of enjoying the adulation.

Former Federal Reserve Chair Alan Greenspan had only to muse on investors’ “irrational exuberance” to stop stock bulls from charging. When one-time European Central Bank President Jean-Claude Trichet proclaimed himself “extremely vigilant,” market players knew for sure rates would rise next month. And they acted accordingly. His successor Mario Draghi solved a 2012 sovereign-debt crisis which threatened to sweep away the Eurozone merely by telling markets he’d do “whatever it takes” to save the single currency.

They believed him. Super Mario indeed.

Much of that reputation lay in central bankers’ ability to successfully target inflation, the political and economic bane of the 1970s and 80s. Now, it turns out, inflation was unusually amenable to being targeted.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by David Cottle

The rise of export-oriented economies in China, across Asia more broadly and in South America, provided the world with a flood of cheap goods. Shipping was transformed by information technology and containerized transport. So those goods could come to consumers with unprecedented speed and at lower cost.

And developed-market central bankers had leeway to deploy tactics which at any other time would have been seriously inflationary without even threatening, never mind missing, those crucial inflation targets.

From the trillions of dollars in quantitative easing administered after the financial crisis of 2008, to Draghi’s masterful promise, so much was made possible by inflation’s long, blessed docility.

Today’s central bankers are perforce a humbler breed. Initial Fed assessments that inflation would prove “transitory” have not aged at all well. Chair Jerome Powell has had to backpedal on his once-confident guidance that a 0.75 percentage point interest rate rise was “not on the table” and, well, put one firmly on it. The Bank of England seemed sure it was going to hike last November, only to demur and then shock markets by doing so a month later. Over in Frankfurt, in June, ECB President Christine Lagarde had to convene an emergency meeting, right after the governing council’s usual get-together, to discuss speculative attacks on the Eurozone bond market.

Investors were no longer convinced by mere words, as they had been in Draghi’s day. They wanted to see the plan.

Central Banks Simply Don’t Have Complete Control

Of course, inflation is not entirely within the control of central bankers, even those at the Fed. The Covid pandemic has cut savagely into supply chains, Vladimir Putin’s attack on Ukraine has twisted the knife and rising geopolitical tensions between the United States and China have cut deeper still.

It's possible that all three of these awful weights will be lifted in time, with, hopefully, beneficial effects on global prices.

Even so, there will be some permanent shift away from the free globalization of recent decades, so crucial to keeping prices down. Singapore’s Prime Minister Lee Hsien Loong put it succinctly in his keynote National Day Address this month.

“The basic reality is that international economic conditions have fundamentally changed,” Lee said. “It is not just the pandemic or the war in Ukraine.”

Not sparing his audience, he went on to say unequivocally that the era of low, stable prices is now “over.” When the political leader of perhaps the most open, trading economy on Earth says that, it matters.

Trading Strategies and Risk Management

Global Macro

Recommended by David Cottle

Countries and firms may well prioritize more secure local production and increased supply-chain resilience, even if these come with higher prices.

What will also, of course, matter is the effect central bankers can have on the monetary conditions they can control. There will be knee-jerk analyses suggesting the entire basis of monetarist inflation-targeting has collapsed and that something else is now needed. We should be wary of this sort of thing. The fact that global conditions flattered inflation targeting for years is not by itself enough to invalidate the entire game. Central bankers retain potent weapons and have shown willingness to use them.

Interest-Rate Decisions Can No Longer Be Pain-Free

The caveat here is that their decisions are also likely to involve a lot more real-world economic pain than they have for a generation in terms of higher borrowing costs. What those with no memory of real inflation-fighting will make of that remains to be seen.

In the markets, the day is likely to belong to countries which most successfully control rising prices, and their currencies. Old inflation hedges such as gold, and bonds whose payouts link to consumer price indices, are likely to see lasting increases in demand. Even when prices fall here, they’ll probably bottom out at higher levels than they did when central bank credibility ruled unchallenged.

Stock markets are likely to see luxury struggle at the expense of necessity as consumers pull in their horns and focus on the essential. With oil and natural gas prices rising sharply, even the essential is likely to overstretch many in the years ahead. US banking revenue, meanwhile, is close to all-time peaks. Commercial banks, savings banks and savings and loan outfits earned $93.2 billion in the second quarter, according to data from S&P Global Market Intelligence. When interest rates rise, borrowers urge to lock in the deals they can get now, rather than waiting for next week, is very strong.

But it’s in the raw inflation data that the markets’ big battles are likely to be fought for a long time to come. It may be instructive to look at the current rate of inflation in the US for consumer prices without the volatile effects of food and fuel. That so-called “core” measure stands at 6.6% after a short climb up from its long home around 2% which began in 2021.

That’s the sort of price rise which investors must probably get used to seeing more often, even if central banks do eventually win some semblance of their old credibility back.

Written by David Cottle for DailyFX

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team