Nasdaq 100, US CPI, US Election – Talking Points

- Nasdaq 100 extends gains beyond 11000 ahead of US CPI data

- Tesla struggles after announcing recall of 40,000 Model S and Model X cars

- Meta continues to struggle after weekend report about layoffs

The Nasdaq 100 extended its recent rally on Tuesday as traders await the key October CPI report on Thursday. Equities have put in a strong rally over the last few sessions as traders continue to re-price Federal Reserve expectations. While the terminal rate has moved higher, the expected pace of rate hikes has slowed. This has seen both yields and the US Dollar ease from recent highs, which has given new life to risk assets.

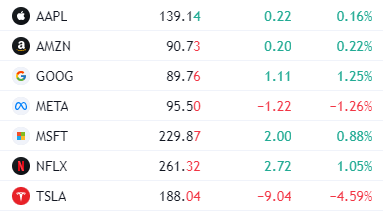

The 2-year Treasury yield has slipped back below 4.7%, while the 10-year appears headed for a collision course for the 4% level. As a result, mega cap tech stocks were largely in the green on Tuesday’s session. Google is the notable outperformer amongst the GAMMA+ crowd, while Tesla struggles down over 4.5% on the session. Meta also remains under pressure once again off the back of a weekend report on potential layoffs.

Popular Tech Stocks

Courtesy of TradingView

Markets could continue to show strength in the near-term as bond yields come in. I would make the argument that we still remain in a “rates world,” and that everything still revolves around the bond market. While yields have come in slightly, a retracement of the recent decline could usher in pain for markets that appear optimistic that the worst is in the rearview mirror. This picture may become clearer by the end of the week, as Thursday’s CPI print may go a long way to settle the 50 bps or 75 bps debate for the December FOMC meeting. Should the market feel the need to reprice for 75 bps, recent gains in equities may fade.

Nasdaq 100 Futures (NQ) 2 Hour Chart

Chart created with TradingView

Taking this into account, NQ has put in a robust rally off the monthly lows below 10700. As we sit over 4.5% off of the Friday lows, sentiment appears to have changed. While there has been some chop, this move over the last 3 sessions has been a constant grind higher back above the 11000 threshold. If we can continue with this bullish momentum, NQ may look to test the 21-day EMA at 11229.

Overall, this trend may look to make another test of the descending trendline stemming from the August swing high. This trendline resistance marked the top in September, and also failed to break on a test during the Nov. 1st session. Bears may be waiting patiently to short at higher prices, which also may partially explain the grind higher of the last few sessions.

Should CPI upend this move higher, I would expect the 11000 psychological level to offer little resistance should price cascade lower. There appears to be a large zone for buyers between 10700 and 10800, as this area has acted as a buffer on multiple occasions now. I would expect this area to come under the microscope should NQ reverse course. A failure to hold that area and NQ may look to revisit the pre-Covid highs.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter