Bullish Continuation Setups Considered for EUR/JPY

- The euro continues its general grind higher against G7 currencies as the ECB contemplate a 25 or 50 bps hike in May.

- The Bank of Japan’s (BoJ) new Governor, Ueda sticks to ultra-loose policy for now

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

The recent euro trend is undeniable and none more so than the advance witnessed in EUR/JPY. The euro has recovered prior declines after a unified ECB set out to tame stubbornly high inflation in the euro zone. The resolve to hike as growth in the region contracts, suggests the committee is committed in re-attaining its goal of price stability.

While still lagging other regions as far as the actual level of interest rates is concerned, more hikes are on the cards as core inflation remains unacceptably high in Europe and the shock of a banking crisis has all but vanished. Although, it has been generally accepted that European banks are safer than the US banks due to stringent EU regulation and frequent stress testing across multiple investment scenarios. In the absence of tighter credit conditions likely to emanate from the shock in the banking sector, rate hikes will continue unabated.

The Japanese yen on the other hand has surrendered gains made in early to mid-March when its safe-haven status lured worried investors during the regional US bank collapses. With the changing of the guard at the BoJ, new Governor Ueda has signaled his intention to keep ultra-loose policy in place for now, suggesting that while inflation is above target, it is still nothing like what is being experienced elsewhere. With this in mind, the yen appears vulnerable once more.

Bullish EUR/JPY Setup Eyes Trend Continuation

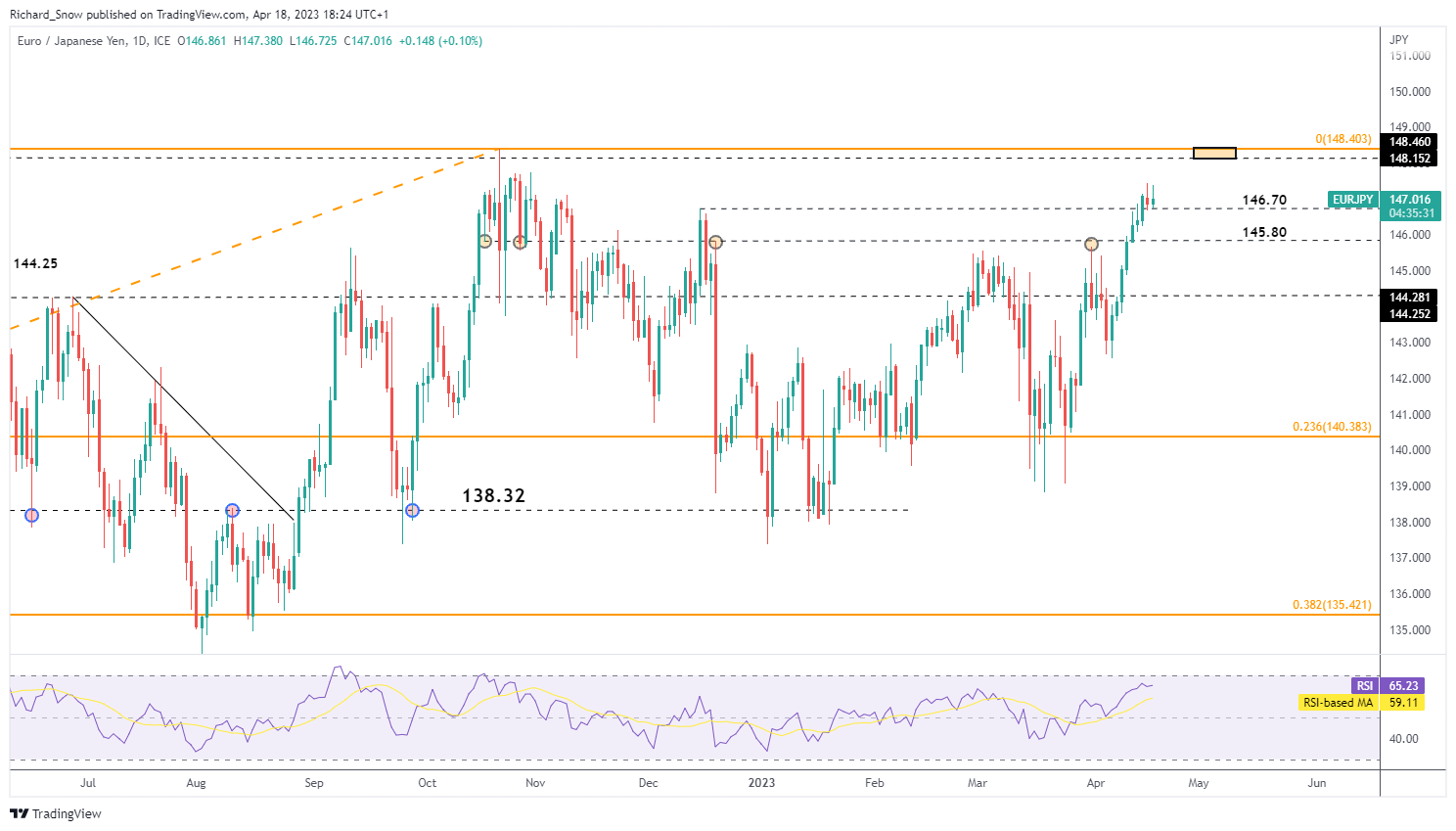

The current bullish move is advanced and therefore it remains prudent to look for opportunities to re-enter the uptrend after a pullback. Currently prices are testing 146.70 as immediate support, where a bounce higher could see the pair trade at the 2022 high of 148.40.

The emergence of longer upper wicks on yesterday’s and today’s daily candle thus far, suggests the possibility of an even deeper pullback, towards 145.80.

EUR/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX