Japanese Yen, USD/JPY, US Dollar, AUD/USD, RBA, RBNZ, Crude Oil - Talking Points

- The Japanese Yen continues to linger near 145 as markets take a breather

- APAC equities that were open today moved higher as yields slide lower

- The RBA action has led to hopes of less tightening globally from other banks

The Japanese Yen held it’s ground today as USD/JPY traded toward 145.00 even though North Korea launched a ballistic missile. It travelled over Japan before splashing down east of the island nation in the Pacific Ocean.

The government instructed residents in the north of the country to seek shelter. Despite this, Japan’s Nikkei 225 index finished 2.81% higher. Chinese and Hong Kong markets remained closed today.

Market positivity appeared to carry over from Wall Street and seemed to get another leg up from the RBA.

The Australian Dollar slipped half a cent lower after the Reserve Bank of Australia (RBA) lifted the cash rate target by a less than expected 25 basis points (bps) to 2.85% from 2.60%.

The RBA’s dovish hike boosted equities and bonds as yields sunk. The ASX 200 index finished 3.46% higher while the 3-year Australian Commonwealth Government bond (ACGB) is returning more than 30 bps less, near 3.25%.

The market seems to be getting excited about the prospect of less aggressive tightening from central banks going forward.

The slide in the Aussie dragged NZD/USD down ahead of the RBNZ meeting tomorrow. The market is anticipating a 50 basis point hike to 3.50%.

GBP/USD is unchanged through the Asian session after yesterday’s fireworks. The backflip in fiscal policy plans saw Sterling and Gilts recover to pre-announcement levels.

Despite New York Federal Reserve President John Williams hawkish comments, Treasury yields have continued to dip across the curve today, compounding yesterday’s large moves down.

Crude oil is steady so far today as the market awaits the result of Wednesday’s OPEC+ meeting where a cut to production appears to be on the agenda. The WTI futures contract is just under US$ 84 bbl while the Brent contract is a touch above US$ 89 bbl.

The full economic calendar can be viewed here.

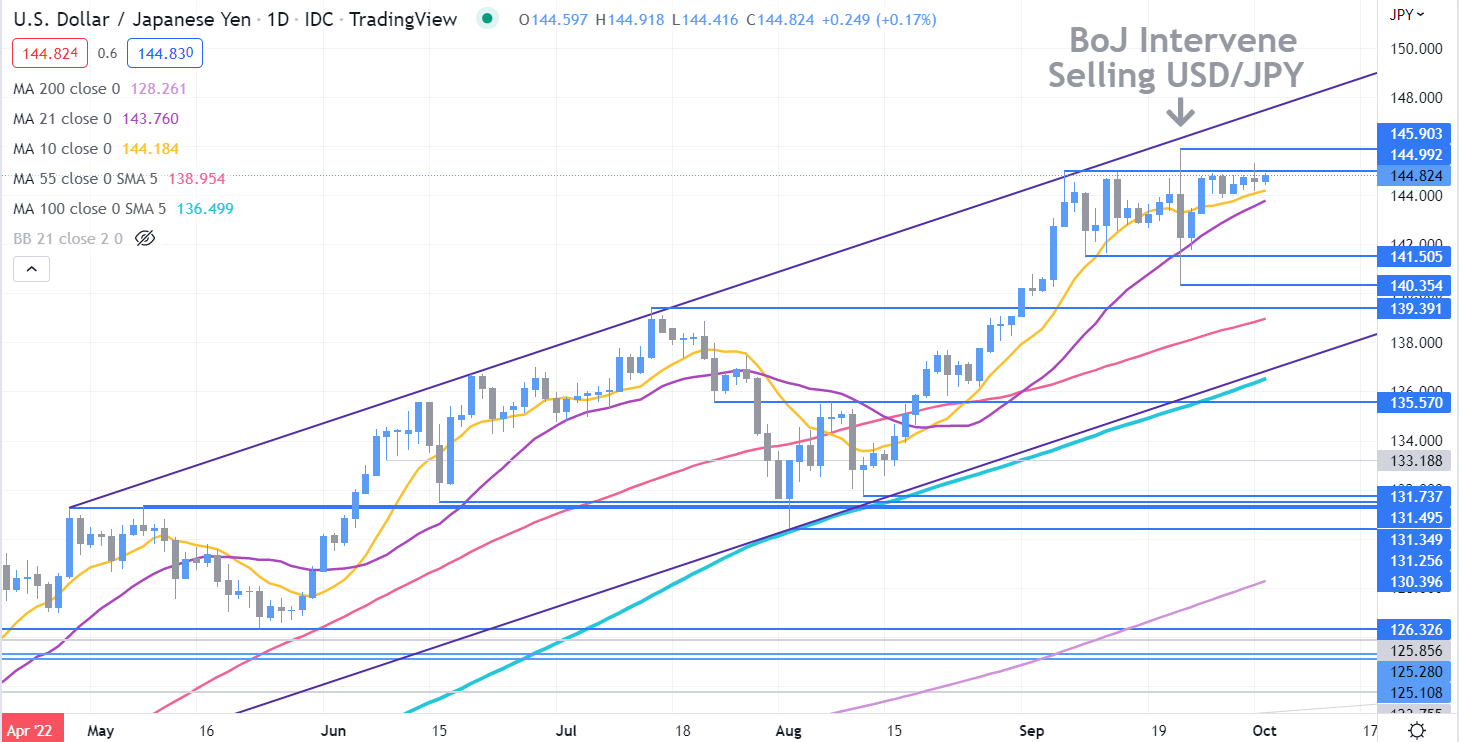

USD/JPY TECHNICAL ANALYSIS

USD/JPY remains in an ascending trend channel as it approaches 145 again. On a previous visit above this level, the Bank of Japan intervened, selling USD/JPY.

The price remains above several end simple moving average (SMA) with positive gradients and this may indicate bullish momentum is unfolding.

Support could be at the break points of 141.50 and 139.39 or the recent low of 140.35. On the topside, resistance might be at the last peak of 145.90.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter