Gold Price, Analysis, and Charts

- Gold looks set for a third straight week of falls

- Stronger Dollar and question marks over further rate rises have weighed

- A prominent daily-chart uptrend is under threat

The near-term climate isn’t constructive for the oldest financial haven of them all. Reports of progress toward raising the US Federal debt ceiling have weighed on the market, chiming with a widespread belief that a deal will be done in time because the alternative is so dire.

General Dollar strength can also reduce gold’s attraction to non-US investors.

The market may glean some support from hopes that inflation is coming under control, meaning interest rates may not need to rise much further, if at all. But this thesis is highly data-dependent. A climate of rising interest rates tends to make life trickier for gold bulls as it increases the yield of paper assets while gold, famously, yields nothing.

The US Federal Reserve’s preferred inflation measure, the Personal Consumption and Expenditure pricing series is due later in the session (at 1230 GMT). Its ‘core’ pricing index is expected to show an annual rise of 4.6% for April. That would be disappointingly unchanged from the March reading, but quite restrained by current international standards.

The chance of another rate rise in June is put at just under 40% by the popular ‘Fedwatch’ tool from the Chicago Mercantile Exchange. Group, clearly non-negligible.

Still, a general backdrop of strong global price rises, war in Ukraine, and the struggle experienced by many national economies to return to pre-Covid growth levels is highly likely to limit the fundamental downside for gold.

Central banks also appear to be increasing their gold holdings in the face of heightened global uncertainty. They reportedly bought 1078 metric tons of gold in 2022. That’s the most since record-keeping began in 1950 and more than twice the amount purchased in the previous year. This appetite will offer the market meaningful support.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

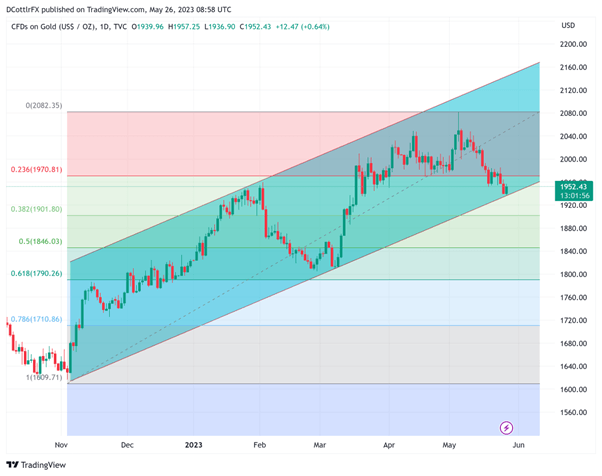

Gold Technical Analysis

Chart Compiled Using TradingView

The daily chart doesn’t look great for gold bugs, with a key uptrend that has underpinned prices since the end of last year now under a clear bearish attack.

It currently offers support very close to the current market at $1937.69. A daily and weekly close below that level is in prospect and that could well presage further falls. Support below that is likely in the $1912 area from mid-March, but the next clear downside level would be $1901.80. That’s the second Fibonacci retracement of the rise from November’s lows to the peak of May 4, just above the $2000 level.

The psychologically important $1950 point bears watching now, however. The market hasn’t spent long below that point since March 23, and its ability to stay above that point now could be a key near-term indicator.

IG’s own sentiment indicators suggest that the precious metal may have suffered enough for now. Fully 68% of respondents are bullish at current levels.

--By David Cottle for DailyFX