Gold Price (XAU/USD), Chart, and Analysis

- BoE relief rally may be short-lived.

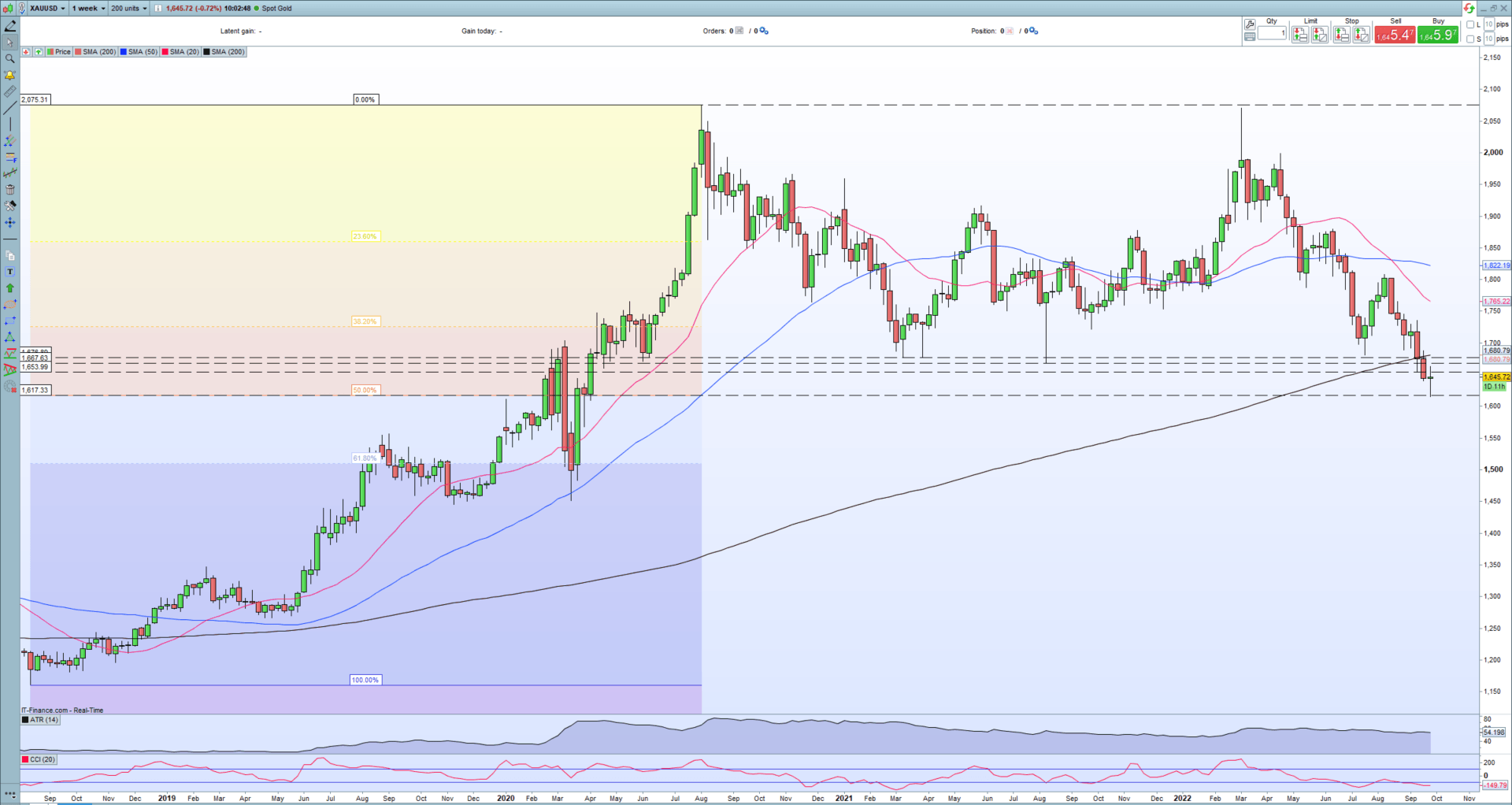

- Gold held support at $1,617/oz. yesterday.

- Retail traders trim their daily and weekly long positions.

The Bank of England (BoE) intervened in the gilt market yesterday by announcing a fresh bond-buying program in the long-end of the UK bond market. The BoE’s operation, seen by some as a pivot by the UK central bank, was in fact urgently needed action to shore up a certain part of the UK pension market, which if it had been left alone had the ability to spark further turmoil throughout the financial market. UK bond yields fell sharply, recovering almost all of their recent losses, prompting global bond yields to fall and risk-on markets to rise.

As more clarity and understanding of the problem the BoE faced on Wednesday is made known, bond yields are moving higher again as traders see the BoE’s bond buying as a specific, targeted action rather than a shift in monetary policy. Global bond yields are starting to move higher, and that is a familiar problem for gold bulls.

The interest-rate sensitive UST 2-year is currently offered with a yield of 4.21%, around 12 basis points higher than Wednesday and just 14 basis points from its recent 15-year high.

US 2-Year Chart – September 29, 2022

Chart via Investing.com

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Traders should be aware that there is a raft of central bank speakers on tap this week, while Friday’s core US PCE reading will be closely watched. Federal Reserve speakers this week have so far been doubling-down on the central bank’s view that inflation is too high and that rates need to be hiked faster and higher and left at these elevated levels for longer to counter runaway price pressures.

For all market-moving data releases and events, see the DailyFX Economic Calendar.

Gold traded into, and respected, support around $1,617/oz. yesterday, an old 50% Fibonacci retracement level. The precious metal remains below the 200-sma on the weekly chart with any upside capped between $1,667/oz. and $1,676/oz. A confirmed break below $1,617/oz. would see $1,600/oz. come into play.

Gold Weekly Price Chart – September 29, 2022

Chart via ProRealTime

Retail trader data show 78.78% of traders are net-long with the ratio of traders long to short at 3.71 to 1.The number of traders net-long is 8.79% lower than yesterday and 16.38% lower from last week, while the number of traders net-short is 15.07% higher than yesterday and 13.19% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | -2% |

| Weekly | 10% | -16% | -4% |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.