USD/JPY Price, Charts and Analysis:

- USD/JPY and Dollar Index Both Remain Rangebound.

- Dovish Comments by BoJ Governor to Keep USD/JPY Downside Limited.

- Risk Events Eyed as Potential Catalyst.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: Dollar Yen Forecast: USD/JPY Remains Conflicted Around 130.000

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY has struggled to hold onto any meaningful gains above the psychological 130.00 level. Yen strength has been capped by dovish sounding comments from the BoJ governor which has kept the pair in a narrow trading range for the past week.

BoJ Governor Kuroda continues to stand by his easy monetary policy stance. This comes as traders grow optimistic that growing inflation will result in a hawkish shift from BoJ. Any further hawkish shift from the BoJ seems unlikely with Governor Kuroda at the helm and could come when the Governor steps down in April.

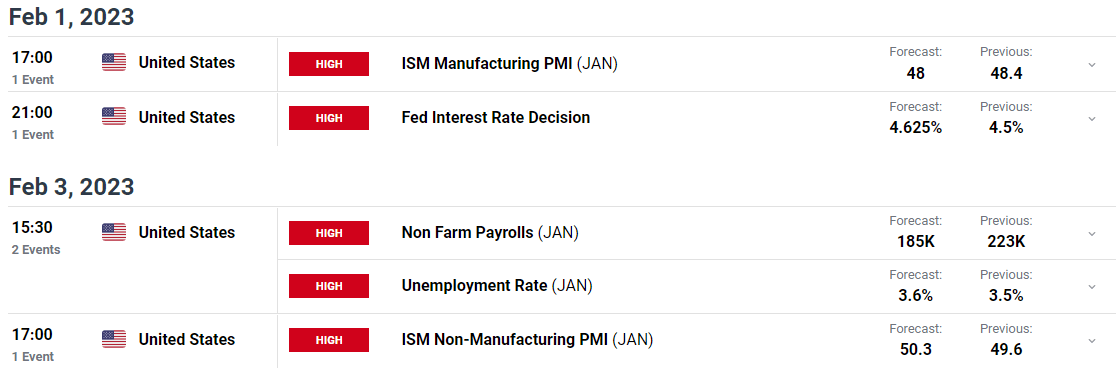

The majority of Yen gains recently can be attributed to a weaker dollar as the dollar index continues to struggle and trade in a narrow range. This week brings major risk events which could facilitate a breakout of the range for both the dollar index and USD/JPY. The Fed meeting and NFP release could give the pair some much needed direction.

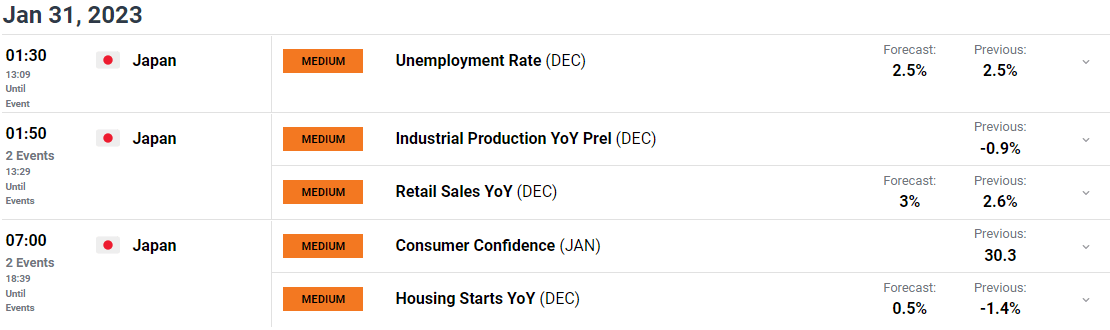

Looking ahead we have a host of medium impact data out of Japan tomorrow which could add further pressure on the BoJ. This comes as we await the all-important FOMC meeting closely followed by Friday’s job numbers. A dovish shift by the Fed toward policy easing or any announcement as such could see the dollar index break to the downside and USD/JPY rise.

TECHNICAL OUTLOOK

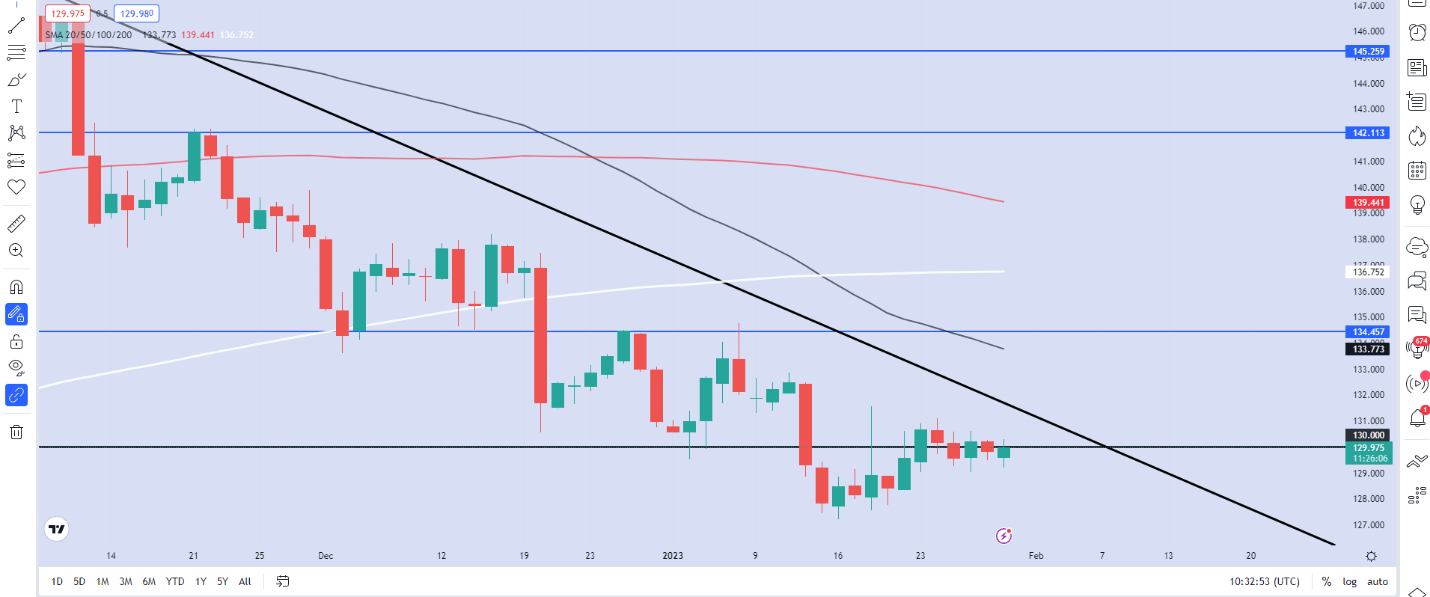

From a technical perspective, USD/JPY remains in a bearish downtrend as we approach the trendline. Over the past 6 days the pair seesawed between profits and losses while being stuck in a 200-pip range. A daily candle close above the 132.550 will see structure turn bullish with a test of the 50 and 200-day MA on the cards. A rejection of the trendline could see a push lower with the lows around 127.200 coming into play.

USD/JPY Daily Chart – January 30, 2022

Source: TradingView

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently SHORT on USD/JPY, with 59% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that USD/JPY may continue rise.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda