USD/CAD PRICE, CHARTS and ANALYSIS:

- Monetary Policy Divergence Does Not Bode Well for the Loonie.

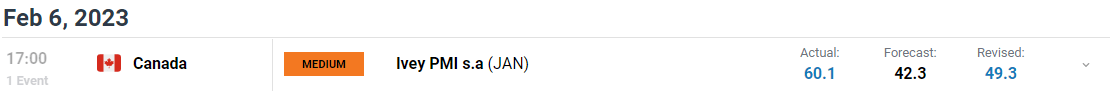

- Ivey PMI Data Posts its Best Number Since August.

- Falling Wedge Breakout Hints at Further Upside.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

MOST READ: USDCAD Offers a More Direct Contrast on Rates Post-Fed

USD/CAD FUNDAMENTAL OUTLOOK

USD/CAD has continued its upside move today amid a strong follow through from the dollar index. The European session saw gains capped as WTI oil staged a modest rebound affording the loonie a bit of strength. The early parts of the US session have seen WTI retreat once more allowing USDCAD to push on trading around the 1.3460 handle (at the time of writing).

The Ivey PMI data out of Canada today smashed estimates but did little to arrest the slide in the Canadian dollar. The PMI print was the highest since August 2022 and will provide the Bank of Canada with some food for thought, particularly if it leads to an increase in demand and spending from consumers which could have a knock-on effect on the inflation front.

For all market-moving economic releases and events, see the DailyFX Calendar

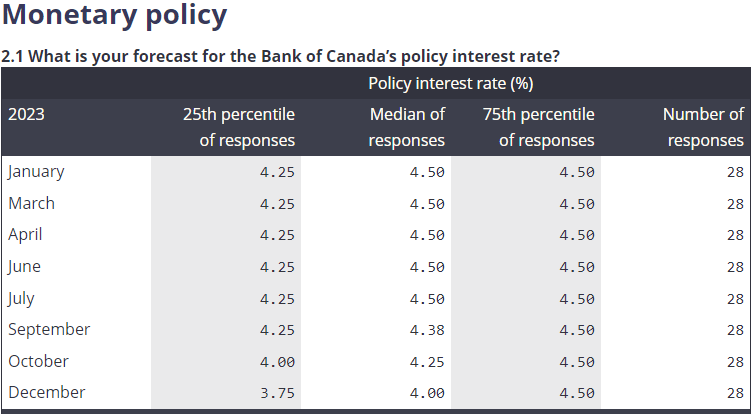

The Bank of Canada’s (BoC) pause on the rate hike front did come with a warning that it could step back in should inflation not continue its downward trajectory. Today's PMI reading could be the first sign of the challenges that may lie ahead for the central bank. The Bank of Canada Market Participants Survey for Q4 2022 was released today with the median expectation for interest rates in December 2023 resting at 4%, down from the current rate of 4.5%.

Bank Of Canada Market Participants Survey Q4 2022

Source: Bank of Canada

The longer-term picture for USDCAD favors further upside at present with the two central banks now on different paths. Following Friday’s blockbuster data out of the US markets see little chance of the Fed cutting rates in 2023, with a minimum of two more rate hikes expected. Should the US central bank follow through, and US data remain robust moving forward we could very well see further upside over the medium term.

The Canadian dollar does look extremely vulnerable to further losses, however a rebound in WTI prices could offer the loonie some respite. At the moment WTI is facing its own headwinds as it waits for a demand surge out of China which is yet to materialize. This will be interesting to watch as the week and month progresses.

TECHNICAL OUTLOOK

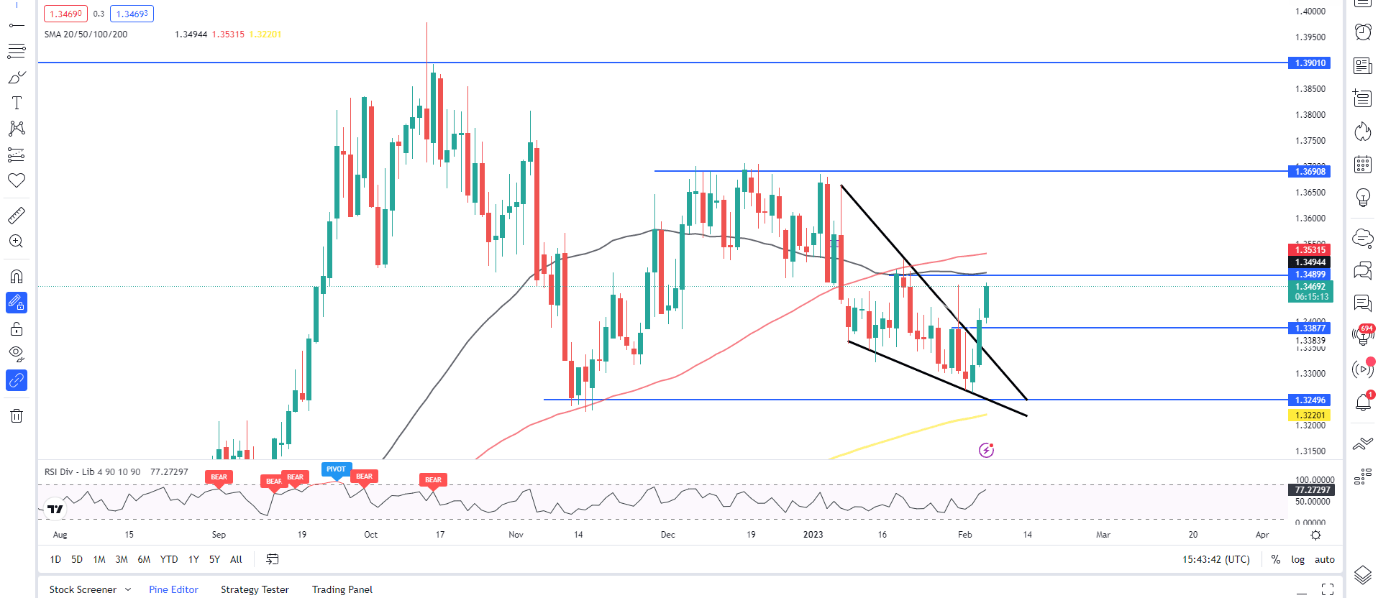

From a technical perspective, USD/CAD broke out of the falling wedge pattern on Friday putting it on course for a potential 300-pip rally. The pair is likely to post its third successive day of gains for the first time since early December.

Resistance currently rests around the 1.3500 mark, which was the January 19 swing high while we also have the 50 and 100-day MA resting around the same level. Given the confluences in play we could be in for a retracement before continuing with the next leg to the upside targeting the 1.3650 area.

USD/CAD Daily Chart, February 6, 2023

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently SHORT on USD/CAD, with 61% of traders currently holding SHORT positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests that USD/CAD may continue to rise.

--- Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda