KEY POINTS:

- GBP/USD Falls 170-odd Pips.

- US Dollar Index Starts 2023 with a Bang, Are We in For Another January of Gains for the Greenback?

- UK Manufacturing PMI Falls to 31-Month Low.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: XAU/USD Forecast: Technical Factors Drive Gold Bulls to 1850

GBP/USD FUNDAMENTAL BACKDROP

GBP/USD has broken below the key 1.2000 level for the first time in 4 weeks as the dollar index came to life. Having been stuck in a 100-odd pip range since December 19, it seems GBPUSD has finally found some direction with some key data events ahead this week.

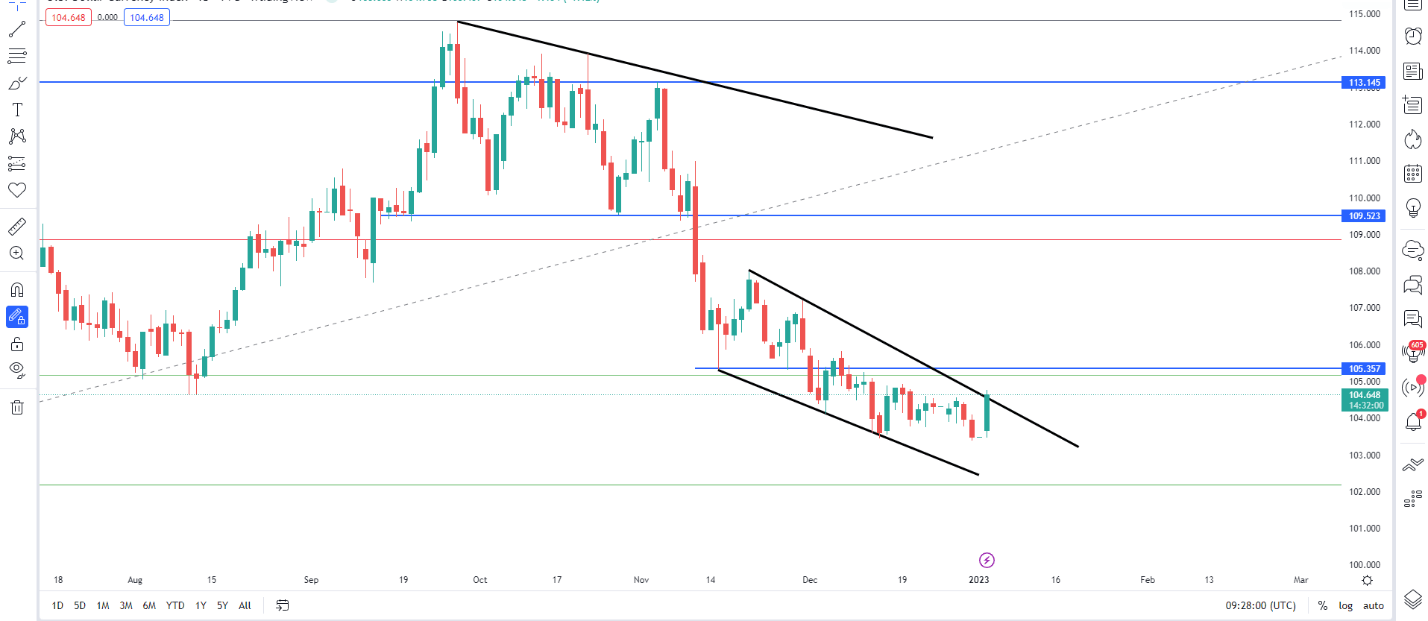

The decline on GBPUSD this morning comes on the back of a resurgent dollar index which has finally roared to life following a few weeks of indecisive price action. The dollar index has needed some positivity following a less than impressive end to 2022 with 3 consecutive months of losses. January has proven to be a winner for the greenback in the recent past, with today's open hinting that could continue. Looking at the chart below we can see index flirting with a breakout of the wedge pattern that has been in play since November 15 which could lead to a significant upside rally.

US Dollar Index Daily Chart- January 3, 2023

Source: TradingView

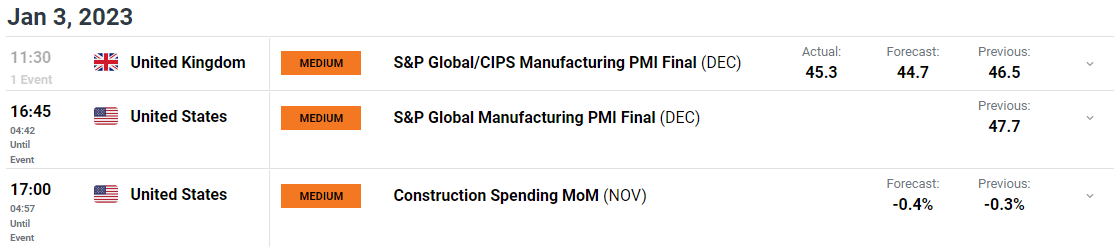

Adding further to cables woes, UK data out this morning indicated a weak ending to 2022 for manufacturing with the S&P Global / CIPS UK Manufacturing Purchasing Managers’ Index hitting a 31-month low. The print of 45.3 for December is down from 46.5 in November with output, new orders and employment all falling at faster rates. Domestic and overseas demand remained lackluster as economic uncertainty, client destocking and customers postponing orders continue to weigh on the sector.

The economic calendar is presents only one more data point of significance today in the form of the US Manufacturing PMI before attention turns to tomorrows FOMC minutes release as well as Fridays NFP data.

For all market-moving economic releases and events, see the DailyFX Calendar

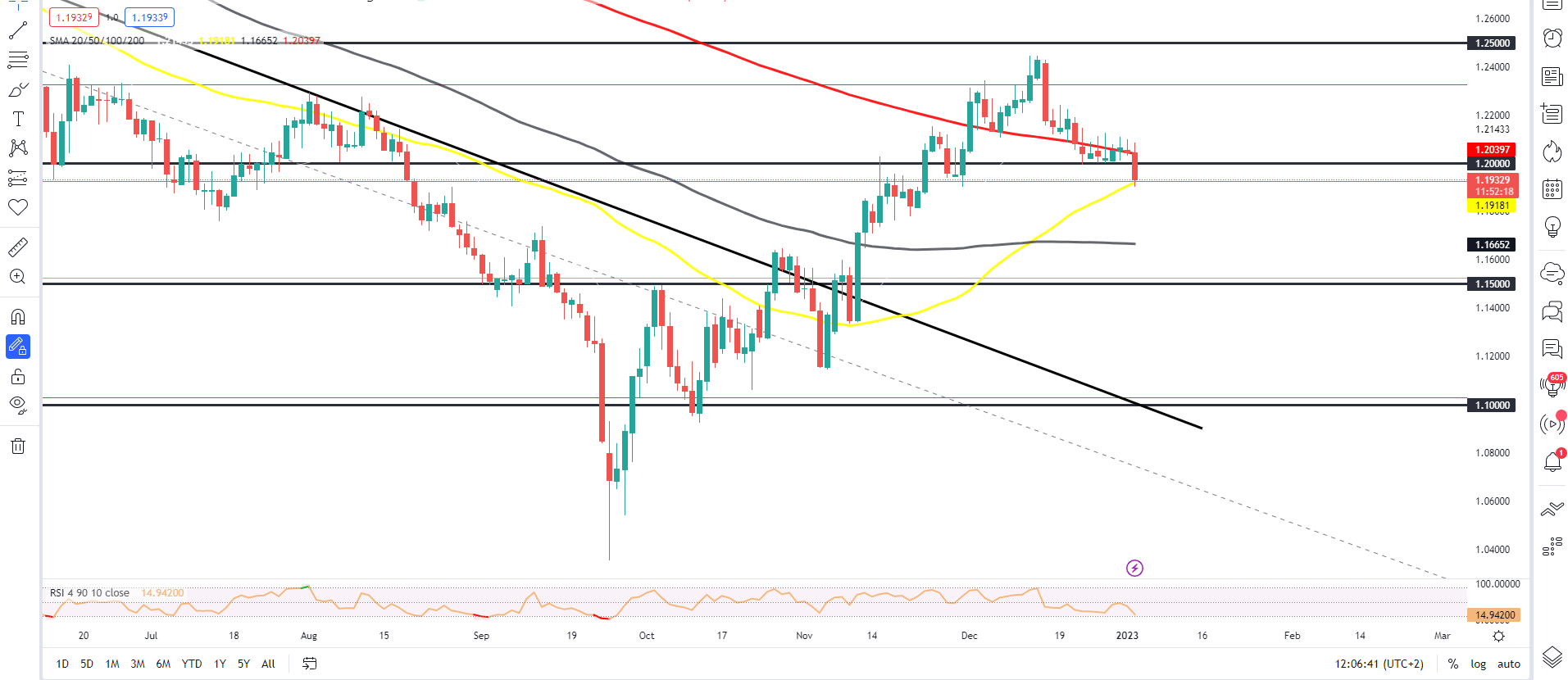

From a technical perspective, given the steep decline this morning there is a chance GBPUSD could see some retracement in the short-term. Having just bounced of the 50-day MA which could serve as support pushing the pair back towards the 1.2000 level or just above to the 200-day MA around 1.2040. Also supporting a retracement is the RSI which is currently in oversold territory, however the overall bias is leaning toward further downside especially if a upside breakout of the wedge pattern on the dollar index comes to fruition. A breakout on the dollar index could push GBPUSD lower bringing support at 1.1750 and the 100-day MA around 1.1650 into play.

GBP/USD Daily Chart – January 3, 2023

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda