US DOLLAR, EUR/USD & GOLD PRICES OUTLOOK:

- U.S. dollar rises and reaches its best level in seven weeks

- EUR/USD and gold prices trend lower on Fed monetary policy jitters

- This article looks at key EUR/USD technical levels to monitor in the near term

Read More: EUR/USD on a Knife Edge as Eurozone Core Inflation Ticks Higher

The US dollar, as measured by the DXY index, rose moderately on Thursday, touching seven-week highs near 104.70, as market sentiment remained fragile, depressing appetite for riskier currencies.

Against this backdrop, EUR/USD continued its descent, falling around 0.10% and breaking below the 1.0600 handle for the first time since early January. Gold prices also retreated, extending losses for the third consecutive session, and rapidly approaching the lowest level since December 30.

Looking ahead, there is reason to believe that the U.S. dollar could maintain leadership in the FX space, at least for some time, creating headwinds for both the euro and precious metals. This move is likely to be catalyzed by the continued rise in U.S. Treasury yields in response to the Federal Reserve's assertive actions in its fight to restore price stability.

Sticky CPI, coupled with strong labor market data, have triggered a hawkish repricing of the FOMC's monetary policy outlook, leading Wall Street to discount a terminal rate of 5.37%, up from 4.90% at the beginning of the month. This essentially implies three additional 25 basis point hikes in the coming quarters.

The minutes of the central bank's last gathering have reinforced current expectations. Based on the readout from Jan 31/Feb 1 meeting, policymakers remain committed to defeating chronically high inflation and anticipate further increases in borrowing costs, even if some officials are beginning to see greater risks of a recession.

All things being equal, the Fed's hawkish stance should support the U.S. dollar in the short term by keeping nominal and real rates biased to the upside. This means that the euro and gold are standing on weak footing and could therefore extend their recent slump heading into March.

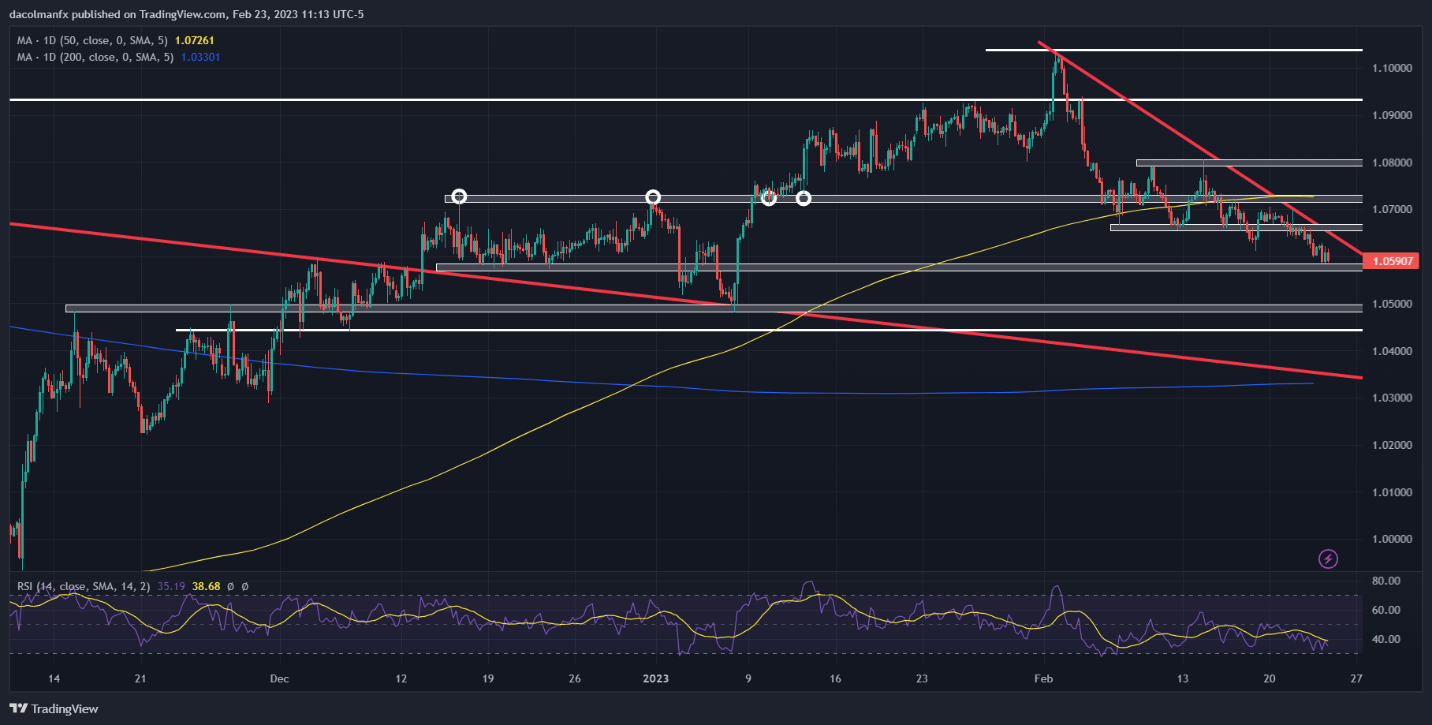

EUR/USD TECHNICAL ANALYSIS

After validating a double top pattern, EUR/USD has deepened its pullback, falling towards a key support slightly above 1.0575. If this area is breached on the downside in the coming days, sellers could launch an attack on the psychological 1.0500 level, followed by 1.0445. On the flip side, if price action reverses higher, trendline resistance appears near 1.0650. On further strength, the focus shifts to 1.0725.

EUR/USD TECHNICAL CHART